The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how design software stocks fared in Q3, starting with Autodesk (NASDAQ:ADSK).

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 7 design software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.9% while next quarter’s revenue guidance was 2.2% below.

Thankfully, share prices of the companies have been resilient as they are up 6.6% on average since the latest earnings results.

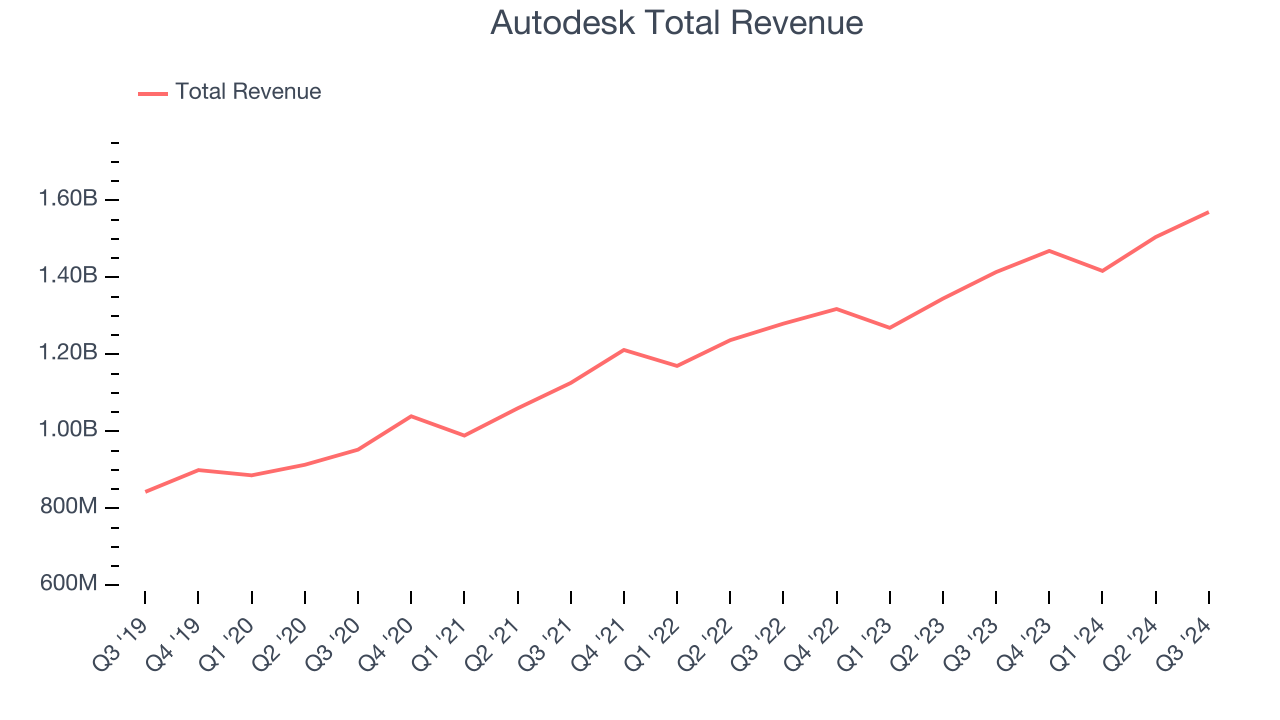

Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.57 billion, up 11% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates but annual recurring revenue in line with analysts’ estimates.

"Autodesk is leading the industry in modernizing its go-to-market motion. These initiatives enable us to build larger and more durable direct relationships with our customers and to serve them more efficiently. We have already seen significant benefits from these optimization initiatives and there's more to come in the next phase," said Andrew Anagnost, Autodesk president and CEO.

Autodesk delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 7.7% since reporting and currently trades at $293.48.

Is now the time to buy Autodesk? Access our full analysis of the earnings results here, it’s free.

