Since June 2024, Kulicke and Soffa has been in a holding pattern, posting a small return of 4.5% while floating around $48.14. The stock also fell short of the S&P 500’s 13.5% gain during that period.

Is now the time to buy Kulicke and Soffa, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.We're sitting this one out for now. Here are three reasons why there are better opportunities than KLIC and a stock we'd rather own.

Why Do We Think Kulicke and Soffa Will Underperform?

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

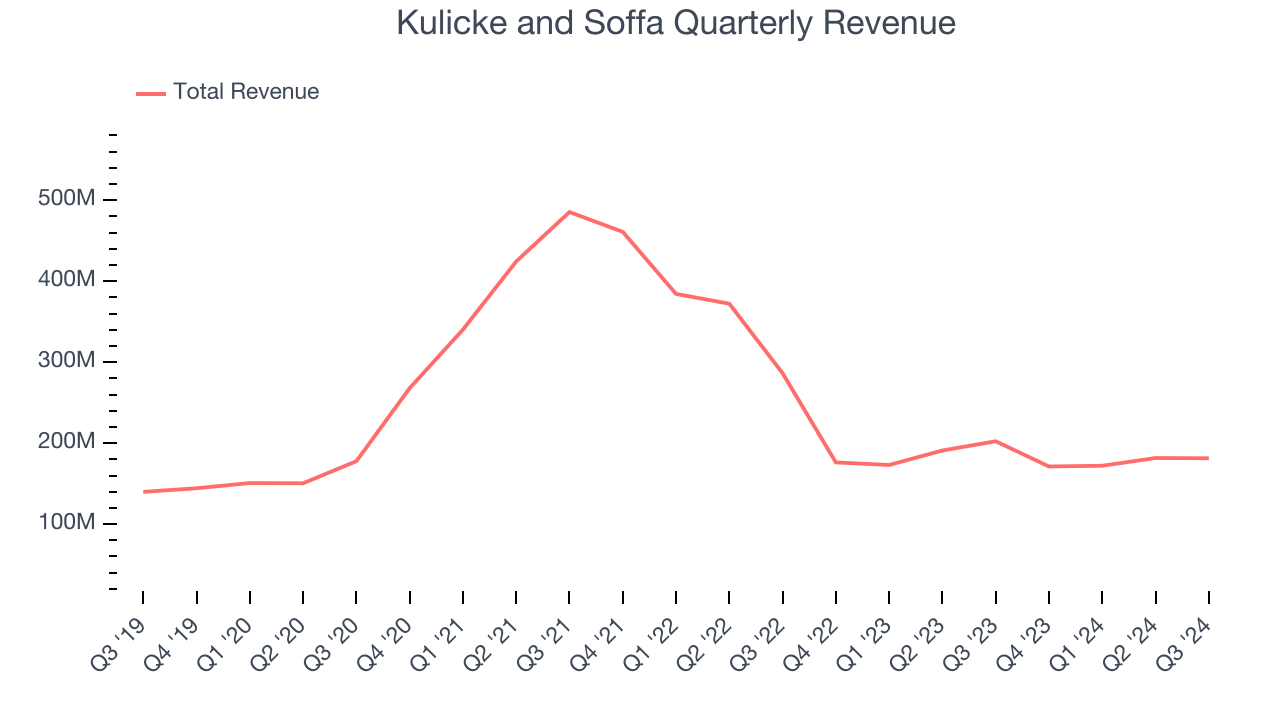

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Kulicke and Soffa’s 5.5% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the semiconductor sector. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

