Furniture company Lovesac (NASDAQ:LOVE) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 2.7% year on year to $149.9 million. Its GAAP loss of $0.32 per share decreased from -$0.15 in the same quarter last year.

Is now the time to buy Lovesac? Find out by accessing our full research report, it’s free.

Lovesac (LOVE) Q3 CY2024 Highlights:

- Revenue: $149.9 million vs analyst estimates of $155.3 million (2.7% year-on-year decline, 3.5% miss)

- Adjusted EBITDA: $2.68 million vs analyst estimates of -$1.39 million (1.8% margin, significant beat)

- Revenue Guidance for Q4 CY2024 is $231 million at the midpoint

- EPS (GAAP) guidance for the full year is $0.51 at the midpoint, missing analyst estimates by 55.6%

- EBITDA guidance for the full year is $43 million at the midpoint

- Operating Margin: -5.2%, down from -2.3% in the same quarter last year

- Free Cash Flow was -$6.59 million compared to -$16.81 million in the same quarter last year

- Market Capitalization: $578.3 million

Shawn Nelson, Chief Executive Officer, stated, “Near-term headwinds for our category clearly persisted through the pre-election period. However, we gained market share and strengthened our competitive position through our relentless focus on product innovation and operational excellence. Our expanding portfolio of innovative products is resonating with customers and creating new avenues for sustained growth in the future. The soft launch of our Reclining Seat in the fourth quarter is just one of many exciting examples to come. The fundamental drivers of our business - including our brand equity, innovation pipeline, and customer relationship opportunities - are strong and give us high conviction in our ability to deliver substantial value creation over the long term. We look forward to sharing a detailed view of these opportunities and our strategic roadmap at our upcoming investor day next week.”

Company Overview

Known for its oversized, premium beanbags, Lovesac (NASDAQ:LOVE) is a specialty furniture brand selling modular furniture.

