Monro trades at $27.73 per share and has stayed right on track with the overall market, gaining 16.8% over the last six months while the S&P 500 has returned 13.4%.

Is now the time to buy Monro, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We're cautious about Monro. Here are three reasons why MNRO doesn't excite us and one stock we'd rather own today.

Why Do We Think Monro Will Underperform?

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

1. Less Negotiating Leverage with Suppliers

Monro is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

2. Declining Same-Store Sales Indicate Demand Is Evaporating

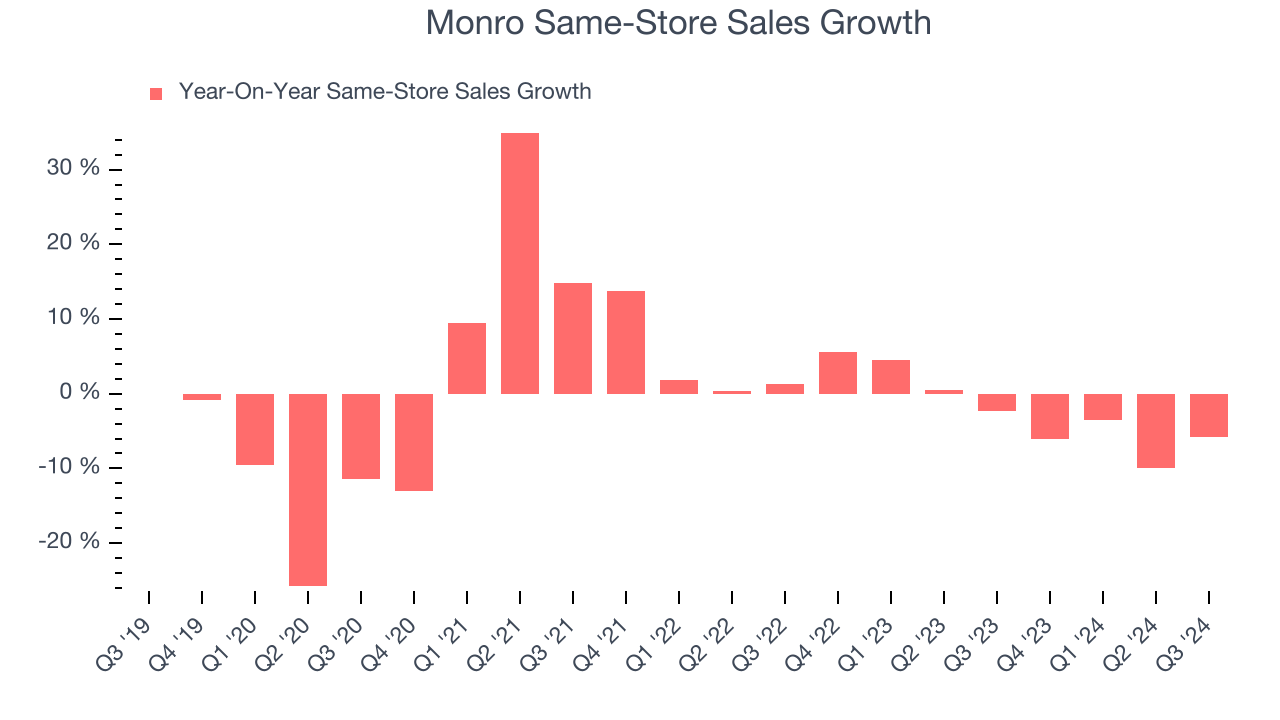

Same-store sales growth shows the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

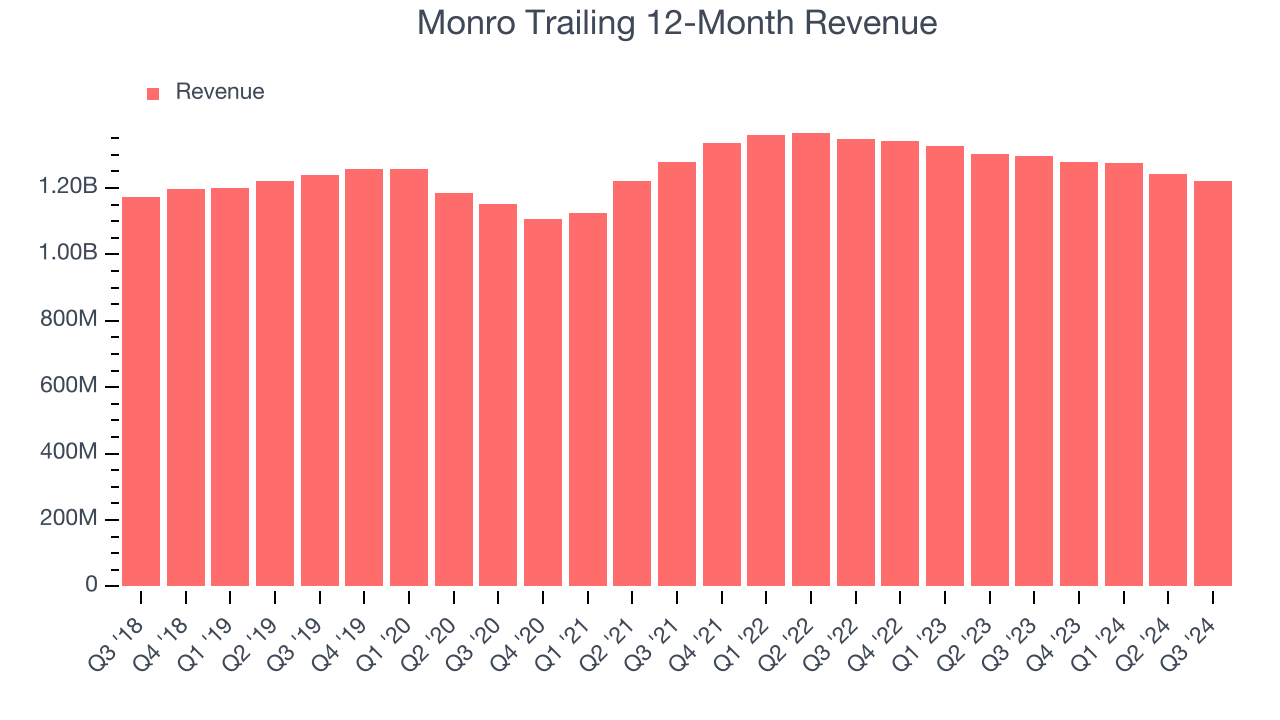

Monro’s demand has been shrinking over the last two years as its same-store sales have averaged 2.1% annual declines.

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Monro’s five-year average ROIC was 6.3%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+. Its returns suggest it historically did a mediocre job at investing in profitable growth initiatives.

Final Judgment

We see the value of companies helping consumers, but in the case of Monro, we’re out. That said, the stock currently trades at 24.3x forward price-to-earnings (or $27.73 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you towards Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Would Buy Instead of Monro

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.