Nikola has gotten torched over the last six months - since June 2024, its stock price has dropped 89.1% to a new 52-week low of $1.15 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Nikola, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even though the stock has become cheaper, we're cautious about Nikola. Here are three reasons why there are better opportunities than NKLA and a stock we'd rather own.

Why Is Nikola Not Exciting?

Named after Nikola Tesla, Nikola (NASDAQ:NKLA) manufactures zero-emission vehicles, focusing on battery-electric and hydrogen fuel cell electric trucks.

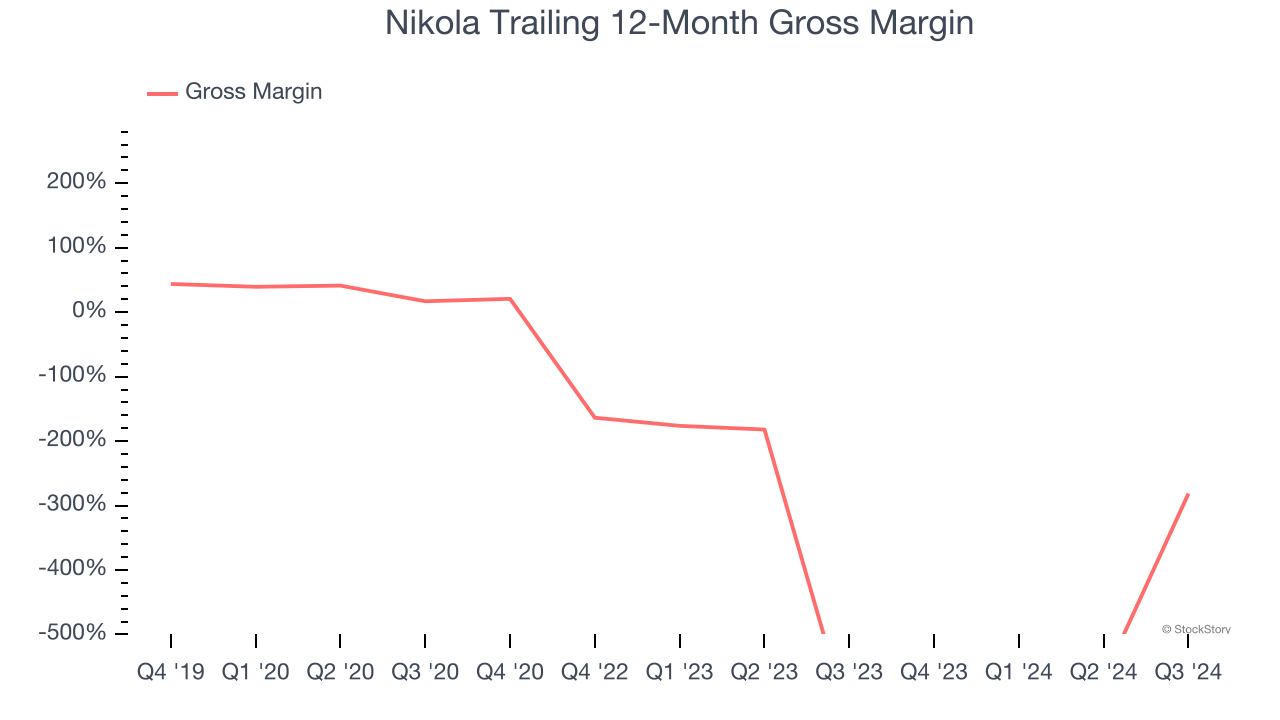

1. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Nikola has bad unit economics for an industrials business, signaling it operates in a competitive market. This is also because it’s an automobile manufacturer.

Automobile manufacturers have structurally lower profitability as they often break even on the initial sale of vehicles and instead make money on parts and servicing, which come many years later - this explains why new entrants whose fleets are too young to generate substantial aftermarket revenues have negative gross margins. As you can see below, these dynamics culminated in an average negative 311% gross margin for Nikola over the last five years.

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Nikola’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1,334%, meaning it lit $1,334 of cash on fire for every $100 in revenue.

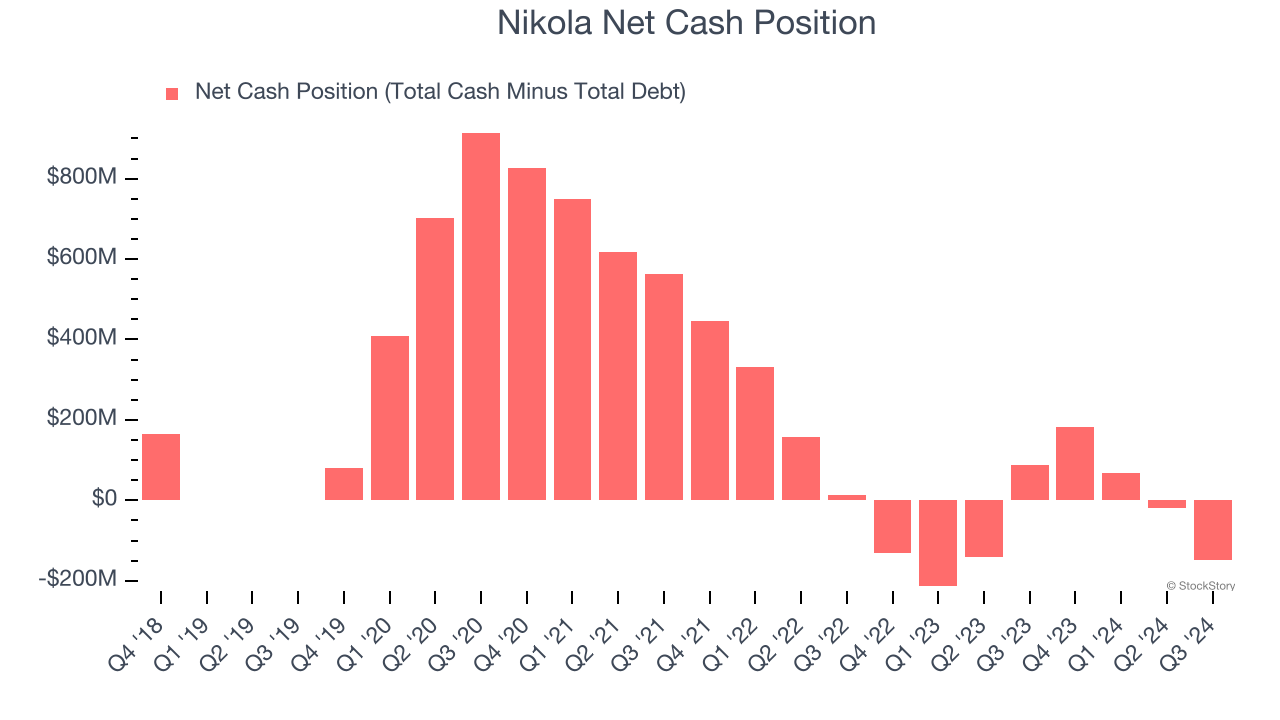

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Nikola burned through $573.1 million of cash over the last year, and its $349.9 million of debt exceeds the $201.7 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Nikola’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Nikola until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Nikola’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at $1.15 per share (or 0.2× forward price-to-sales). The market typically values companies like Nikola based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Nikola

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.