Building products company Boise Cascade Company (NYSE:BCC) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 6.6% year on year to $1.71 billion. Its GAAP profit of $2.33 per share was also in line with analysts’ consensus estimates.

Is now the time to buy Boise Cascade? Find out by accessing our full research report, it’s free.

Boise Cascade (BCC) Q3 CY2024 Highlights:

- Revenue: $1.71 billion vs analyst estimates of $1.72 billion (in line)

- EPS (GAAP): $2.33 vs analyst expectations of $2.32 (in line)

- EBITDA: $154.5 million vs analyst estimates of $153.1 million (small beat)

- Gross Margin (GAAP): 19.7%, down from 21.4% in the same quarter last year

- Operating Margin: 6.8%, down from 10.1% in the same quarter last year

- EBITDA Margin: 9%, down from 11.8% in the same quarter last year

- Free Cash Flow Margin: 6.6%, down from 10.9% in the same quarter last year

- Market Capitalization: $5.22 billion

Company Overview

Formed through the merger of two lumber companies, Boise Cascade Company (NYSE:BCC) manufactures and distributes wood products and other building materials.

Building Material Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Building materials distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is forcing investment in digital capabilities to communicate with and serve customers everywhere. Additionally, building materials distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

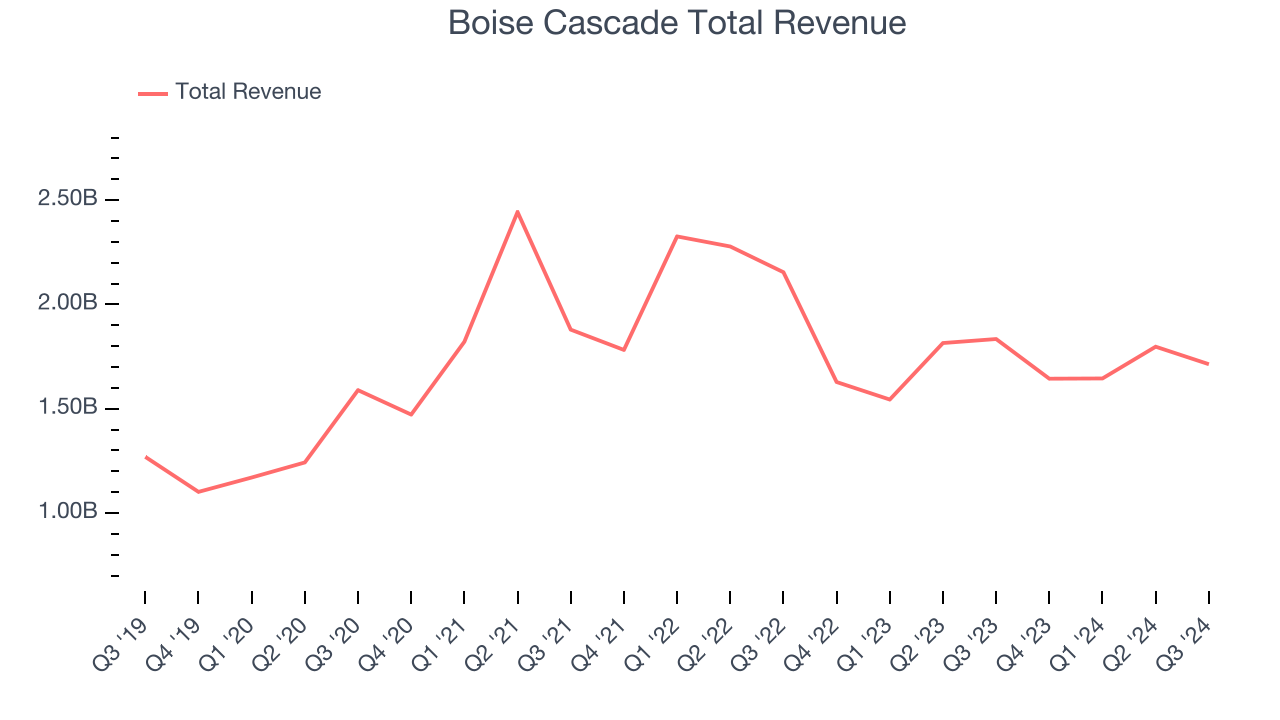

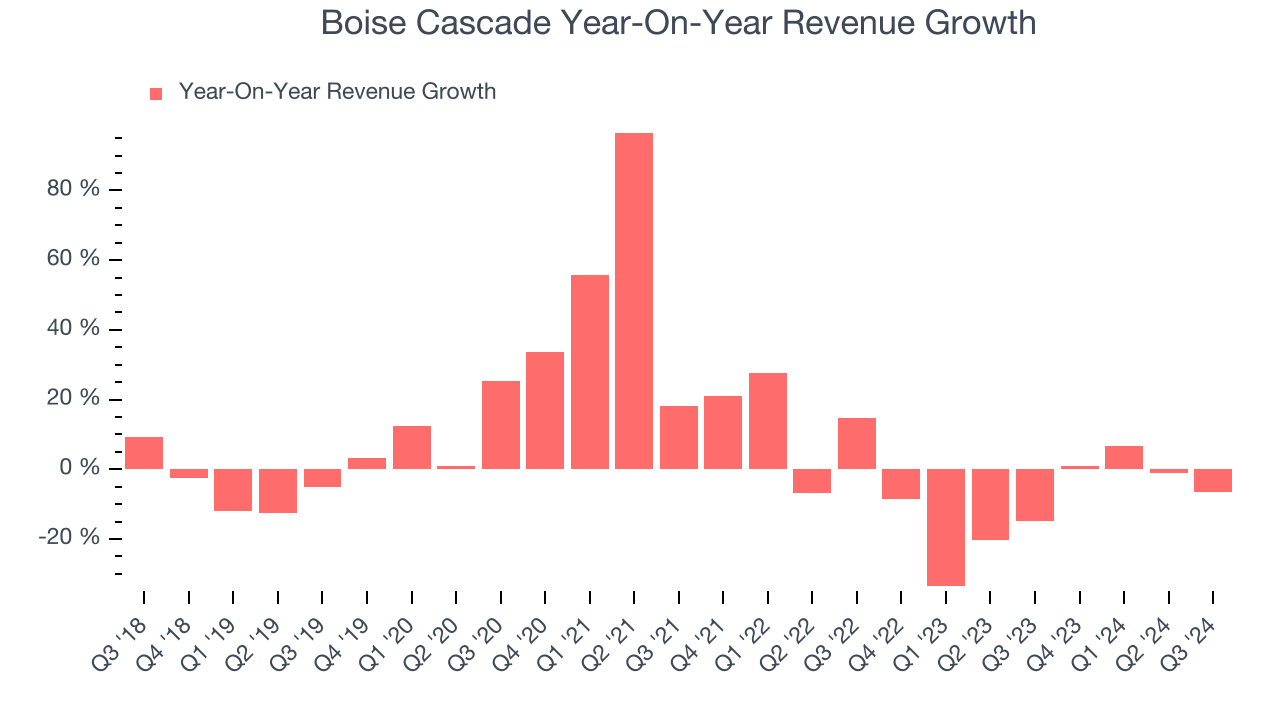

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Boise Cascade grew its sales at a decent 8.1% compounded annual growth rate. This is a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Boise Cascade’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 10.8% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Building Material Distribution and Wood products, which are 91.5% and 26.5% of revenue. Over the last two years, Boise Cascade’s Building Material Distribution revenue (plywood, siding, insulation) averaged 9.7% year-on-year declines while its Wood products revenue (lumber and beams) averaged 6% declines.

This quarter, Boise Cascade reported a rather uninspiring 6.6% year-on-year revenue decline to $1.71 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, an improvement versus the last two years. While this projection indicates the market believes its newer products and services will spur better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