Home Furnishings

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

Sales Growth

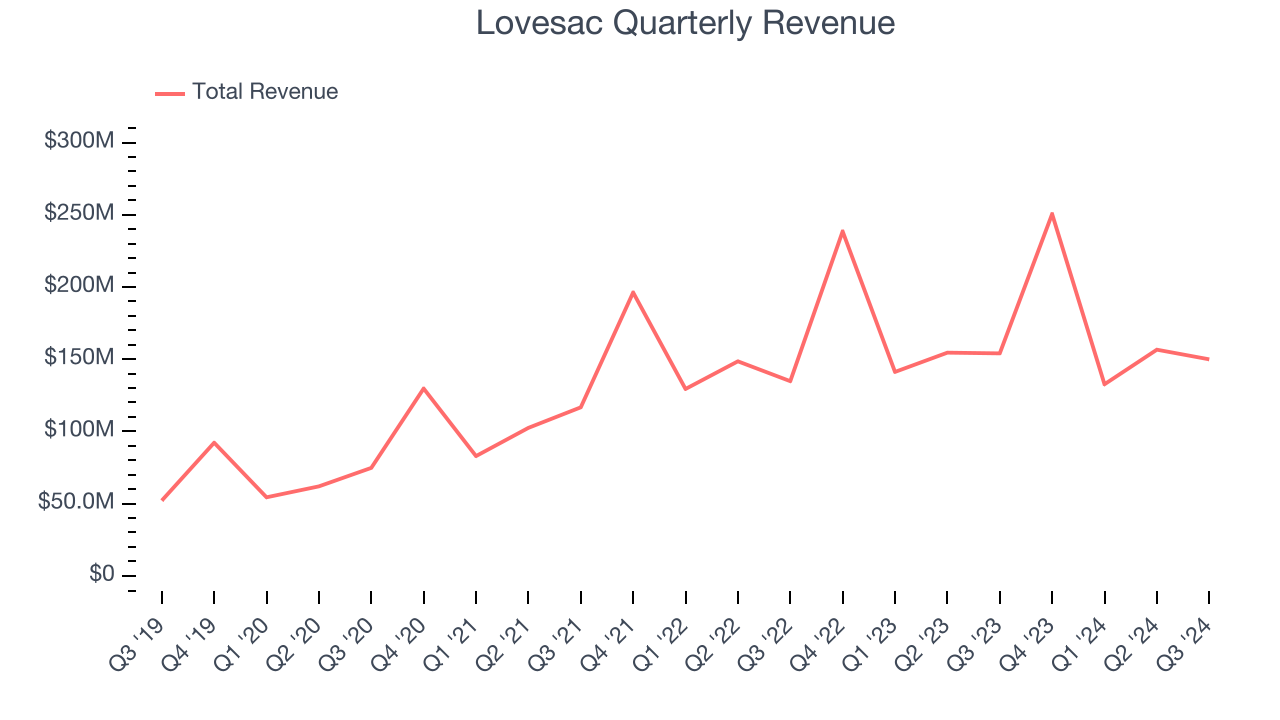

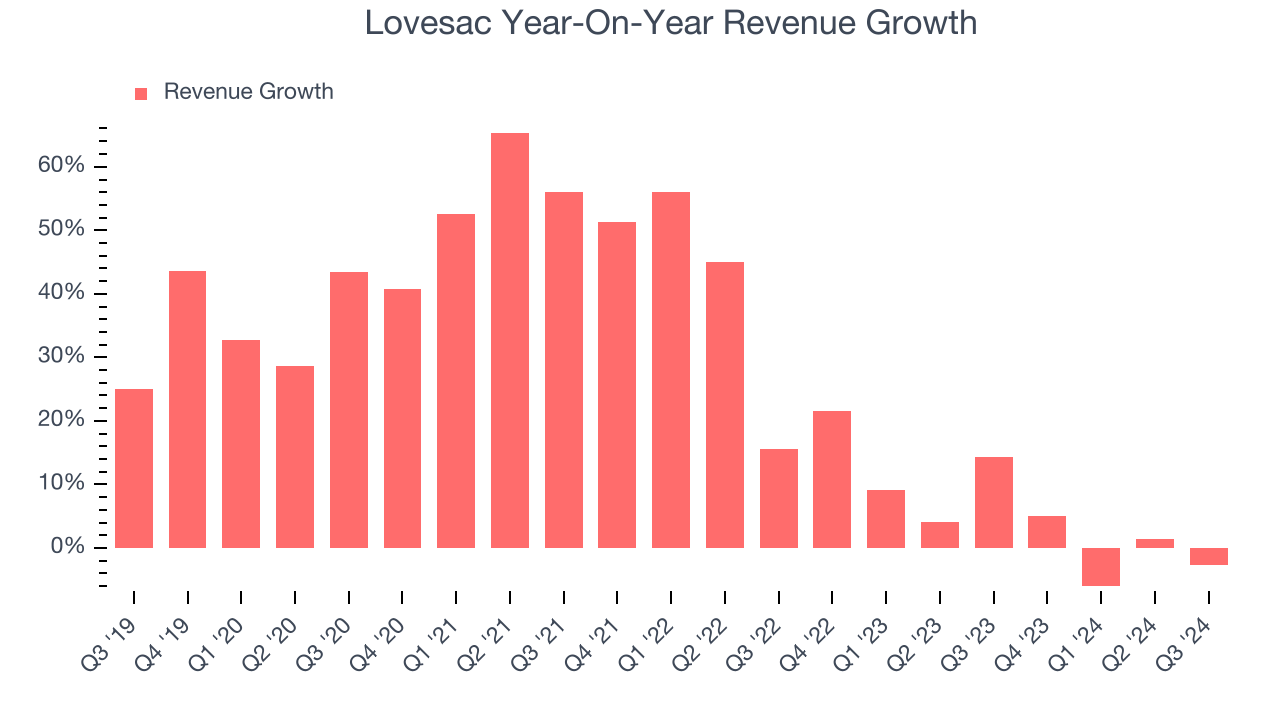

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Lovesac grew its sales at an exceptional 27.4% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Lovesac’s recent history shows its demand slowed significantly as its annualized revenue growth of 6.4% over the last two years is well below its five-year trend.

