Pop culture collectibles manufacturer Funko (NASDAQ:FNKO) beat Wall Street’s revenue expectations in Q3 CY2024, but sales fell 6.4% year on year to $292.8 million. On the other hand, next quarter’s revenue guidance of $287 million was less impressive, coming in 9.3% below analysts’ estimates. Its non-GAAP profit of $0.14 per share was above analysts’ consensus estimates.

Is now the time to buy Funko? Find out by accessing our full research report, it’s free.

Funko (FNKO) Q3 CY2024 Highlights:

- Revenue: $292.8 million vs analyst estimates of $289.6 million (1.1% beat)

- Adjusted EPS: $0.14 vs analyst estimates of $0.04 ($0.10 beat)

- EBITDA: $30.99 million vs analyst estimates of $22.83 million (35.7% beat)

- Revenue Guidance for Q4 CY2024 is $287 million at the midpoint, below analyst estimates of $316.4 million

- EBITDA guidance for the full year is $87.5 million at the midpoint, above analyst estimates of $81.98 million

- Gross Margin (GAAP): 40.9%, up from 35.2% in the same quarter last year

- Operating Margin: 4%, up from -1.7% in the same quarter last year

- EBITDA Margin: 10.6%, up from 8.1% in the same quarter last year

- Free Cash Flow was -$4.19 million, down from $810,000 in the same quarter last year

- Market Capitalization: $607.5 million

"We reported solid financial results for the 2024 third quarter,” said Cynthia Williams, Chief Executive Officer of Funko.

