Looking back on media stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including fuboTV (NYSE:FUBO) and its peers.

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

The 8 media stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Best Q3: fuboTV (NYSE:FUBO)

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

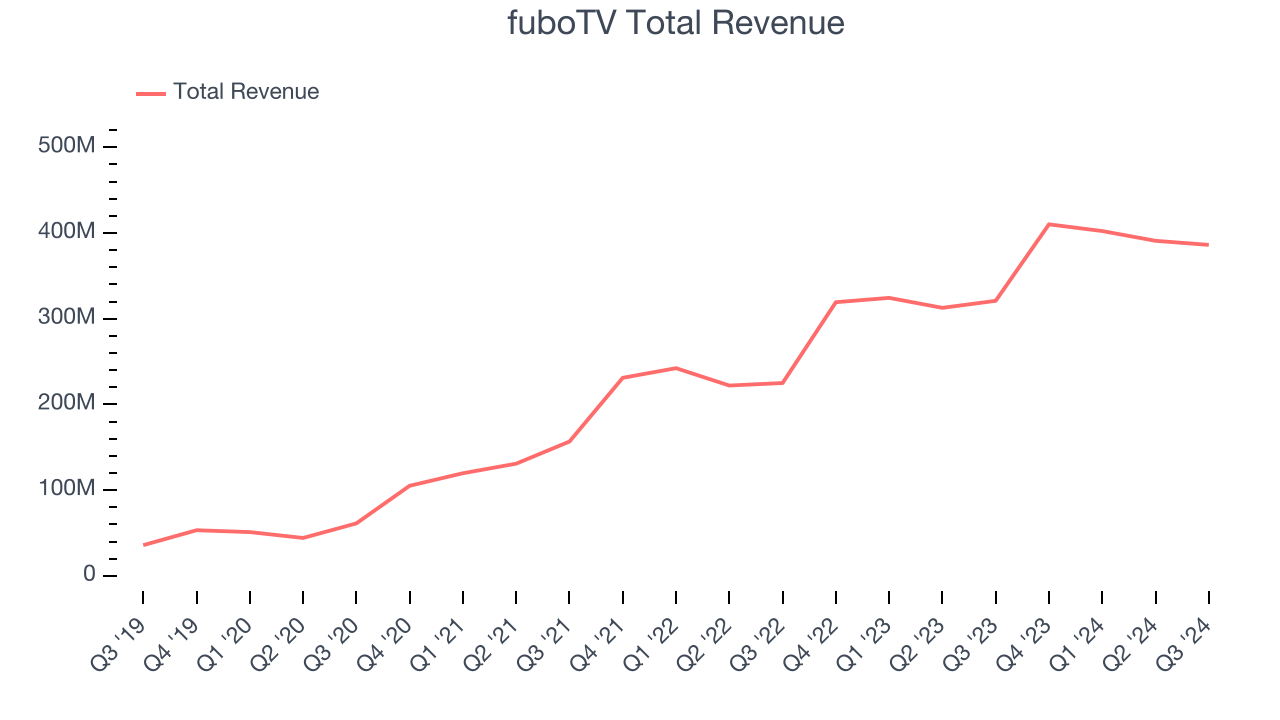

fuboTV reported revenues of $386.2 million, up 20.3% year on year. This print exceeded analysts’ expectations by 2.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

fuboTV scored the biggest analyst estimates beat of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 12.6% since reporting and currently trades at $1.52.

Is now the time to buy fuboTV? Access our full analysis of the earnings results here, it’s free.

Scholastic (NASDAQ:SCHL)

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ:SCHL) is an international company specializing in children's publishing, education, and media services.