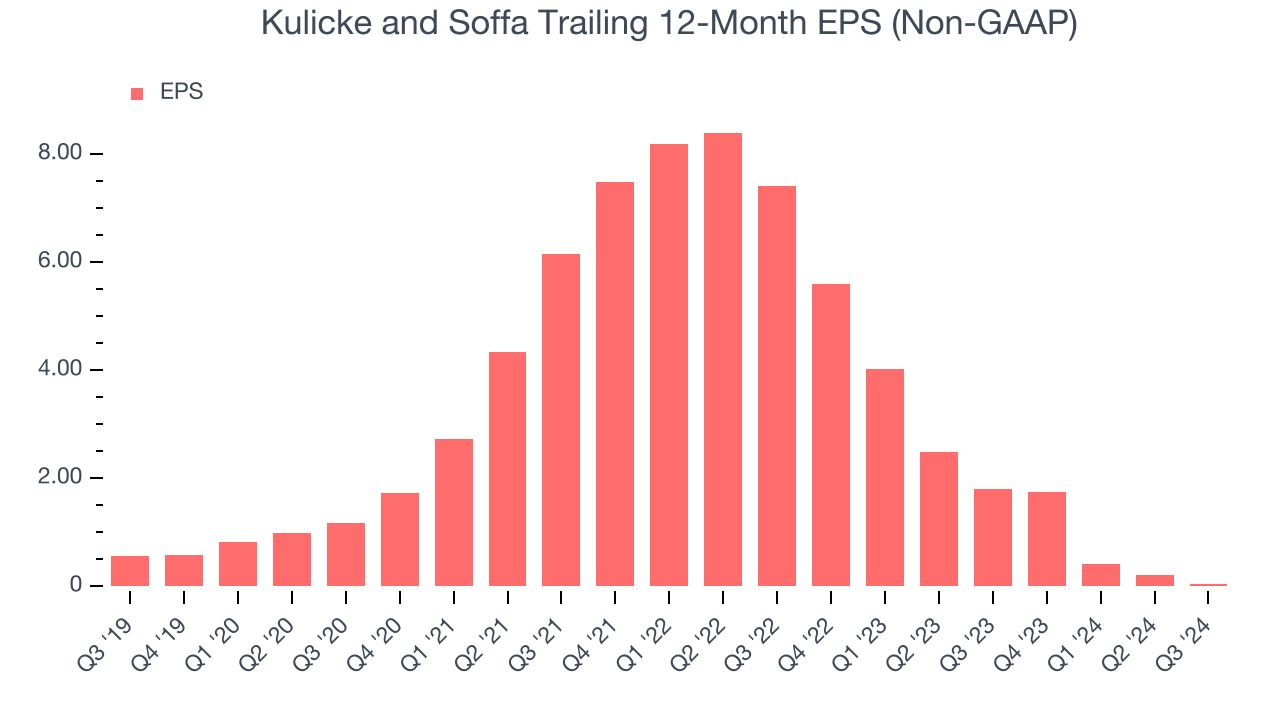

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Kulicke and Soffa, its EPS declined by 41.1% annually over the last five years while its revenue grew by 5.5%. This tells us the company became less profitable on a per-share basis as it expanded.

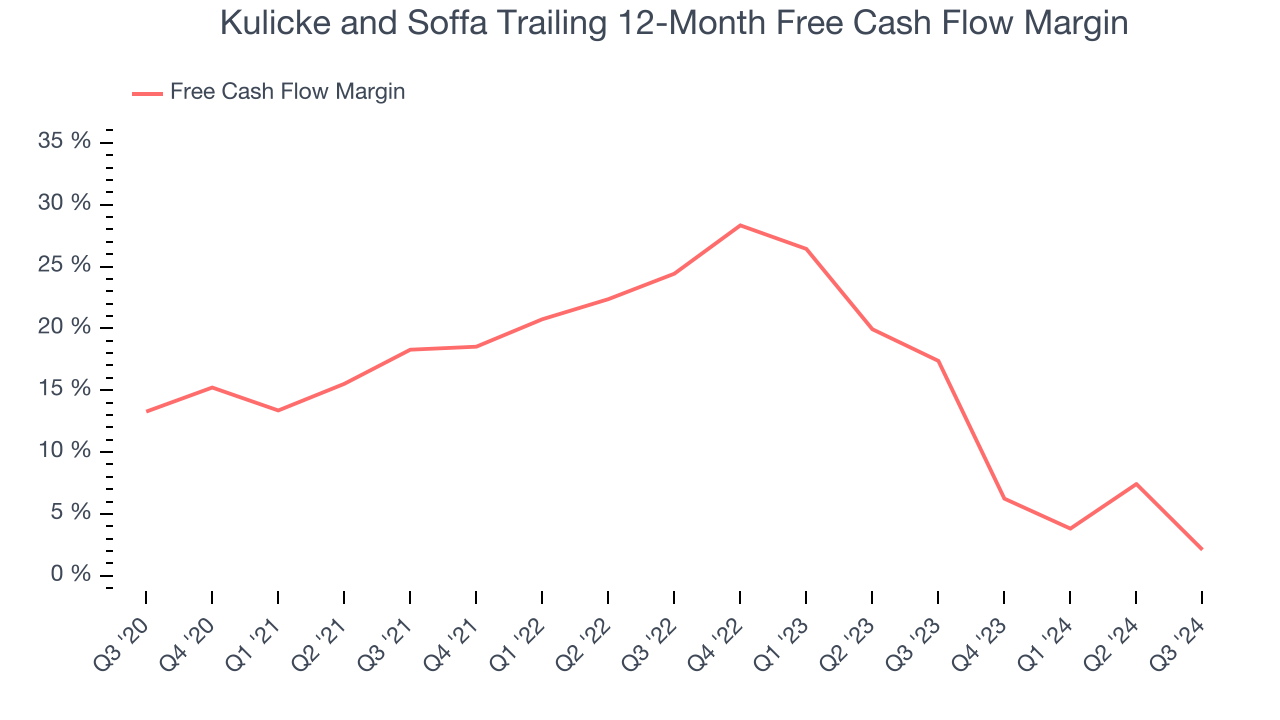

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Kulicke and Soffa’s margin dropped by 11.2 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. Kulicke and Soffa’s free cash flow margin for the trailing 12 months was 2.1%.

Final Judgment

We see the value of companies furthering technological innovation, but in the case of Kulicke and Soffa, we’re out. With its shares underperforming the market lately, the stock trades at 27.2× forward price-to-earnings (or $48.14 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d suggest looking at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Kulicke and Soffa

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.