Company Overview

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Sales Growth

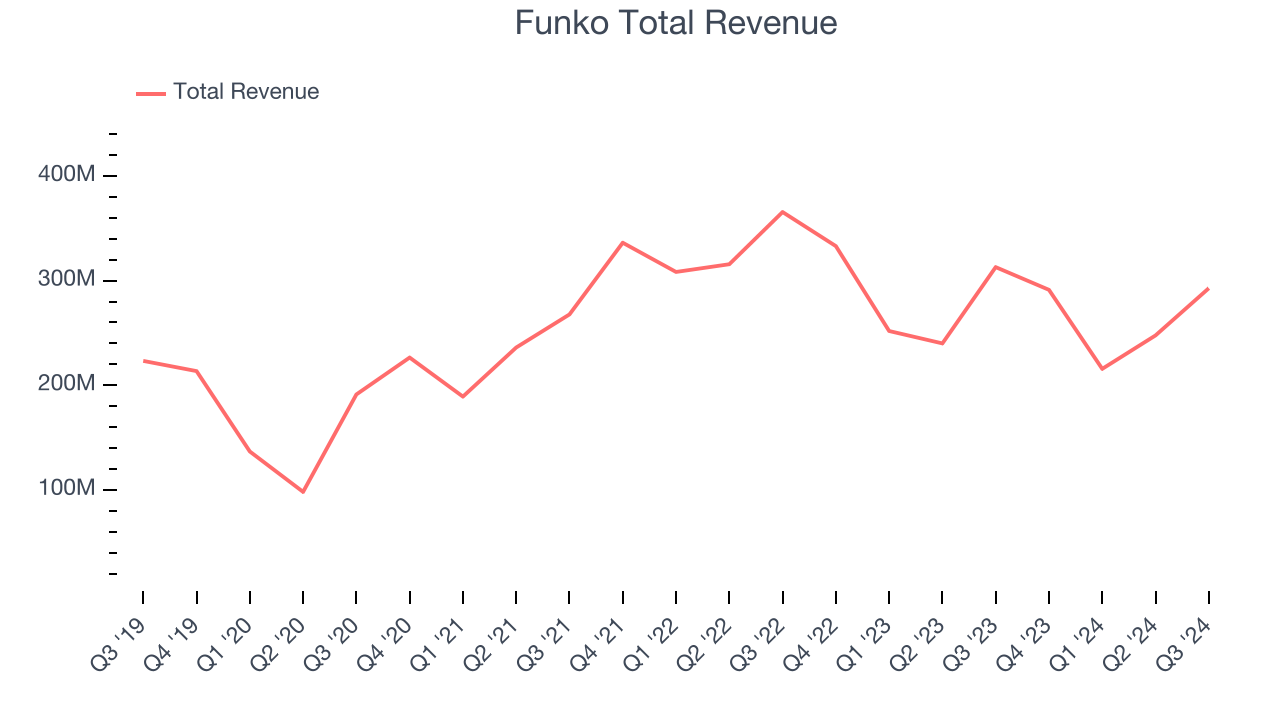

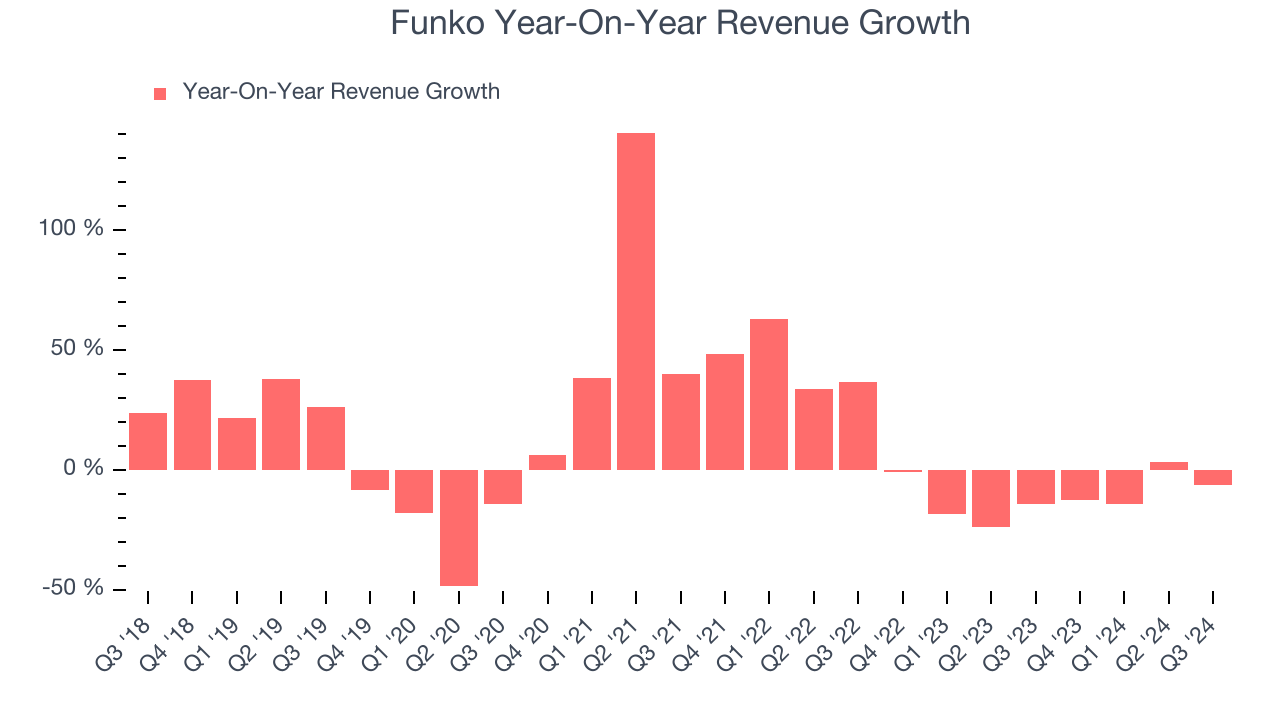

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Funko’s sales grew at a sluggish 5.1% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Funko’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 11.1% annually.

This quarter, Funko’s revenue fell 6.4% year on year to $292.8 million but beat Wall Street’s estimates by 1.1%. Management is currently guiding for a 1.5% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.8% over the next 12 months, an improvement versus the last two years. Although this projection shows the market thinks its newer products and services will catalyze better performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

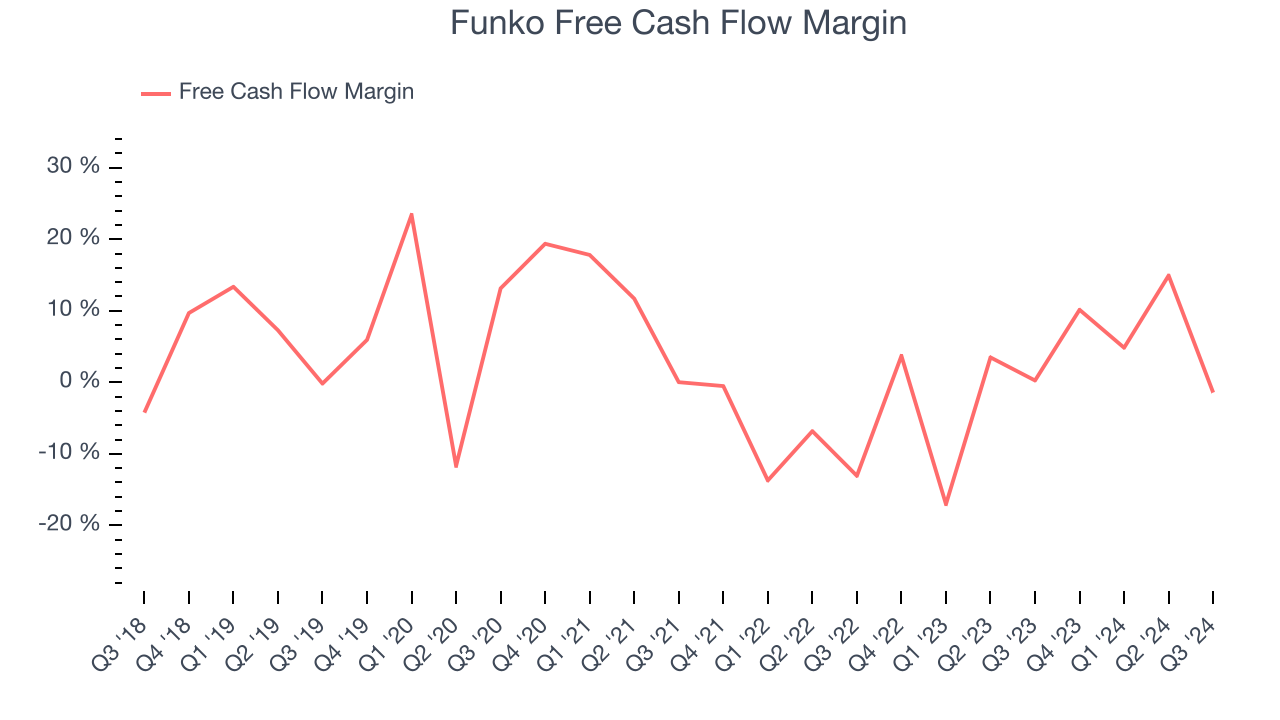

Funko has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, lousy for a consumer discretionary business.

Funko burned through $4.19 million of cash in Q3, equivalent to a negative 1.4% margin. The company’s cash burn increased meaningfully year on year and is a deviation from its longer-term margin, raising some eyebrows.

Key Takeaways from Funko’s Q3 Results

We were impressed by how Funko blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year EBITDA guidance beat Wall Street’s estimates. The one blemish in this print, however, is that its full-year revenue outlook underwhelmed significantly, making this a softer quarter. The stock traded down 1.6% to $12 immediately following the results.

Is Funko an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.