Luxury watch company Movado (NYSE:MOV) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 2.6% year on year to $182.7 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $665 million at the midpoint. Its GAAP profit of $0.22 per share was 31.3% below analysts’ consensus estimates.

Is now the time to buy Movado? Find out by accessing our full research report, it’s free.

Movado (MOV) Q3 CY2024 Highlights:

- Revenue: $182.7 million vs analyst estimates of $187.7 million (2.6% year-on-year decline, 2.6% miss)

- Adjusted EPS: $0.22 vs analyst expectations of $0.32 (31.3% miss)

- The company dropped its revenue guidance for the full year to $665 million at the midpoint from $670 million, a 0.7% decrease

- EPS (GAAP) guidance for the full year is $0.90 at the midpoint, missing analyst estimates by 1.1%

- Operating Margin: 3.6%, down from 11% in the same quarter last year

- Free Cash Flow was -$7.17 million compared to -$3.87 million in the same quarter last year

- Market Capitalization: $464.1 million

Efraim Grinberg, Chairman and Chief Executive Officer, stated, “We continued to advance our strategy in the third quarter, unveiling a captivating Movado brand-building marketing campaign in September, launching iconic product families across our brand portfolio, and delivering solid growth in our digital channel, all while maintaining a strong balance sheet. Our financial results were held back due to tighter inventory management by our retail partners in the U.S. and Europe and our planned increase in investment spend to support future growth. While we now expect net sales and operating income at the lower end of our previous guidance range, we have taken steps to align our expense base with expected sales, making the difficult decision to reduce headcount as part of a cost-savings initiative. This is expected to generate approximately $6.5 million in annualized savings.”

Company Overview

With its watches displayed in 20 museums around the world, Movado (NYSE:MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

