Worthington’s stock price has taken a beating over the past six months, shedding 23.7% of its value and falling to $40.89 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Worthington, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.Despite the more favorable entry price, we're cautious about Worthington. Here are three reasons why there are better opportunities than WOR and a stock we'd rather own.

Why Do We Think Worthington Will Underperform?

Founded by a steel salesman, Worthington (NYSE:WOR) specializes in steel processing, pressure cylinders, and engineered cabs for commercial markets.

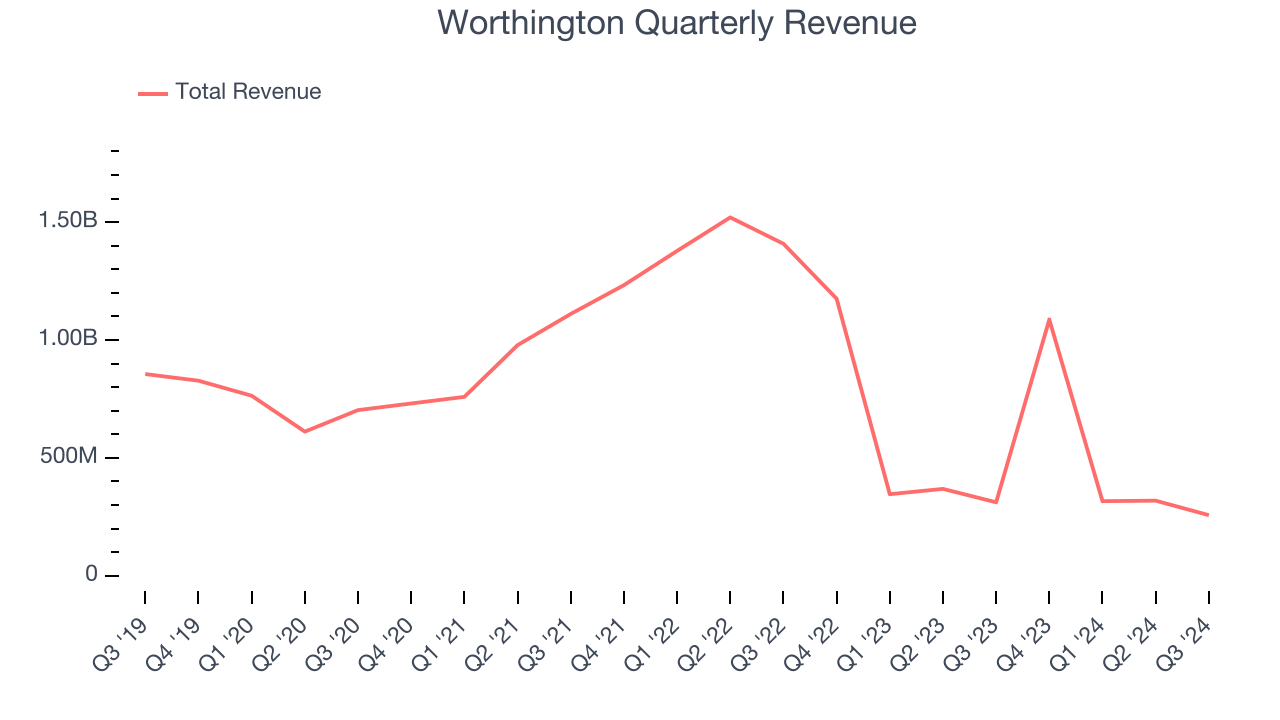

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Worthington’s demand was weak and its revenue declined by 19.7% per year. This fell short of our benchmarks and signals it’s a low quality business.

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Worthington has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 11% gross margin over the last five years. That means Worthington paid its suppliers a lot of money ($89.00 for every $100 in revenue) to run its business.

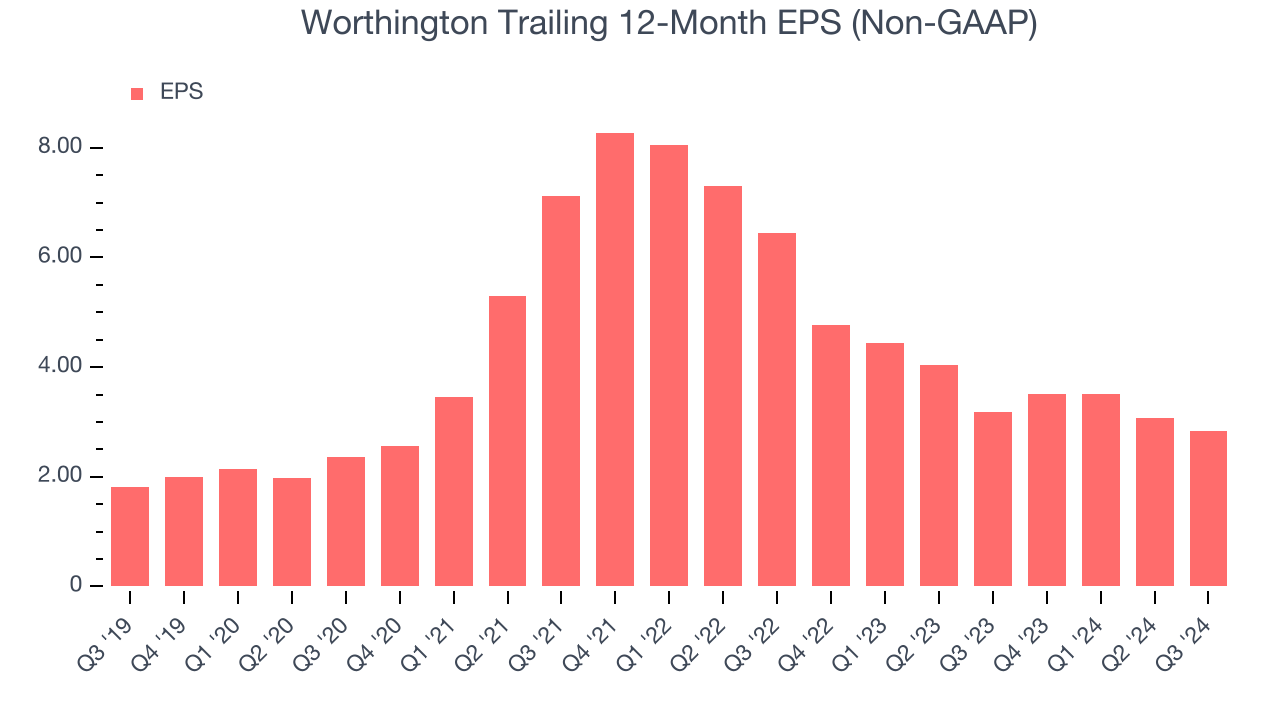

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Worthington, its EPS and revenue declined by 33.7% and 40.2% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Worthington’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Worthington doesn’t pass our quality test. After the recent drawdown, the stock trades at 7.7× forward EV-to-EBITDA (or $40.89 per share). This multiple tells us a lot of good news is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at Meta, a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Worthington

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.