The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how electrical systems stocks fared in Q3, starting with Methode Electronics (NYSE:MEI).

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 16 electrical systems stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 5.7% on average since the latest earnings results.

Best Q3: Methode Electronics (NYSE:MEI)

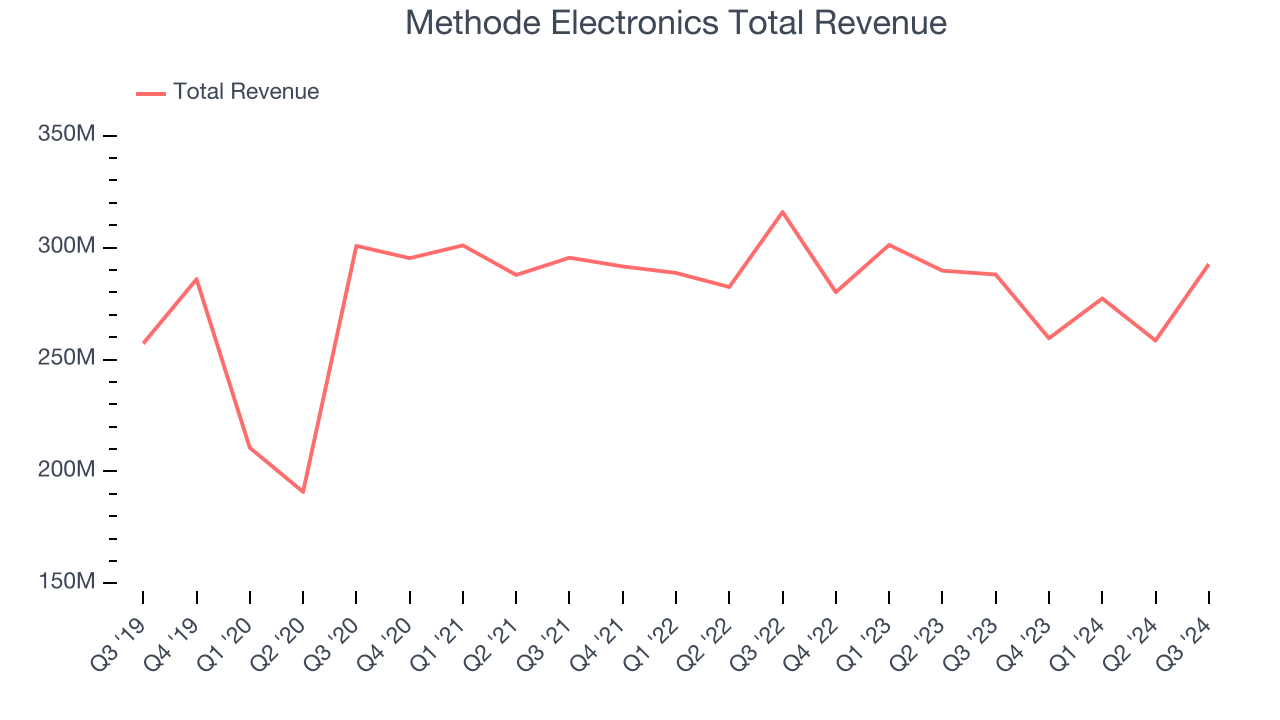

Founded in 1946, Methode Electronics (NYSE:MEI) is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).

Methode Electronics reported revenues of $292.6 million, up 1.6% year on year. This print exceeded analysts’ expectations by 9%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Management CommentsPresident and Chief Executive Officer Jon DeGaynor said, “The team is energized, and these results demonstrate that we are heading in the right direction. Our sales in the quarter were the highest that we have reported since fiscal 2023, and our pre-tax income returned to positive territory. Our bookings remained solid, and our EV sales activity is steadily growing.”

Methode Electronics scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 11% since reporting and currently trades at $12.90.

Is now the time to buy Methode Electronics? Access our full analysis of the earnings results here, it’s free.

