Since May 2024, MasterCraft has been in a holding pattern, posting a small loss of 1.3% while floating around $20.97. The stock also fell short of the S&P 500’s 13.4% gain during that period.

Is now the time to buy MasterCraft, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.We're cautious about MasterCraft. Here are three reasons why MCFT doesn't excite us and one stock we'd rather own today.

Why Is MasterCraft Not Exciting?

Started by a waterskiing instructor, MasterCraft (NASDAQ:MCFT) specializes in designing, manufacturing, and selling sport boats.

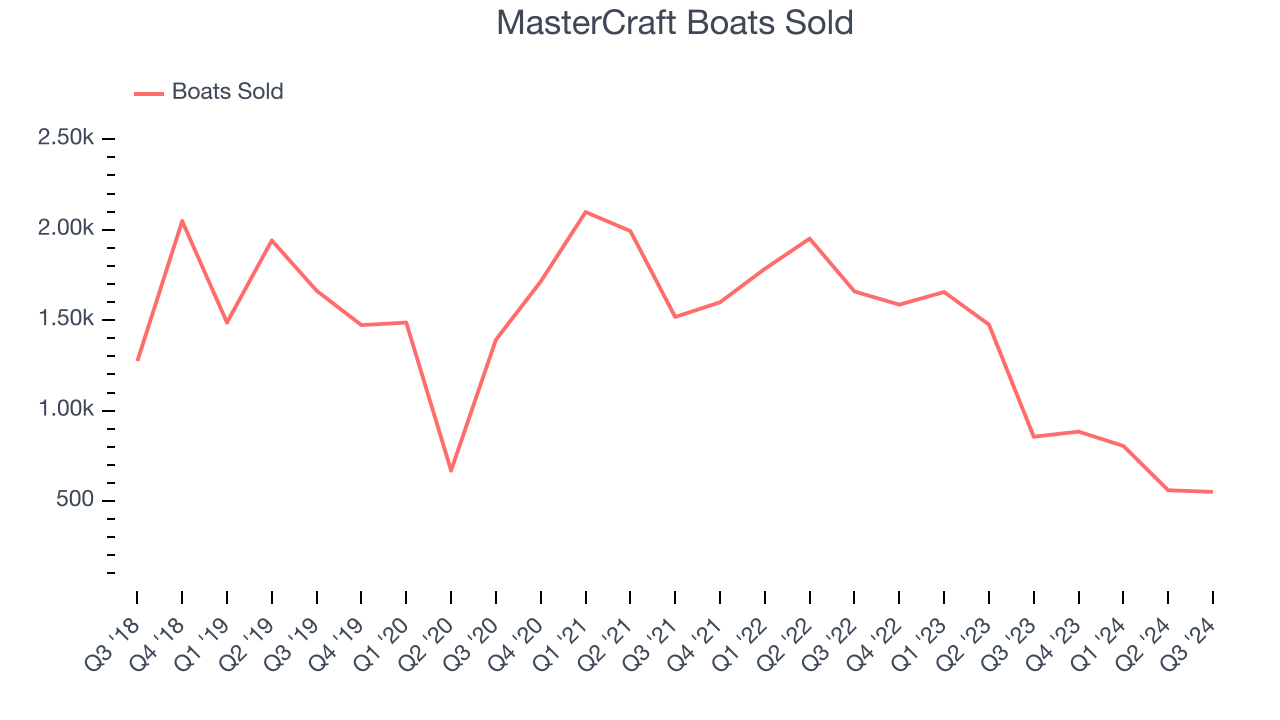

1. Declining Boats Sold Points to Weak Demand

We can better understand MasterCraft’s revenue dynamics by analyzing its number of boats sold, which reached 551 in the latest quarter. Over the last two years, MasterCraft’s boats sold averaged 34.3% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

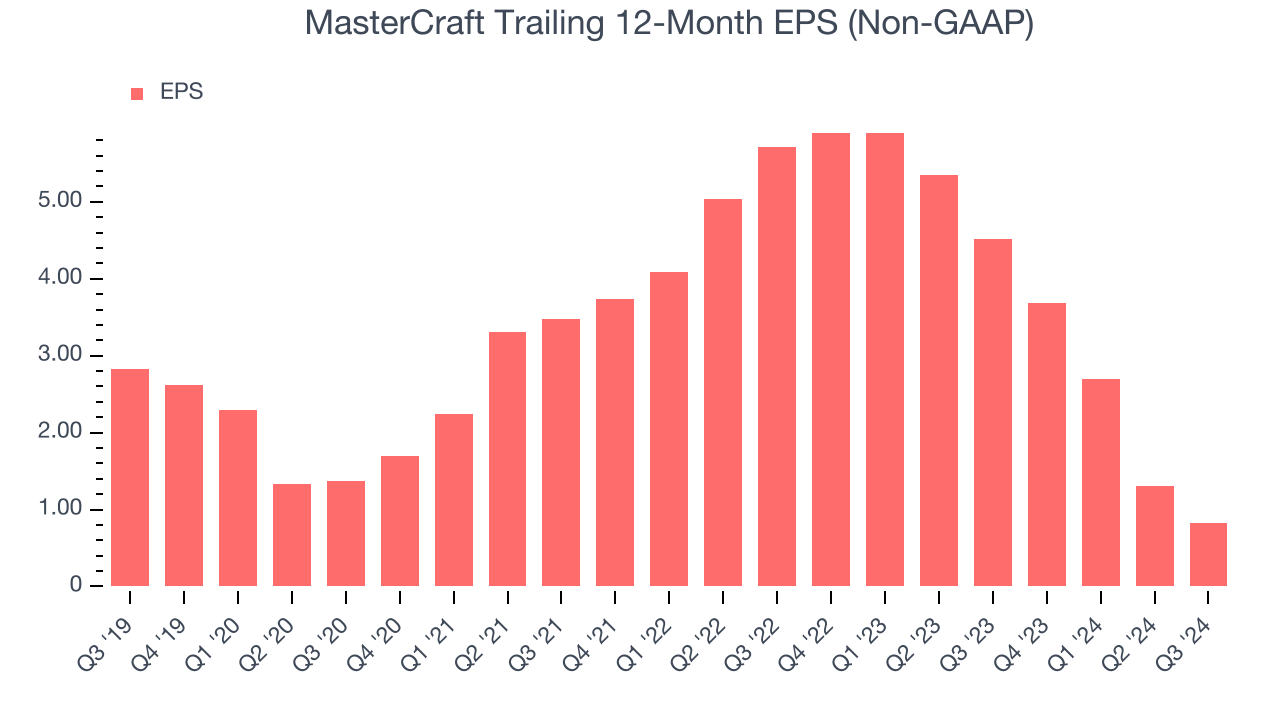

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for MasterCraft, its EPS declined by more than its revenue over the last five years, dropping 21.9% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict MasterCraft’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 9.7% for the last 12 months will decrease to 4.9%.

Final Judgment

MasterCraft’s business quality ultimately falls short of our standards. With its shares underperforming the market lately, the stock trades at 25.6x forward price-to-earnings (or $20.97 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you towards Yum! Brands, an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of MasterCraft

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.