This quarter, Lovesac missed Wall Street’s estimates and reported a rather uninspiring 2.7% year-on-year revenue decline, generating $149.9 million of revenue. Company management is currently guiding for a 7.8% year-on-year decline in sales next quarter.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

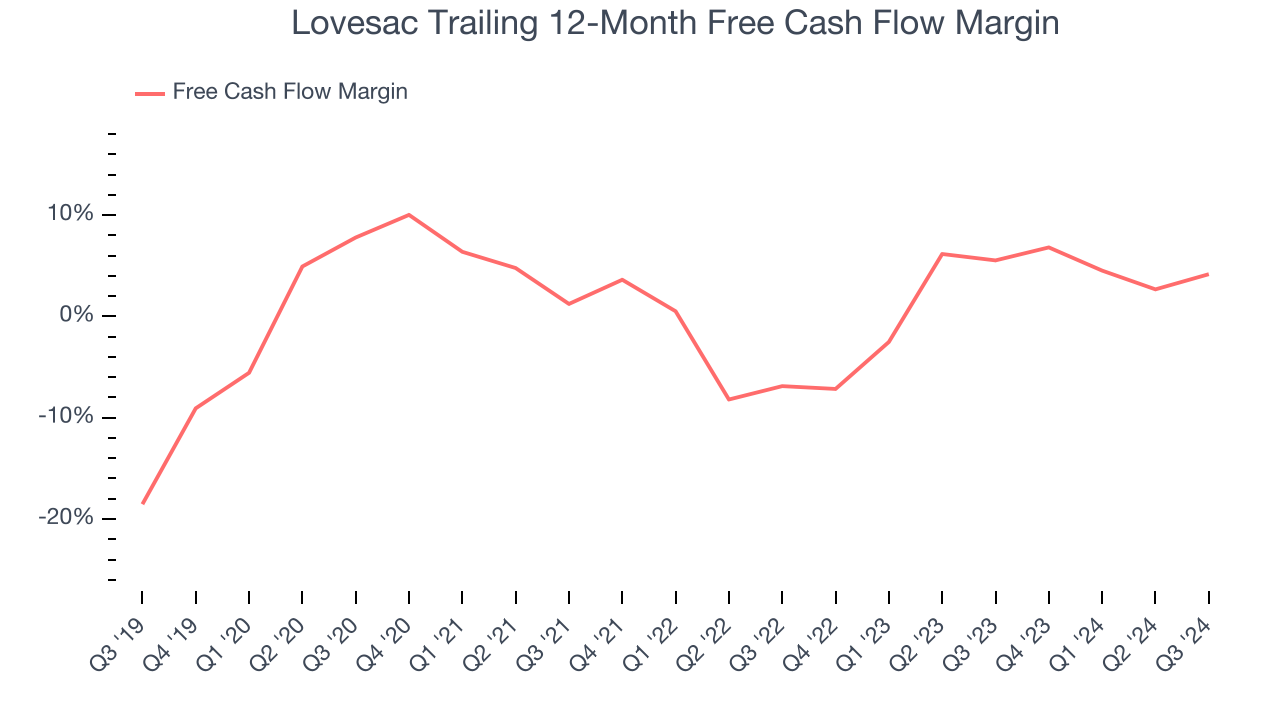

Lovesac has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.8%, lousy for a consumer discretionary business.

Lovesac burned through $6.59 million of cash in Q3, equivalent to a negative 4.4% margin. The company’s cash burn was similar to its $16.81 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Lovesac’s Q3 Results

We were impressed by how significantly Lovesac blew past analysts’ EBITDA expectations this quarter. On the other hand, its full-year EPS guidance missed significantly and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 20.1% to $30.05 immediately after reporting.

Lovesac underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.