Used-car retailer America’s Car-Mart (NASDAQ:CRMT) reported Q3 CY2024 results exceeding the market’s revenue expectations, but sales fell by 3.6% year on year to $347.3 million. Its GAAP profit of $0.61 per share was significantly above analysts’ consensus estimates.

Is now the time to buy America's Car-Mart? Find out by accessing our full research report, it’s free.

America's Car-Mart (CRMT) Q3 CY2024 Highlights:

- Revenue: $347.3 million vs analyst estimates of $344.4 million (3.6% year-on-year decline, 0.8% beat)

- Adjusted EPS: $0.61 vs analyst estimates of -$0.10 (significant beat)

- Adjusted EBITDA: $29.05 million vs analyst estimates of $19.38 million (8.4% margin, 49.9% beat)

- Operating Margin: 7.8%, up from -5.3% in the same quarter last year

- Free Cash Flow was -$21.22 million compared to -$31.5 million in the same quarter last year

- Locations: 154 at quarter end, in line with the same quarter last year

- Same-Store Sales fell 8.4% year on year (2.7% in the same quarter last year)

- Market Capitalization: $376.3 million

Company Overview

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

America's Car-Mart is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new stores.

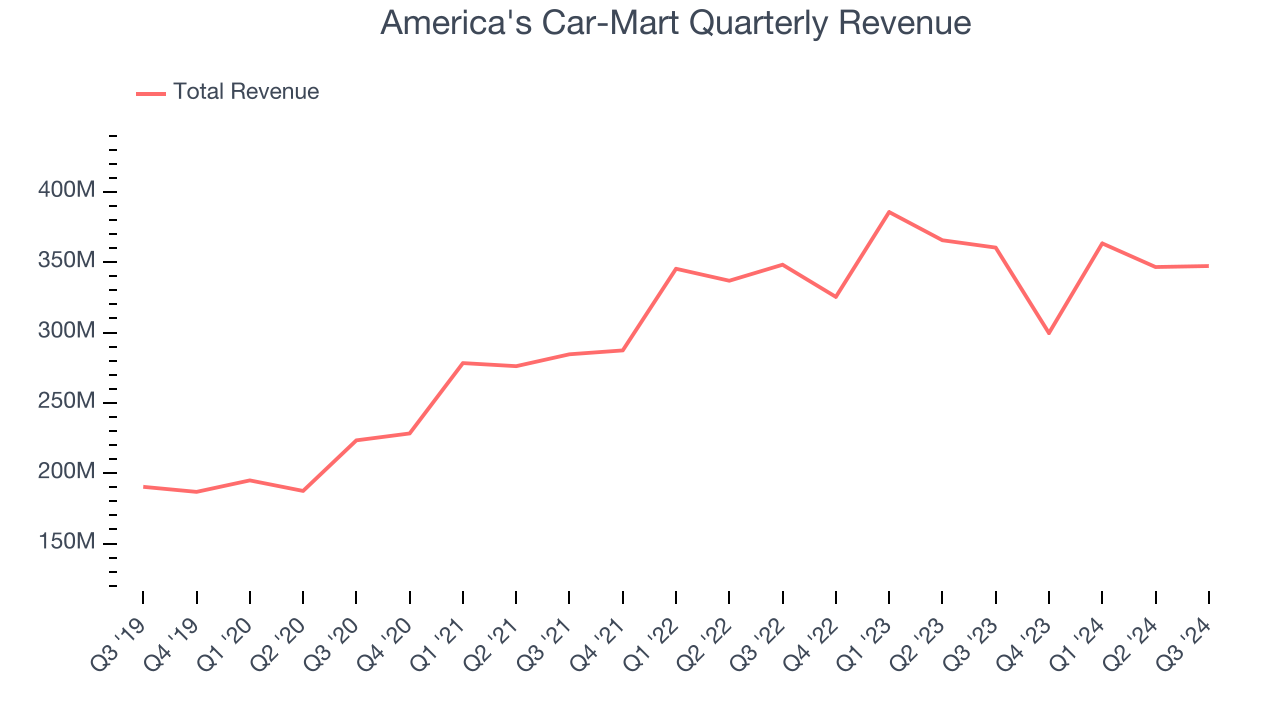

As you can see below, America's Car-Mart’s sales grew at a solid 14.2% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) despite not opening many new stores.

This quarter, America's Car-Mart’s revenue fell by 3.6% year on year to $347.3 million but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months, a deceleration versus the last five years. This projection doesn't excite us and suggests its products will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

