The past six months have been a windfall for BWX’s shareholders. The company’s stock price has jumped 49%, hitting $130.99 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in BWX, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.We’re glad investors have benefited from the price increase, but we're swiping left on BWX for now. Here are three reasons why we avoid BWXT and a stock we'd rather own.

Why Is BWX Not Exciting?

Contributing components and materials to the famous Manhattan Project in the 1940s, BWX (NYSE:BWXT) is a manufacturer and service provider of nuclear components and fuel for government and commercial industries.

1. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Sell-side analysts expect BWX’s revenue to grow by 1.7% over the next 12 months, a deceleration versus its 10.4% annualized growth rate for the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

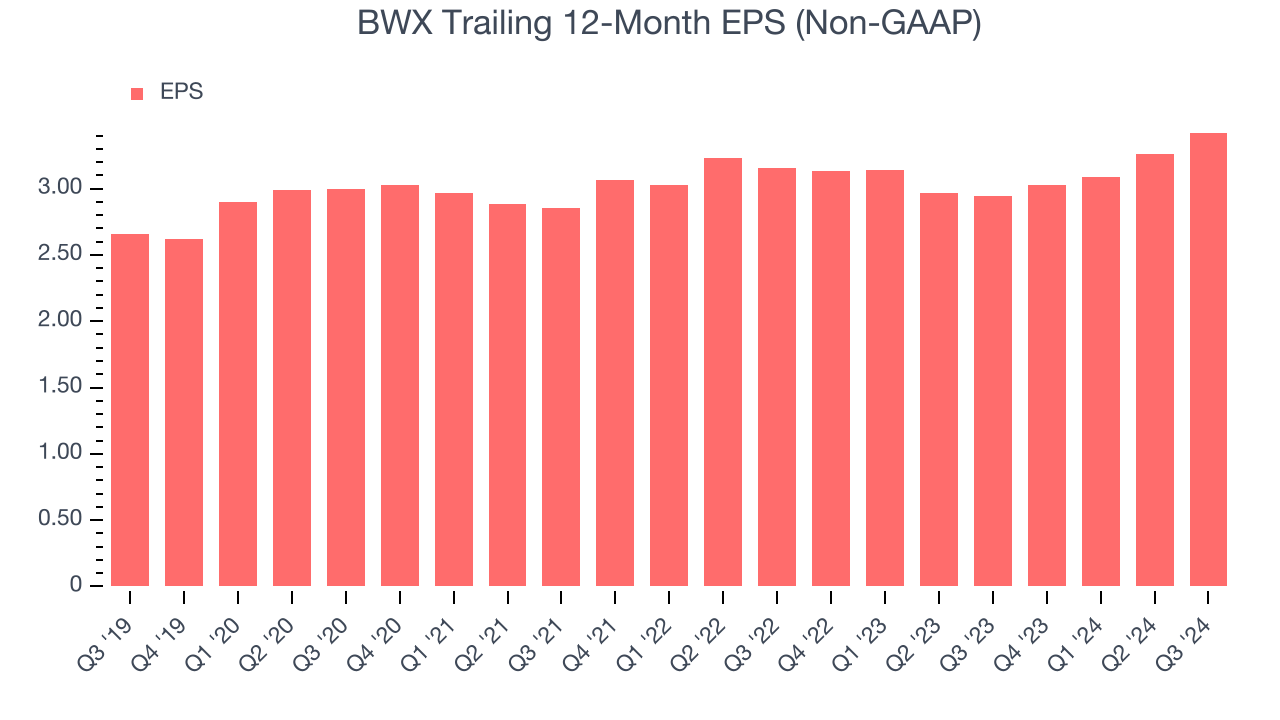

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

BWX’s EPS grew at an unimpressive 5.2% compounded annual growth rate over the last five years, lower than its 7.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

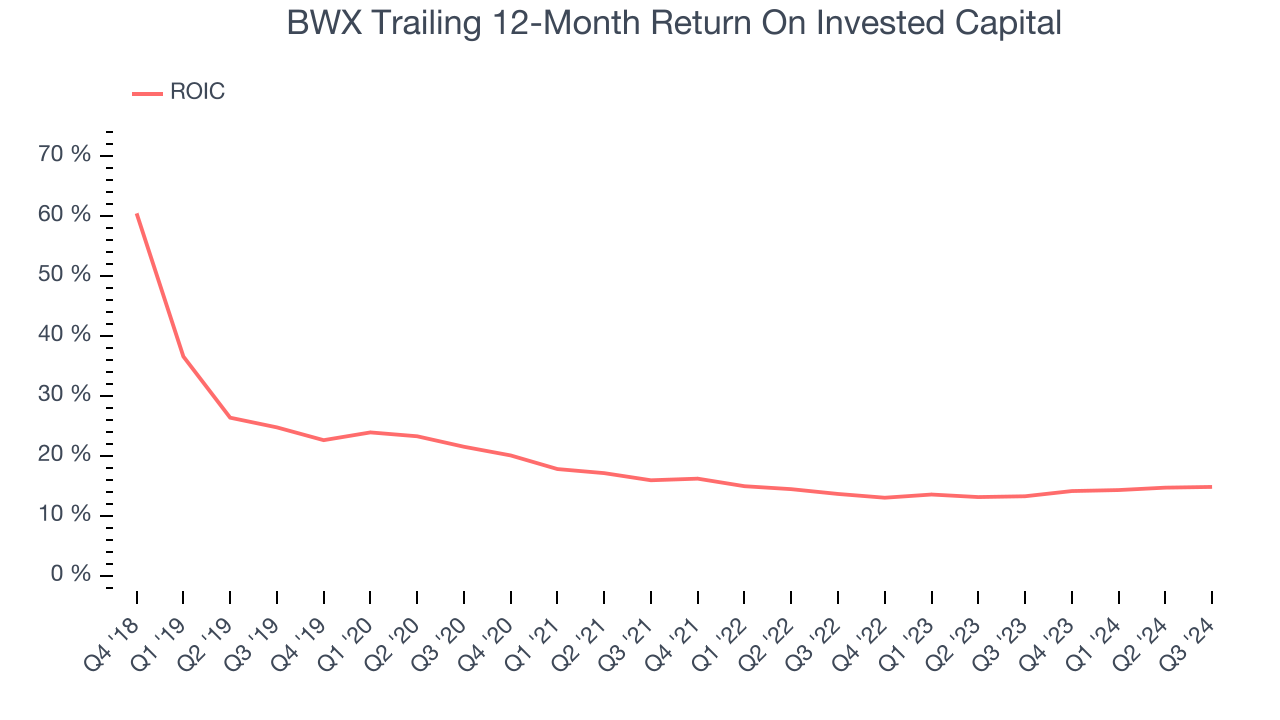

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. On average, BWX’s ROIC decreased by 4.7 percentage points annually over the last few years. We like what management has done in the past but are concerned its ROIC is declining, perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

BWX isn’t a terrible business, but it isn’t one of our picks. After the recent rally, the stock trades at 39.6x forward price-to-earnings (or $130.99 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. Let us point you toward FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than BWX

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.