Payroll and human resources software provider, Paychex (NASDAQ:PAYX) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 4.7% year on year to $1.32 billion. Its non-GAAP profit of $1.14 per share was 1.5% above analysts’ consensus estimates.

Is now the time to buy Paychex? Find out by accessing our full research report, it’s free.

Paychex (PAYX) Q4 CY2024 Highlights:

- Revenue: $1.32 billion vs analyst estimates of $1.31 billion (4.7% year-on-year growth, in line)

- Adjusted EPS: $1.14 vs analyst estimates of $1.12 (1.5% beat)

- Adjusted EBITDA: $579.1 million vs analyst estimates of $578.5 million (44% margin, in line)

- "Our business outlook for fiscal 2025 remains unchanged from what we previously provided in the first quarter"

- Operating Margin: 40.9%, in line with the same quarter last year

- Free Cash Flow Margin: 18.8%, down from 38.7% in the previous quarter

- Market Capitalization: $48.9 billion

President and Chief Executive Officer , John Gibson commented, "We are pleased to report strong financial results for the second quarter of fiscal 2025 with a 5% increase in total revenue. Excluding the impact of the expiration of the Employee Retention Tax Credit ("ERTC") program, revenue growth was 7% for the quarter.

Company Overview

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

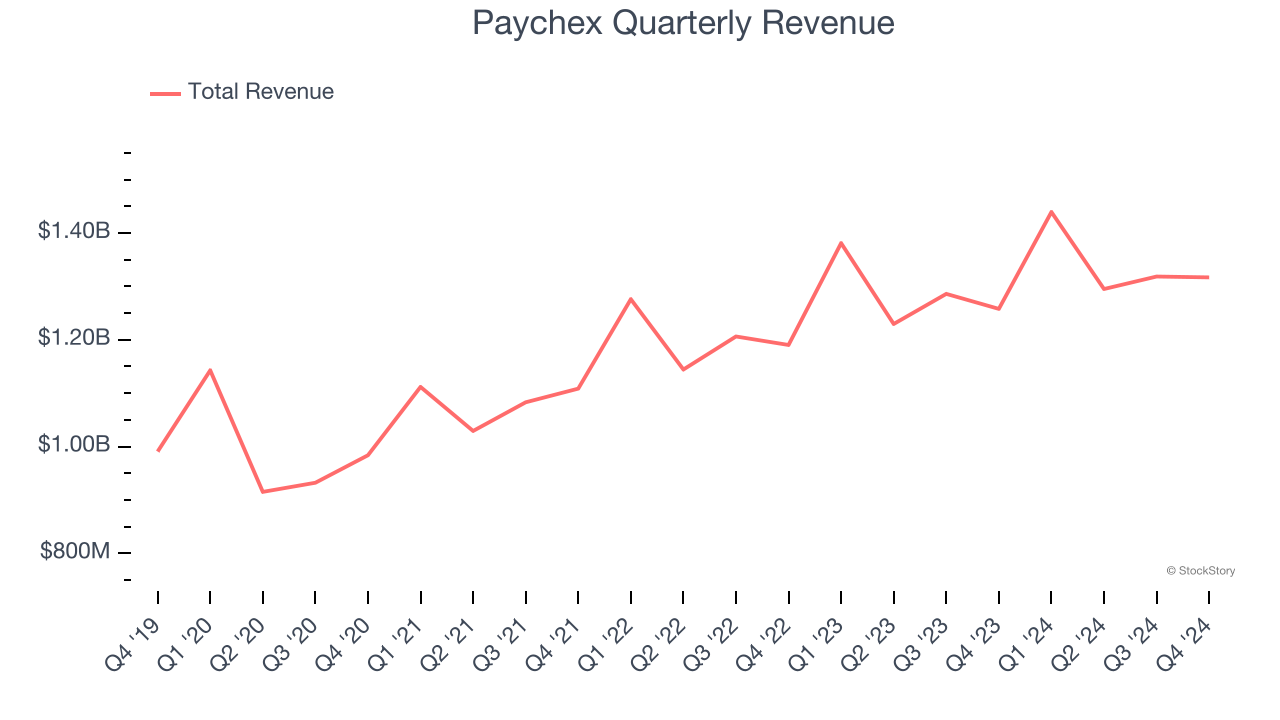

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Paychex grew its sales at a weak 7.4% compounded annual growth rate. This was below our standard for the software sector and is a poor baseline for our analysis.

