Even though Carlisle (currently trading at $438.24 per share) has gained 7.6% over the last six months, it has lagged the S&P 500’s 13.7% return during that period. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Carlisle, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We're cautious about Carlisle. Here are three reasons why we avoid CSL and a stock we'd rather own.

Why Is Carlisle Not Exciting?

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies (NYSE:CSL) is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

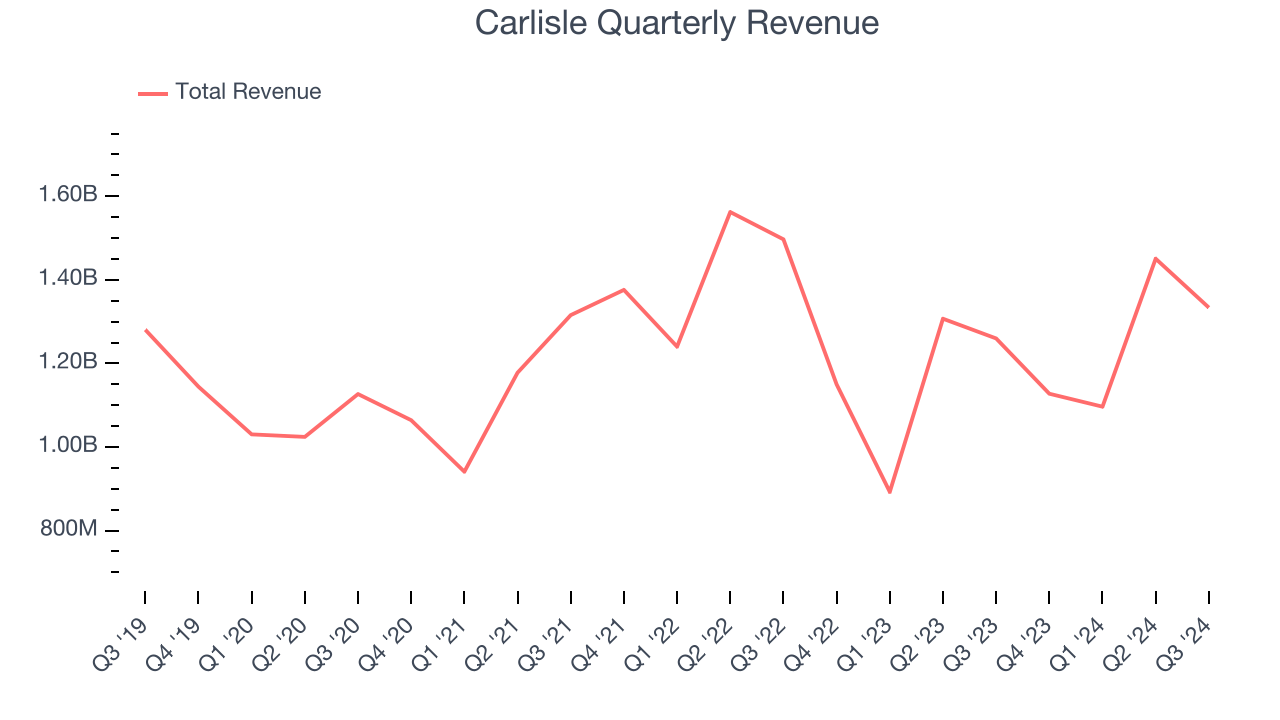

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Carlisle grew its sales at a weak 1.1% compounded annual growth rate. This fell short of our benchmarks.

