Over the past six months, United Parks & Resorts’s stock price fell to $52.23. Shareholders have lost 9.9% of their capital, which is disappointing considering the S&P 500 has climbed by 8.1%. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is now a good time to buy PRKS? Find out in our full research report, it’s free.

Why Do Investors Watch United Parks & Resorts?

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

Three Positive Attributes:

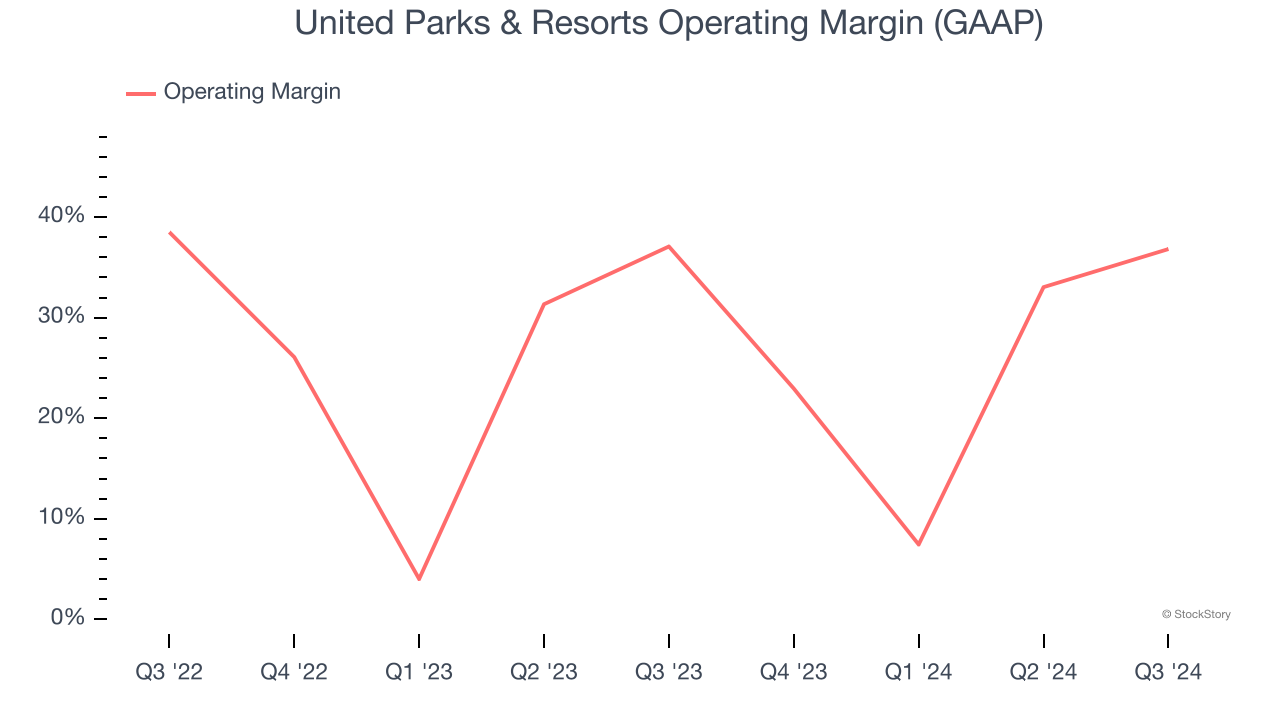

1. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

United Parks & Resorts’s operating margin might have seen some fluctuations over the last 12 months but has generally stayed the same, averaging 27.4% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

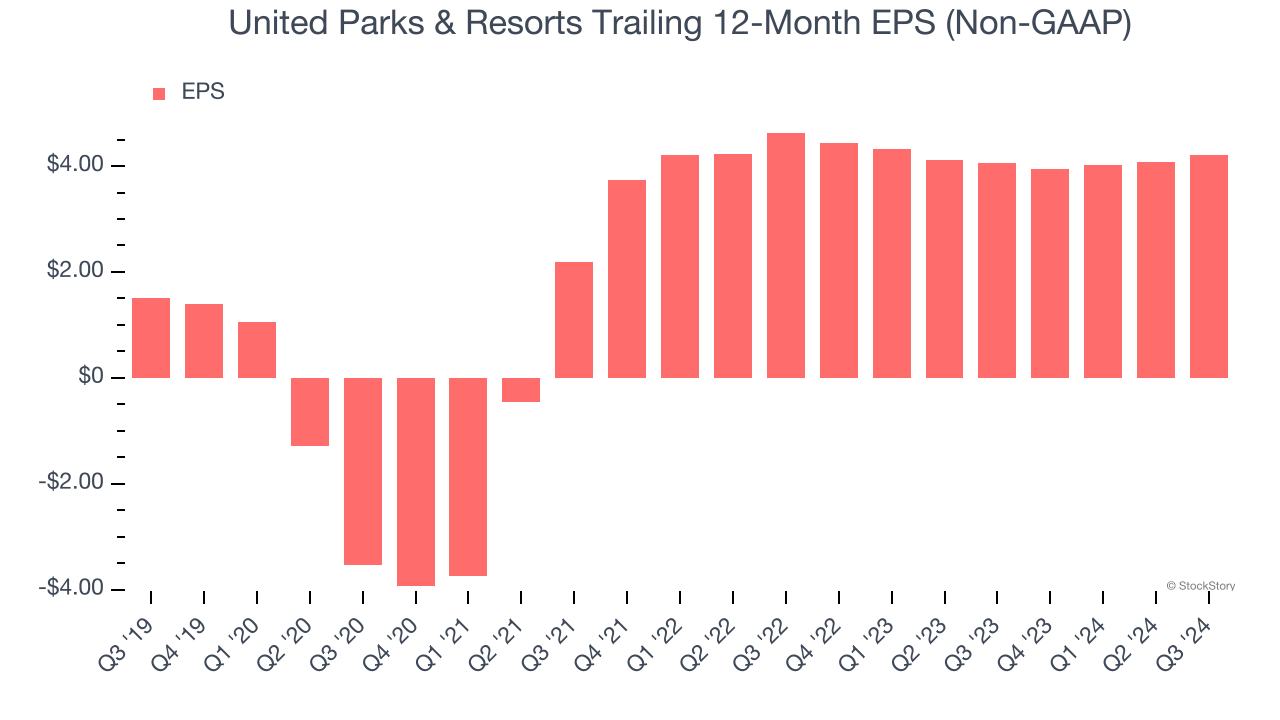

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

United Parks & Resorts’s EPS grew at a spectacular 22.8% compounded annual growth rate over the last five years, higher than its 4.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

3. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Over the last few years, United Parks & Resorts’s ROIC has increased. This is a great sign when paired with its already strong returns, but we also recognize its lack of profits during the COVID era contributed to its high growth.

Final Judgment

There are definitely things to like about United Parks & Resorts. With the recent decline, the stock trades at 11.1× forward price-to-earnings (or $52.23 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than United Parks & Resorts

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.