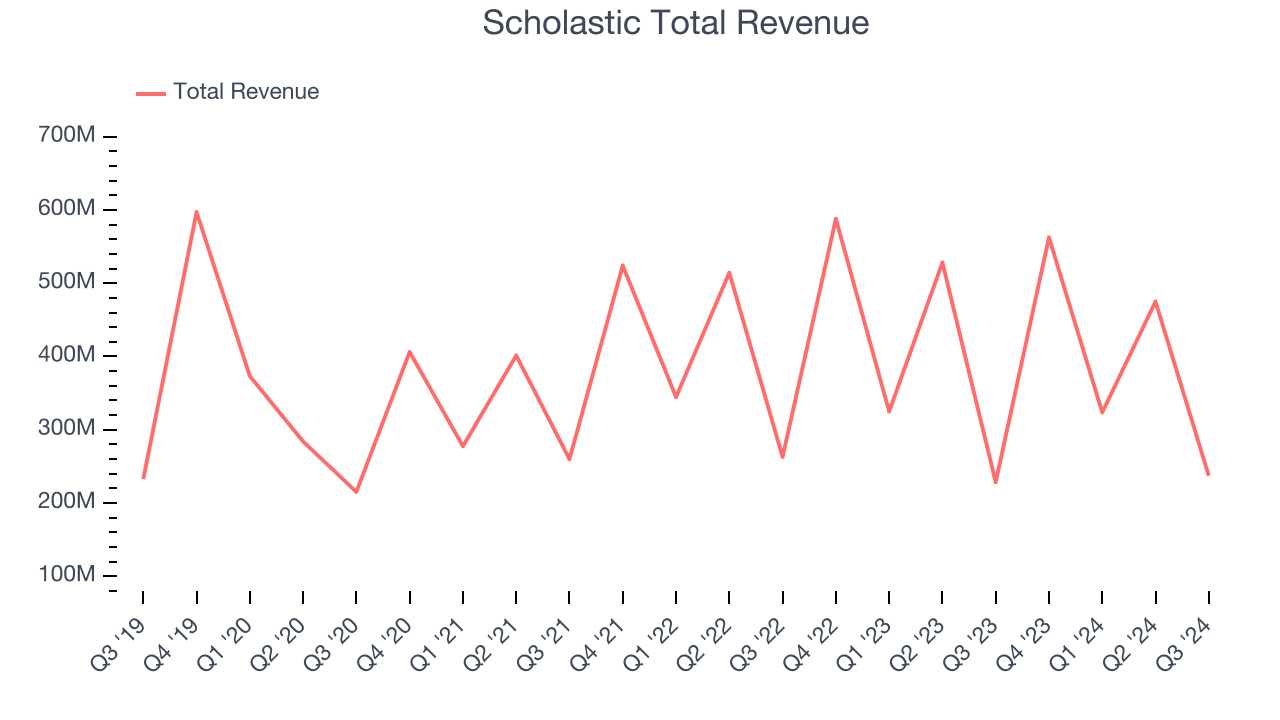

Scholastic reported revenues of $237.2 million, up 3.8% year on year, outperforming analysts’ expectations by 1.6%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA and EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 9.9% since reporting. It currently trades at $27.22.

Is now the time to buy Scholastic? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Endeavor (NYSE:EDR)

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE:EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Endeavor reported revenues of $2.03 billion, up 66.6% year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Endeavor delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 6.6% since the results and currently trades at $30.92.

Read our full analysis of Endeavor’s results here.

Warner Bros. Discovery (NASDAQ:WBD)

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ:WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Warner Bros. Discovery reported revenues of $9.62 billion, down 3.6% year on year. This print came in 1.7% below analysts' expectations. Taking a step back, it was still a strong quarter as it recorded a solid beat of analysts’ EPS and adjusted operating income estimates.

Warner Bros. Discovery had the slowest revenue growth among its peers. The stock is up 21.4% since reporting and currently trades at $10.14.

Read our full, actionable report on Warner Bros. Discovery here, it’s free.

Disney (NYSE:DIS)

Founded by brothers Walt and Roy, Disney (NYSE:DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

Disney reported revenues of $22.57 billion, up 6.3% year on year. This print was in line with analysts’ expectations. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 12.6% since reporting and currently trades at $115.61.

Read our full, actionable report on Disney here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.