OSI Systems (NASDAQ:OSIS)

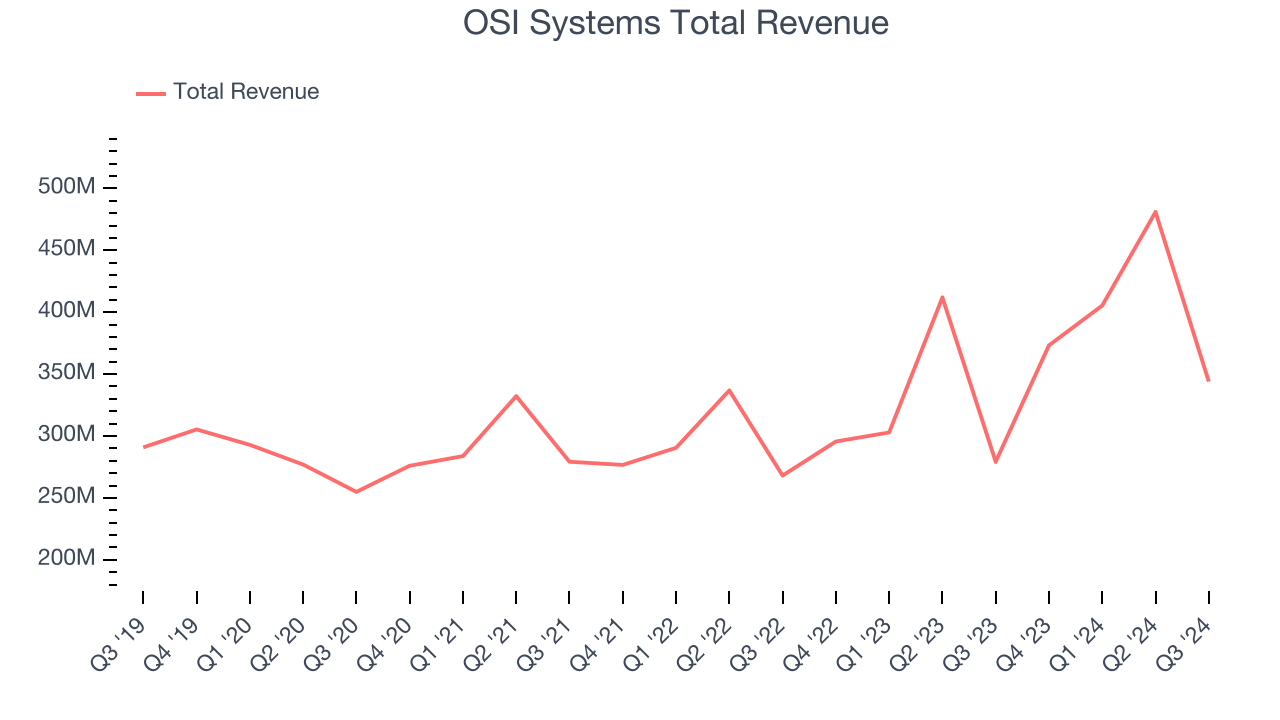

With a name reflecting its initial focus on optical sensors, OSI Systems (NASDAQ:OSIS) is a designer and manufacturer of specialized electronic systems and components.

OSI Systems reported revenues of $344 million, up 23.2% year on year, outperforming analysts’ expectations by 8%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates.

OSI Systems scored the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 20.3% since reporting. It currently trades at $171.

Is now the time to buy OSI Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Napco (NASDAQ:NSSC)

Napco Security Technologies, Inc. (NASDAQ:NSSC) is a leading manufacturer and designer of high-tech electronic security devices, cellular communication services for intrusion and fire alarm systems, and school safety solutions.

Napco reported revenues of $44 million, up 5.6% year on year, falling short of analysts’ expectations by 5.5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Napco delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 6.2% since the results and currently trades at $41.

Read our full analysis of Napco’s results here.

Atkore (NYSE:ATKR)

Protecting the things that power our world, Atkore (NYSE:ATKR) designs and manufactures electrical safety products.

Atkore reported revenues of $788.3 million, down 9.4% year on year. This number topped analysts’ expectations by 5.3%. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ organic revenue estimates but full-year EPS guidance missing analysts’ expectations significantly.

The stock is up 7% since reporting and currently trades at $90.01.

Read our full, actionable report on Atkore here, it’s free.

Whirlpool (NYSE:WHR)

Credited with introducing the first automatic washing machine, Whirlpool (NYSE:WHR) is a manufacturer of a variety of home appliances.

Whirlpool reported revenues of $3.99 billion, down 18.9% year on year. This print missed analysts’ expectations by 2.4%. It was a slower quarter as it also recorded full-year EPS guidance missing analysts’ expectations.

Whirlpool had the slowest revenue growth among its peers. The stock is up 24.8% since reporting and currently trades at $123.98.

Read our full, actionable report on Whirlpool here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September, a quarter in November) have kept 2024 stock markets frothy, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there's still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.