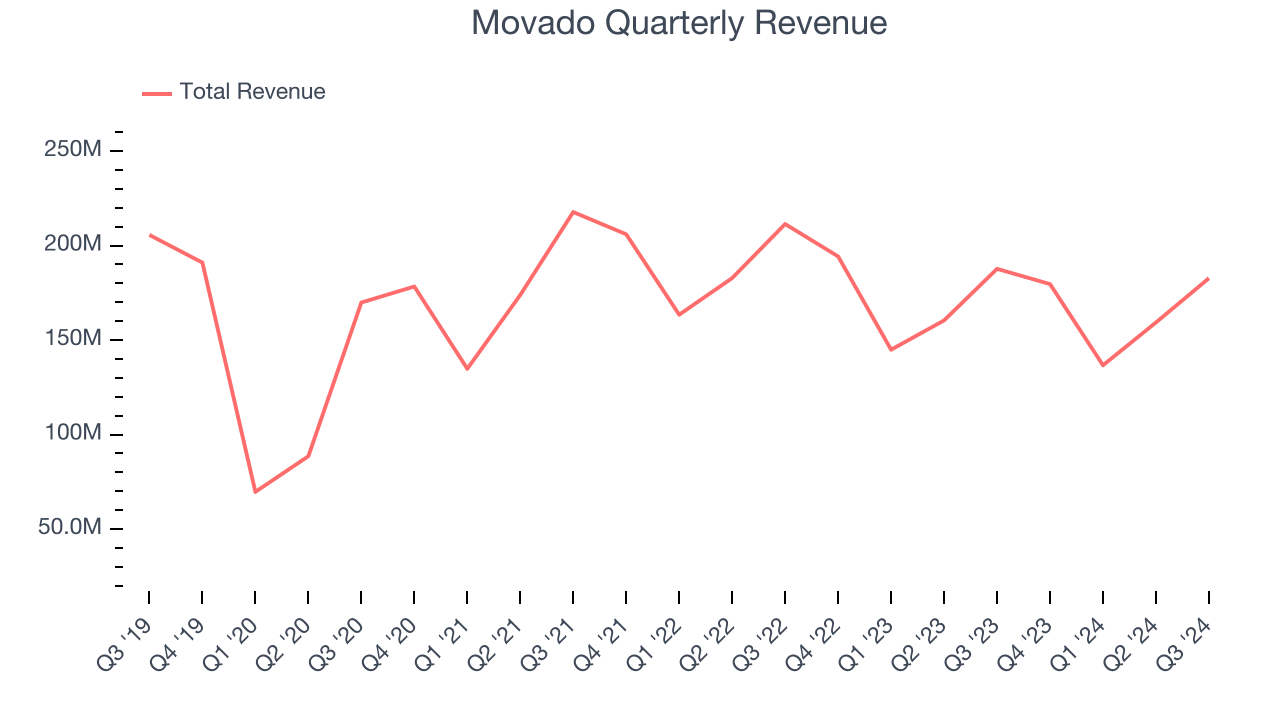

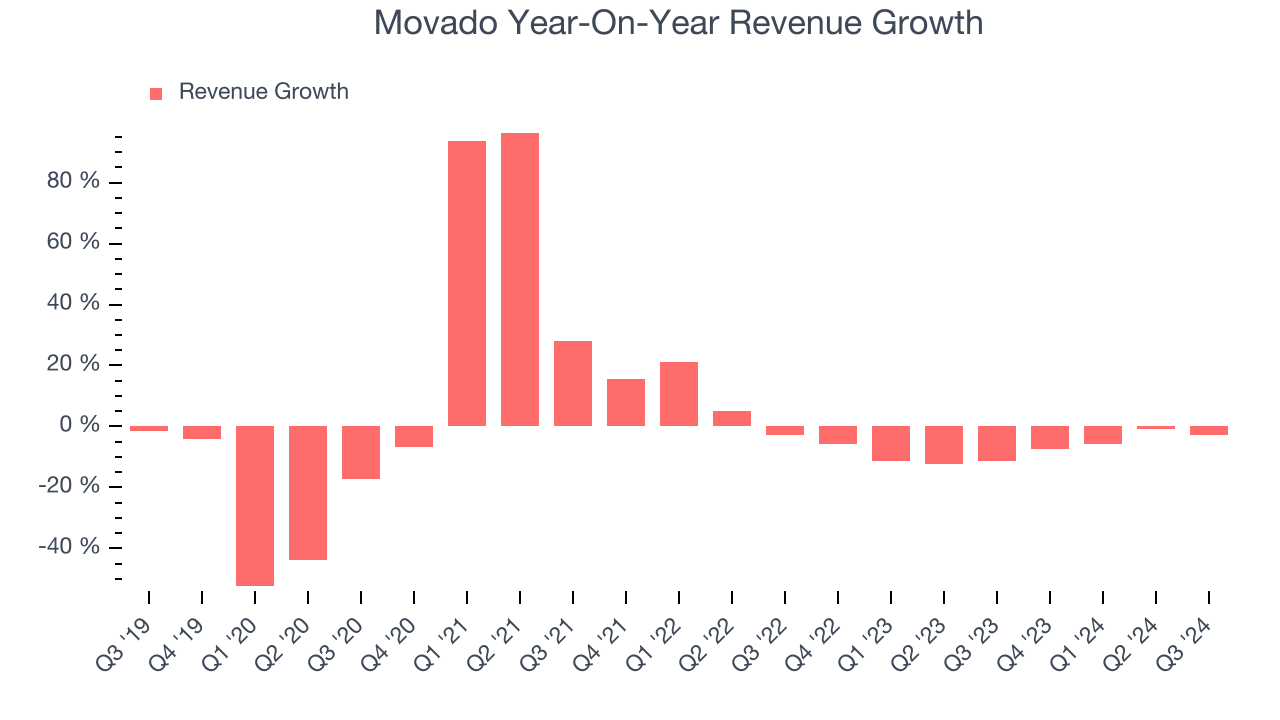

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Movado struggled to consistently generate demand over the last five years as its sales dropped at a 1.5% annual rate. This fell short of our benchmarks and signals it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Movado’s recent history shows its demand has stayed suppressed as its revenue has declined by 7.1% annually over the last two years.

This quarter, Movado missed Wall Street’s estimates and reported a rather uninspiring 2.6% year-on-year revenue decline, generating $182.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

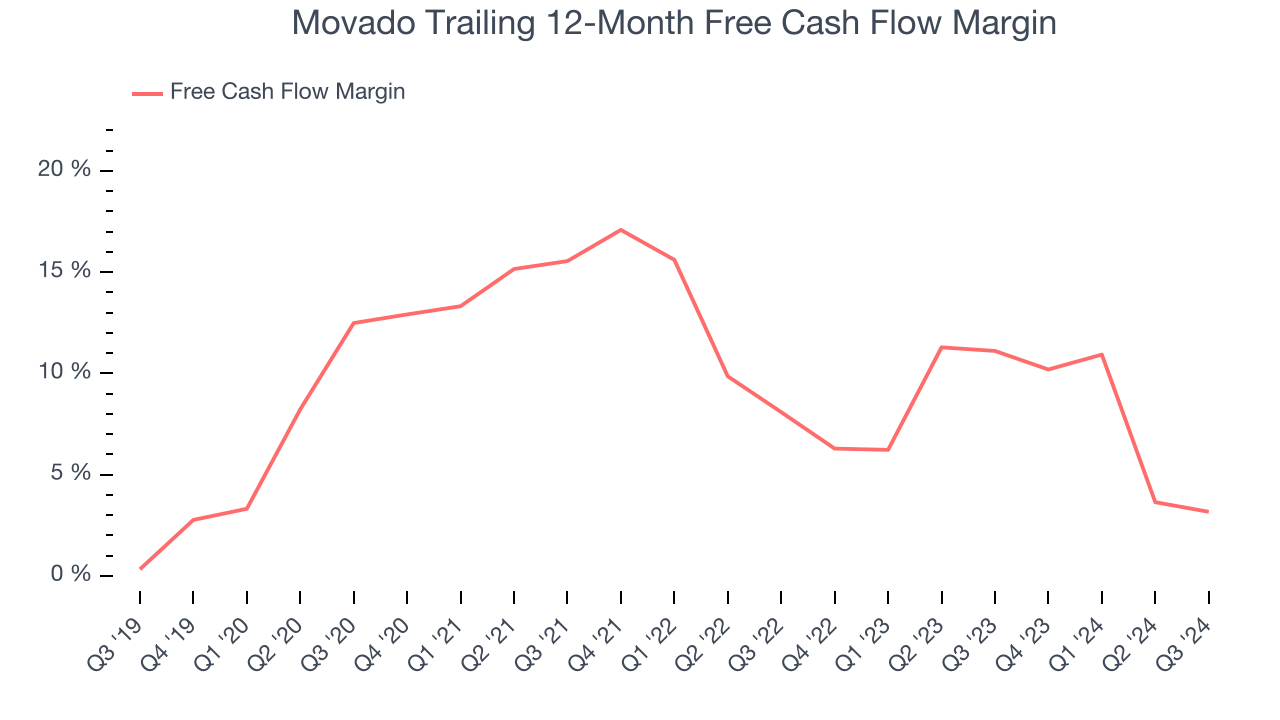

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Movado has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.2%, subpar for a consumer discretionary business.

Movado burned through $7.17 million of cash in Q3, equivalent to a negative 3.9% margin. The company’s cash burn was similar to its $3.87 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, raising some eyebrows.

Key Takeaways from Movado’s Q3 Results

We struggled to find many resounding positives in these results as its revenue, EP, and full-year outlook fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.8% to $20.28 immediately following the results.

Movado’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.