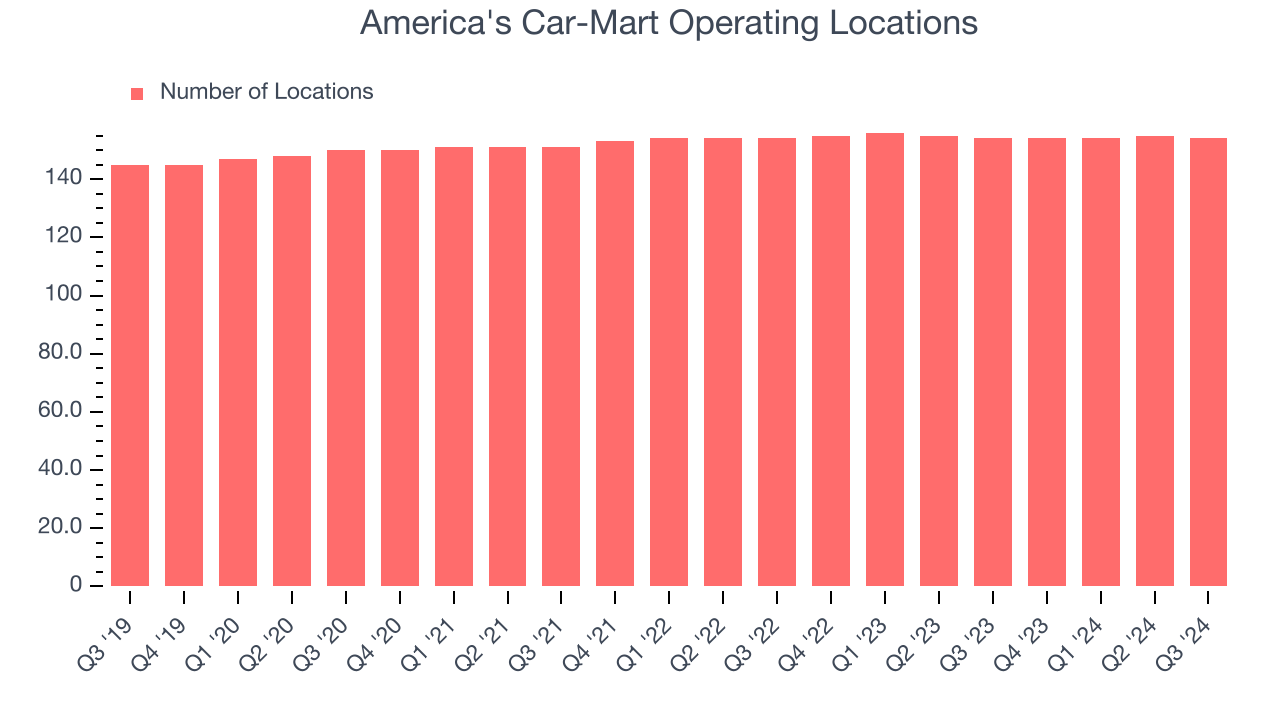

A retailer’s store count often determines how much revenue it can generate.

America's Car-Mart listed 154 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

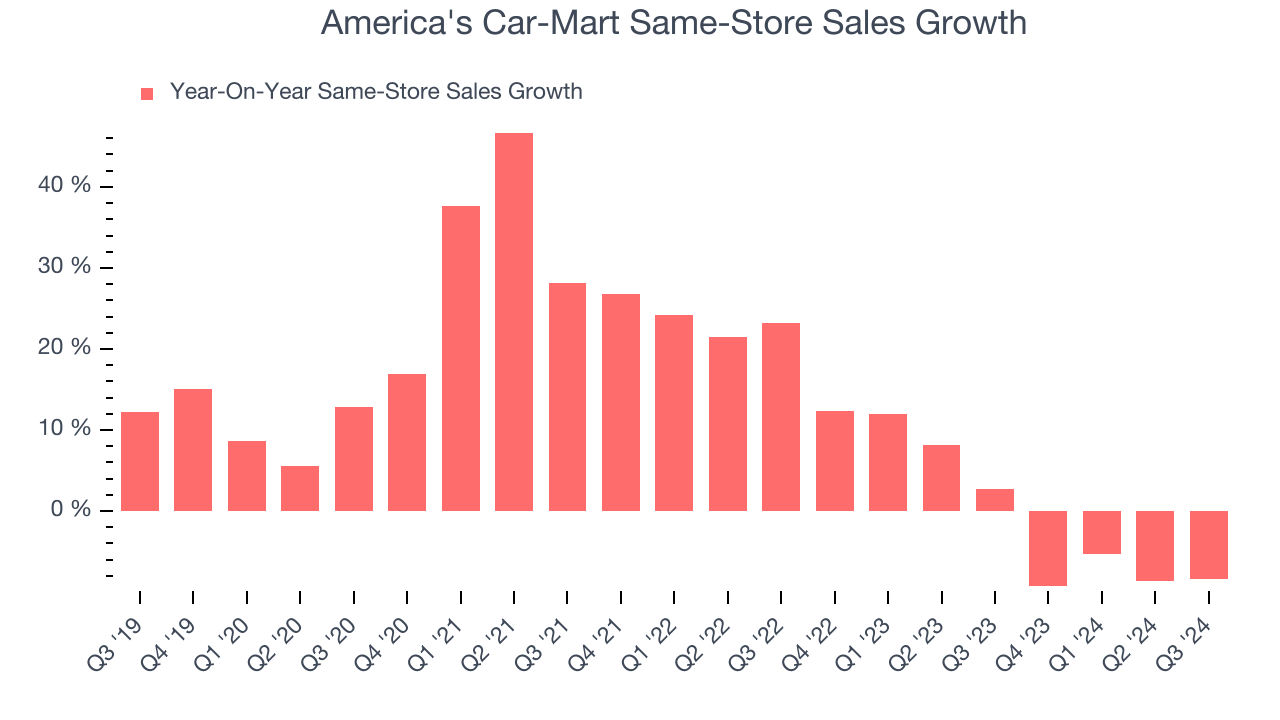

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

America's Car-Mart’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if America's Car-Mart starts opening new stores to artificially boost revenue growth.

In the latest quarter, America's Car-Mart’s same-store sales fell by 8.4% year on year. This decline was a reversal from its historical levels.

Key Takeaways from America's Car-Mart’s Q3 Results

We were impressed by how significantly America's Car-Mart blew past analysts’ EPS and EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its gross margin missed. Still, we think this was a solid quarter. The stock traded up 1.8% to $46.51 immediately after reporting.

America's Car-Mart had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.