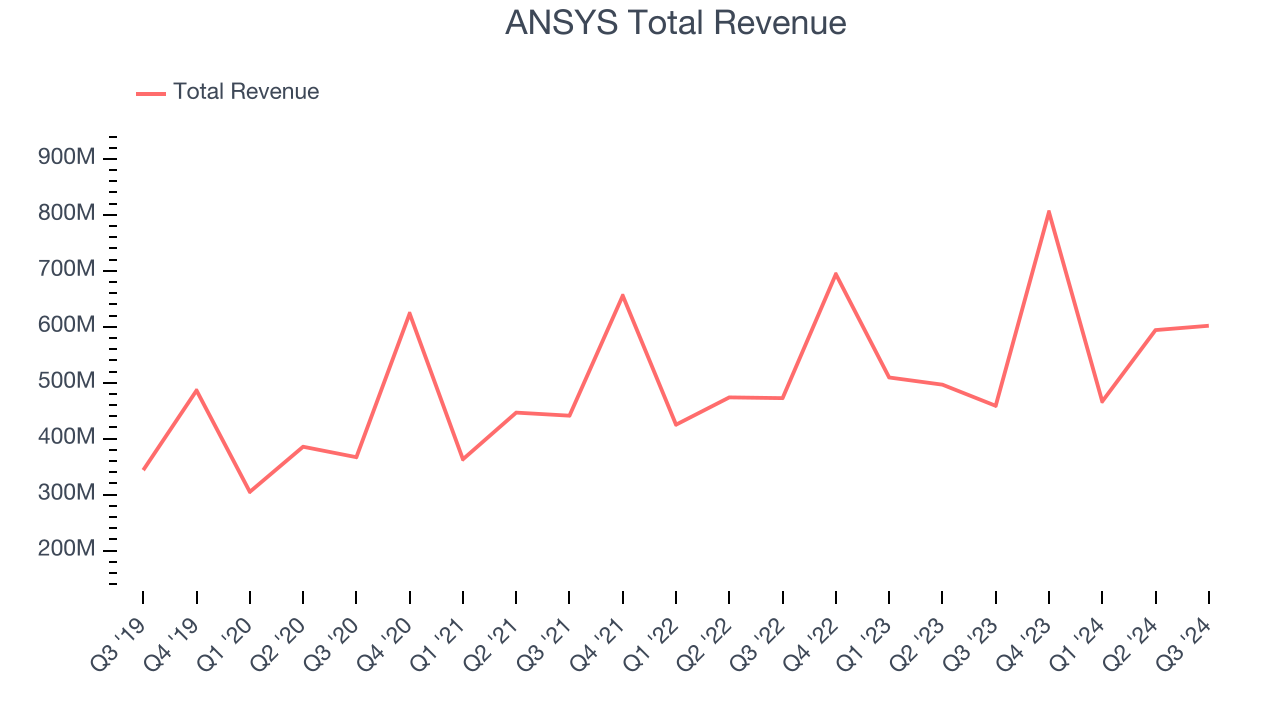

Best Q3: ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $601.9 million, up 31.2% year on year, outperforming analysts’ expectations by 14.9%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA and annual contract value estimates.

ANSYS scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 3.9% since reporting. It currently trades at $346.36.

Is now the time to buy ANSYS? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $5.41 billion, up 10.6% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a slower quarter as it posted revenue guidance for next quarter slightly missing analysts’ expectations.

As expected, the stock is down 12.1% since the results and currently trades at $515.90.

Read our full analysis of Adobe’s results here.

Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $446.5 million, down 18% year on year. This result beat analysts’ expectations by 4.3%. Zooming out, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ billings estimates.

Unity had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is up 8.6% since reporting and currently trades at $24.16.

Read our full, actionable report on Unity here, it’s free.

PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $626.5 million, up 14.6% year on year. This result beat analysts’ expectations by 1%. Taking a step back, it was a mixed quarter as it also logged full-year guidance of accelerating revenue growth but EPS guidance for next quarter missing analysts’ expectations significantly.

The stock is up 2.5% since reporting and currently trades at $202.89.

Read our full, actionable report on PTC here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.