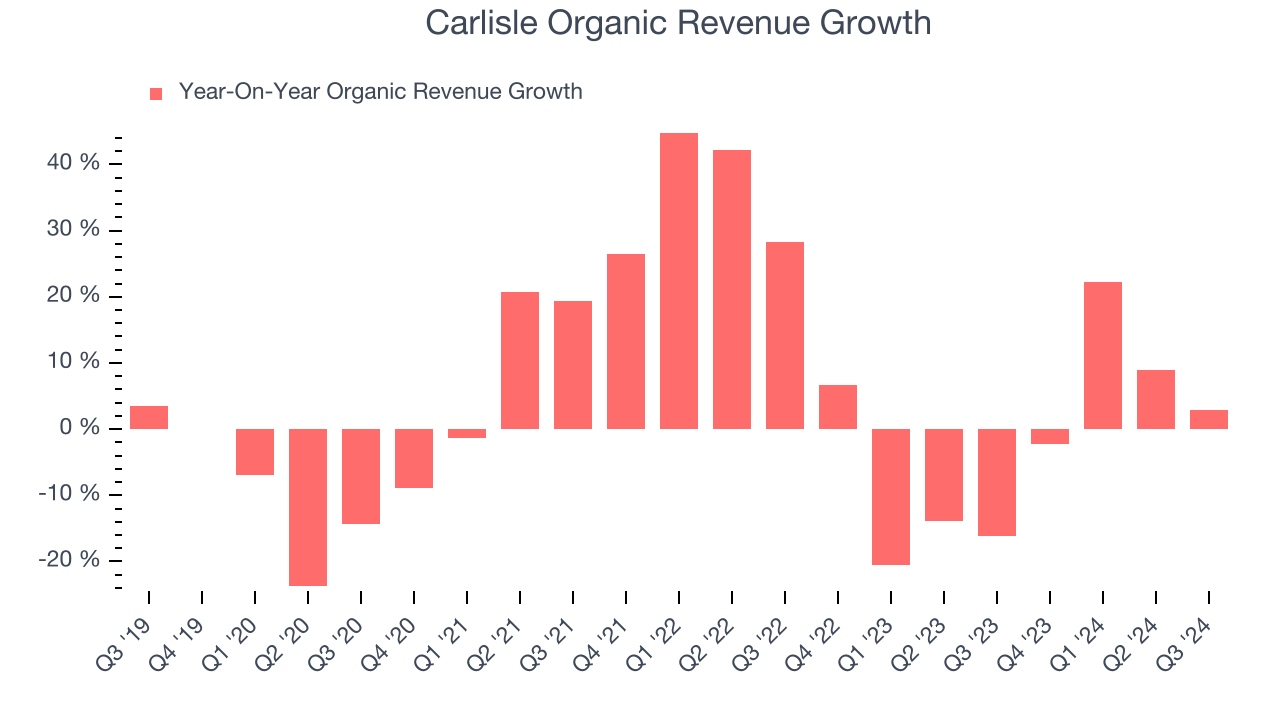

2. Core Business Falling Behind as Demand Declines

In addition to reported revenue, organic revenue is a useful data point for analyzing Building Materials companies. This metric gives visibility into Carlisle’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Carlisle’s organic revenue averaged 1.5% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Carlisle might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

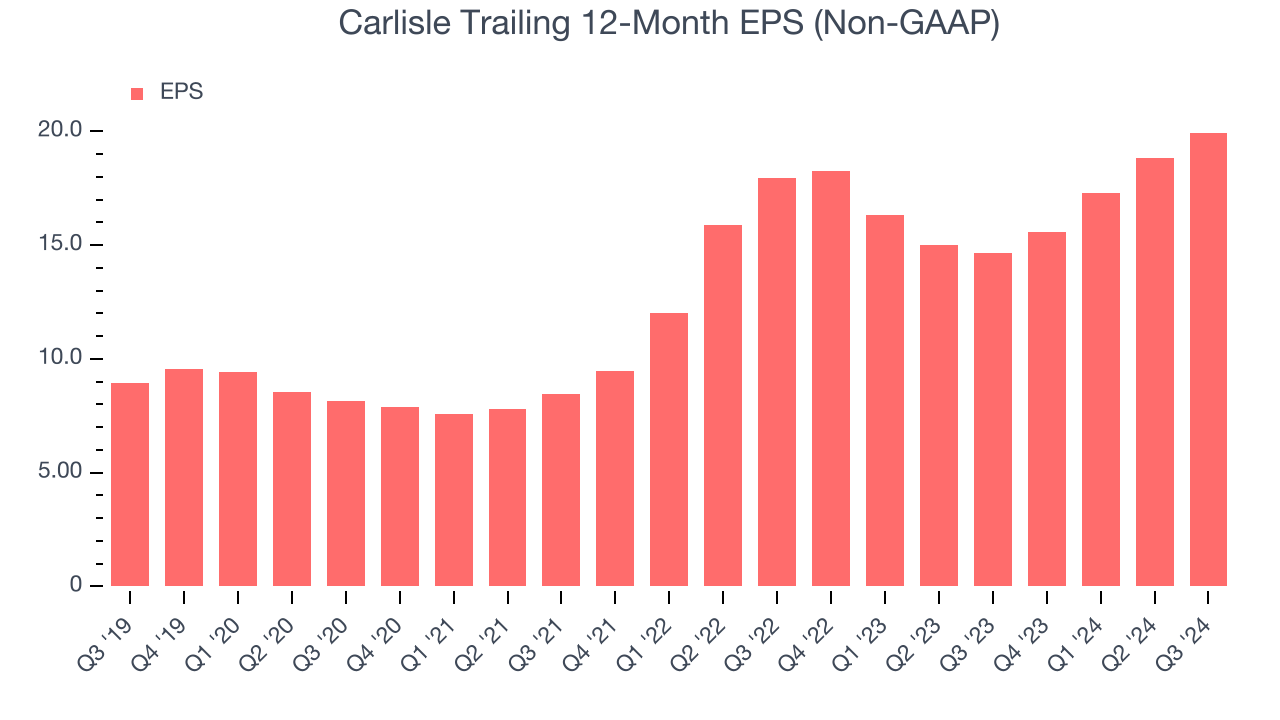

3. Recent EPS Growth Below Our Standards

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Carlisle’s EPS grew at an unimpressive 5.4% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 6.1% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

Carlisle isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 19.5× forward price-to-earnings (or $438.24 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. Let us point you toward Uber, whose profitability just reached an inflection point.

Stocks We Would Buy Instead of Carlisle

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.