Kontoor Brands has had an impressive run over the past six months as its shares have beaten the S&P 500 by 15.4%. The stock now trades at $92.02, marking a 28.7% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Kontoor Brands, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Despite the momentum, we're sitting this one out for now. Here are three reasons why there are better opportunities than KTB and one stock we like more.

Why Is Kontoor Brands Not Exciting?

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE:KTB) is a clothing company known for its high-quality denim products.

1. Long-Term Revenue Growth Flatter Than a Pancake

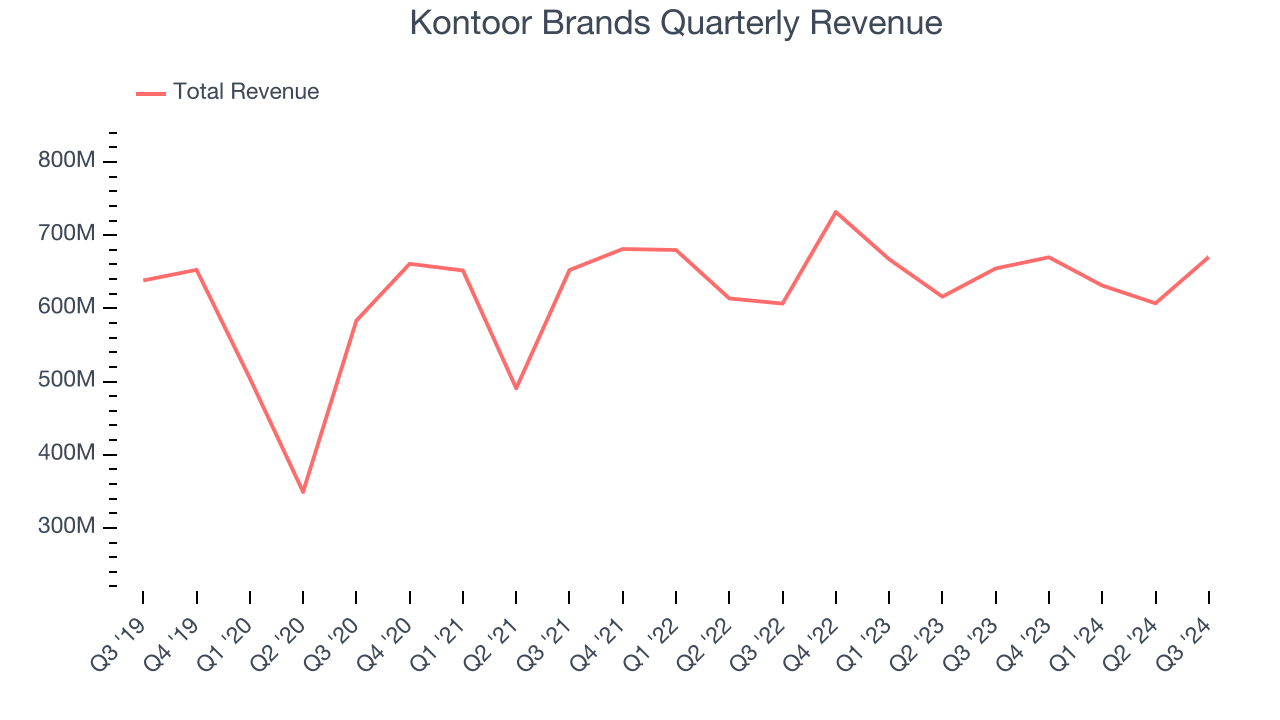

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one sustains growth for years. Unfortunately, Kontoor Brands struggled to consistently increase demand as its $2.58 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Looking ahead, sell-side analysts expect Kontoor Brands’s revenue to grow 3.2% over the next 12 months, an improvement versus its flat sales for the last two years. While this projection implies its newer products and services will fuel better performance, it is still below the sector average.

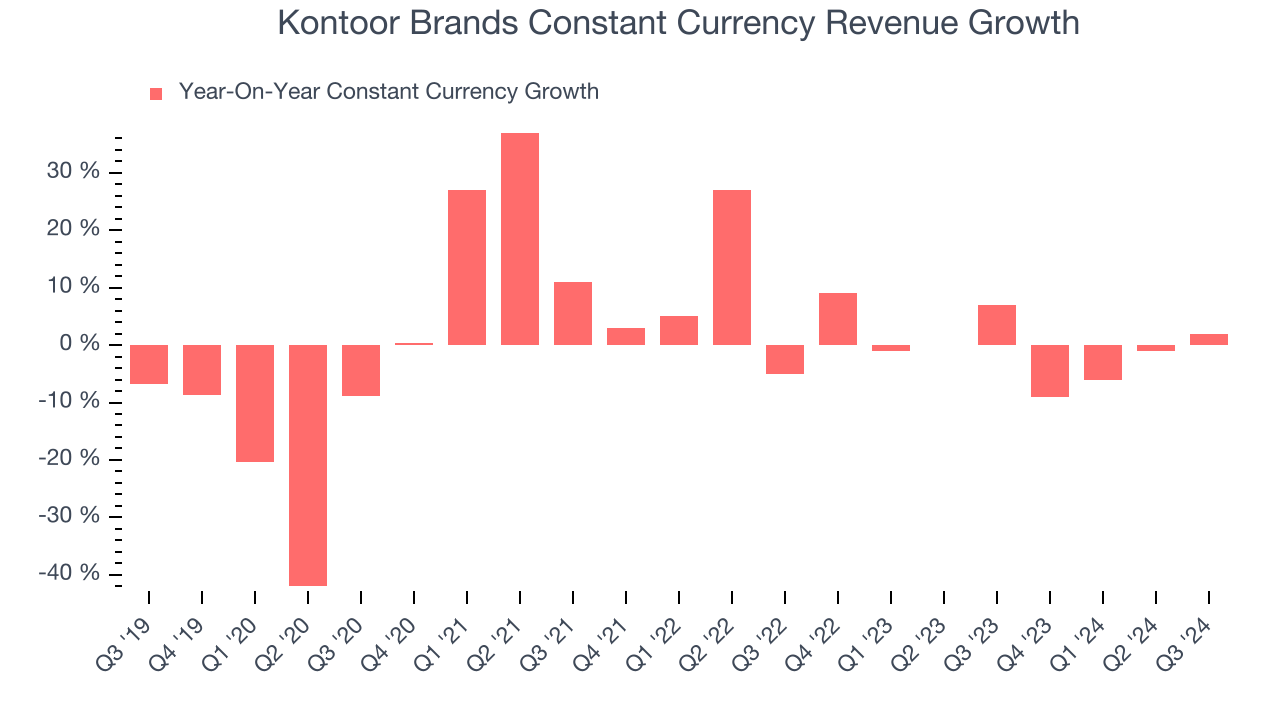

3. Constant Currency Revenue Hits a Standstill

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Apparel and Accessories companies. This metric excludes currency movements, which are outside of Kontoor Brands’s control and are not indicative of underlying demand.

Over the last two years, Kontoor Brands failed to grow its constant currency revenue. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Kontoor Brands might have to lower prices or improve/develop new products to accelerate growth - neither scenario is ideal at this stage because they can hinder near-term profitability.

Final Judgment

Kontoor Brands isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 17.6x forward price-to-earnings (or $92.02 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. We’d suggest taking a look at CrowdStrike, the most entrenched endpoint security platform.

Stocks We Like More Than Kontoor Brands

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.