This quarter, Paychex grew its revenue by 4.7% year on year, and its $1.32 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

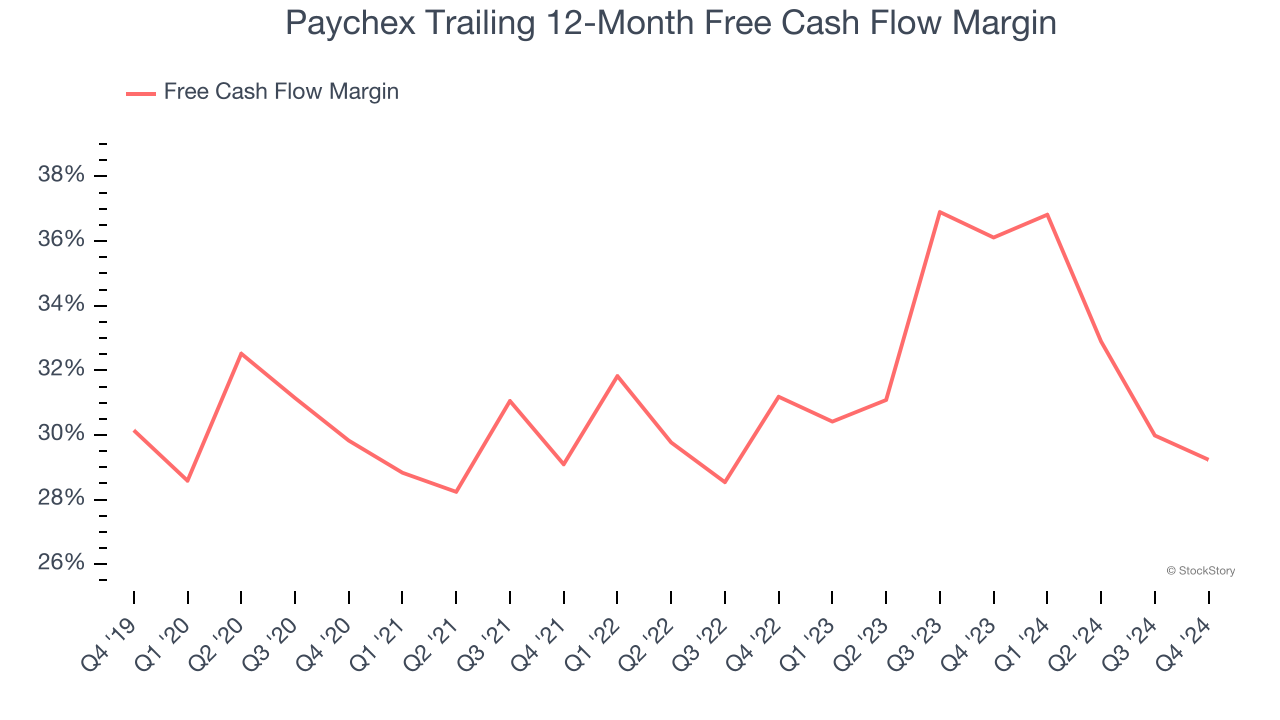

Paychex has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging 29.2% over the last year.

Paychex’s free cash flow clocked in at $248 million in Q4, equivalent to a 18.8% margin. The company’s cash profitability regressed as it was 2.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Paychex’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 29.2% for the last 12 months will increase to 35.1%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from Paychex’s Q4 Results

Revenue was in line and EPS beat slightly. The company's full-year outlook was maintained. Zooming out, we think this was a fine quarter with few surprises, which can certainly be a good thing. The stock traded up 3.8% to $141.25 immediately following the results.

So do we think Paychex is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.