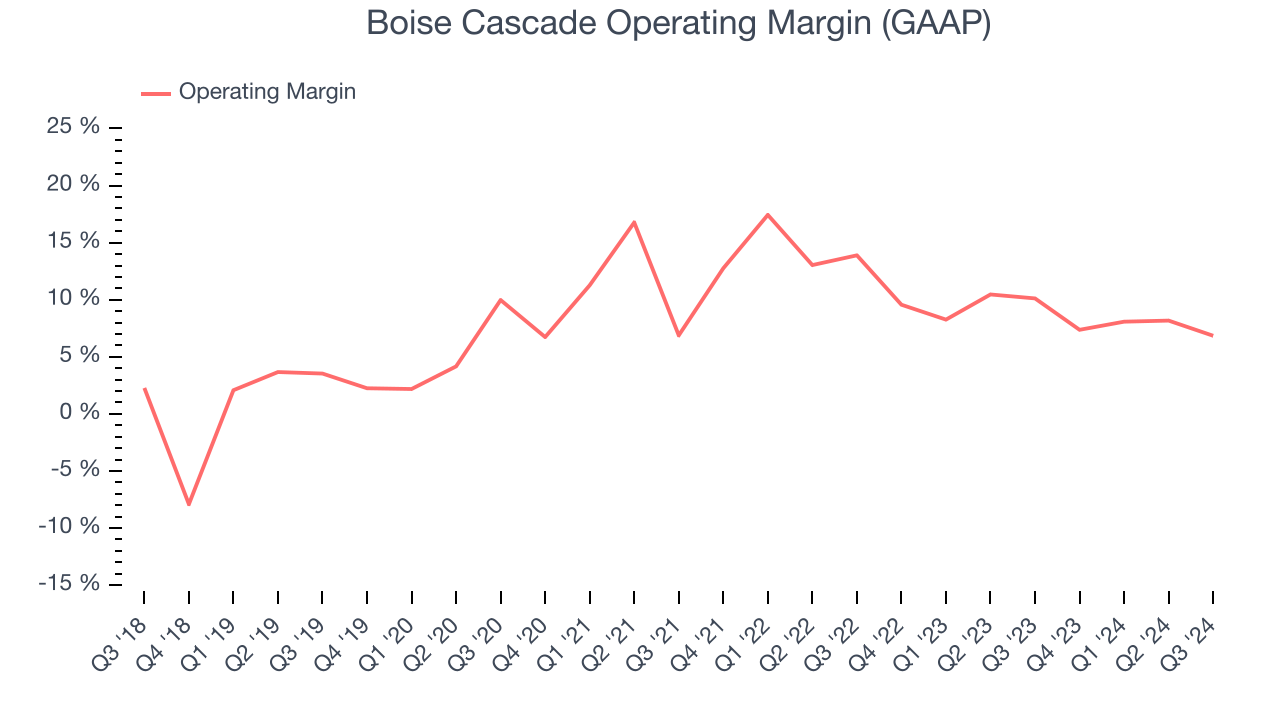

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Boise Cascade has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Boise Cascade’s annual operating margin rose by 2.5 percentage points over the last five years, showing its efficiency has improved.

This quarter, Boise Cascade generated an operating profit margin of 6.8%, down 3.3 percentage points year on year. Since Boise Cascade’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

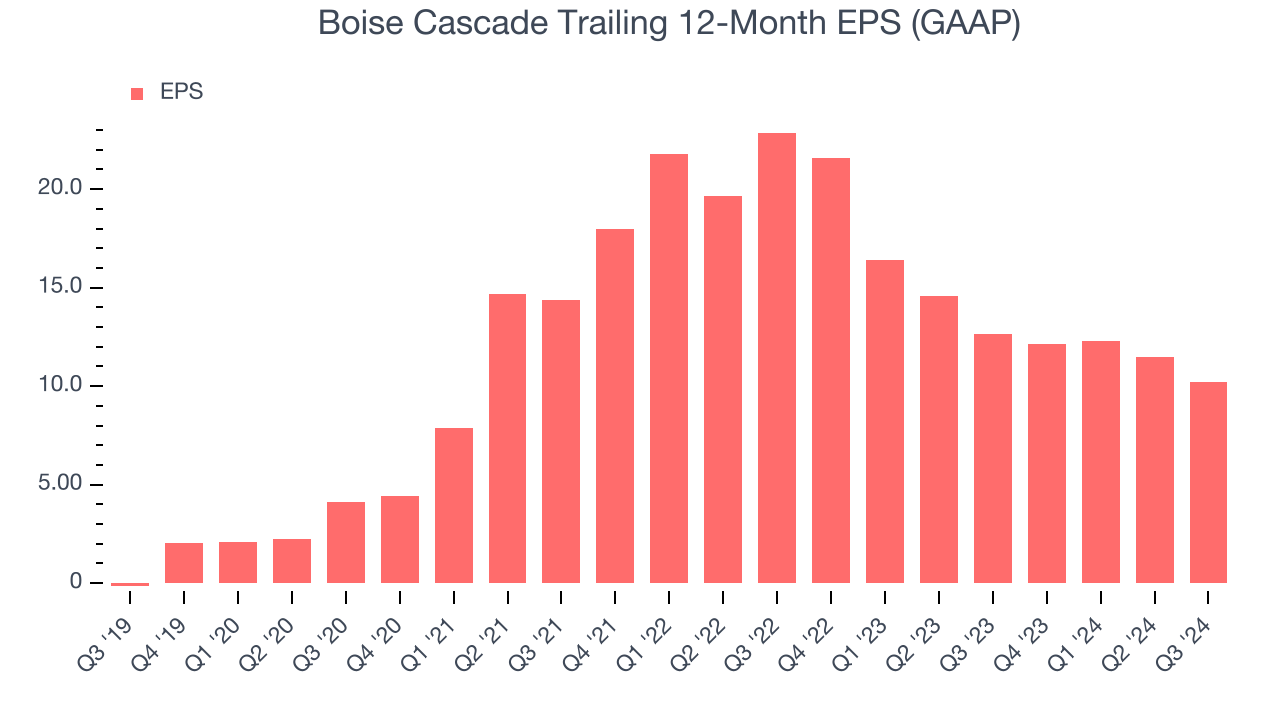

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Boise Cascade’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

Sadly for Boise Cascade, its EPS declined by more than its revenue over the last two years, dropping 33.2%. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Boise Cascade’s earnings to better understand the drivers of its performance. Boise Cascade’s operating margin has declined by 7 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Boise Cascade reported EPS at $2.33, down from $3.58 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Boise Cascade’s full-year EPS of $10.21 to shrink by 1.5%.

Key Takeaways from Boise Cascade’s Q3 Results

It was good to see Boise Cascade beat analysts’ EBITDA expectations this quarter. On the other hand, its revenue and EPS were in line with estimates. Overall, this was a decent quarter. The stock remained flat at $133 immediately after reporting.

So should you invest in Boise Cascade right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.