Actually, this is kind of part 2, as we reviewed the LTP in yesterday's Report . The Dow fell 500 points from Tuesday's close at yesterday's low and we're not cutting back our positions because of that but we are cutting back our positions because THAT is how easily this market can fall. We've had a very low-volume rallly, petty much for the last 18 months and the problem with low-volume rallies is they don't tend to build any support – so you can give up your gains with incredible speed . Yesterday's drop erased the entire month of August's gains as we got back to 35,000 on the Dow and our strong bounce line is 35,200 – which is right where we are this morning but I think we'll fail and head lower and there's no real support until 34,000 – which is only down 5% – so not a big deal, even if it happens. Key support for the S&P 500 is 4,200. On the Nadaq it's 14,500 and on the Russell – back to 2,000 – 10% lower than we are now. Although we are very well-hedged for a 10% drop – why ride it out. We had a lot of trades in our Long-Term Portfolio that already made a lot of money and protecting those gains is expensive (hedging costs) so it's easier and smarter to just get back to CASH!!! and let September play out before jumping back in. This is something we did almost exactly two years ago – and we certainly didn't regret that. Money Talk Portfolio Review: There's not much to review here as we only adjust the MTP when I'm on the show, which I will be in two weeks. Being up 100% is a nice place to quit and start a new portfolio but we'll decide in two weeks. We actually lost a little ground from last month as we're now only up 95% at $195,008 from $199,489 in our last review . As it's a touchless portfolio other than our quartely Televised adjustments, these are generally bullet-proof positions so we'll see what we can bear to part with: GOLD – This is a $17,500 spread currently with a net $1,175 credit so …

Actually, this is kind of part 2, as we reviewed the LTP in yesterday's Report.

Actually, this is kind of part 2, as we reviewed the LTP in yesterday's Report.

The Dow fell 500 points from Tuesday's close at yesterday's low and we're not cutting back our positions because of that but we are cutting back our positions because THAT is how easily this market can fall. We've had a very low-volume rallly, petty much for the last 18 months and the problem with low-volume rallies is they don't tend to build any support – so you can give up your gains with incredible speed.

Yesterday's drop erased the entire month of August's gains as we got back to 35,000 on the Dow and our strong bounce line is 35,200 – which is right where we are this morning but I think we'll fail and head lower and there's no real support until 34,000 – which is only down 5% – so not a big deal, even if it happens.

Key support for the S&P 500 is 4,200. On the Nadaq it's 14,500 and on the Russell – back to 2,000 – 10% lower than we are now. Although we are very well-hedged for a 10% drop – why ride it out. We had a lot of trades in our Long-Term Portfolio that already made a lot of money and protecting those gains is expensive (hedging costs) so it's easier and smarter to just get back to CASH!!! and let September play out before jumping back in. This is something we did almost exactly two years ago – and we certainly didn't regret that.

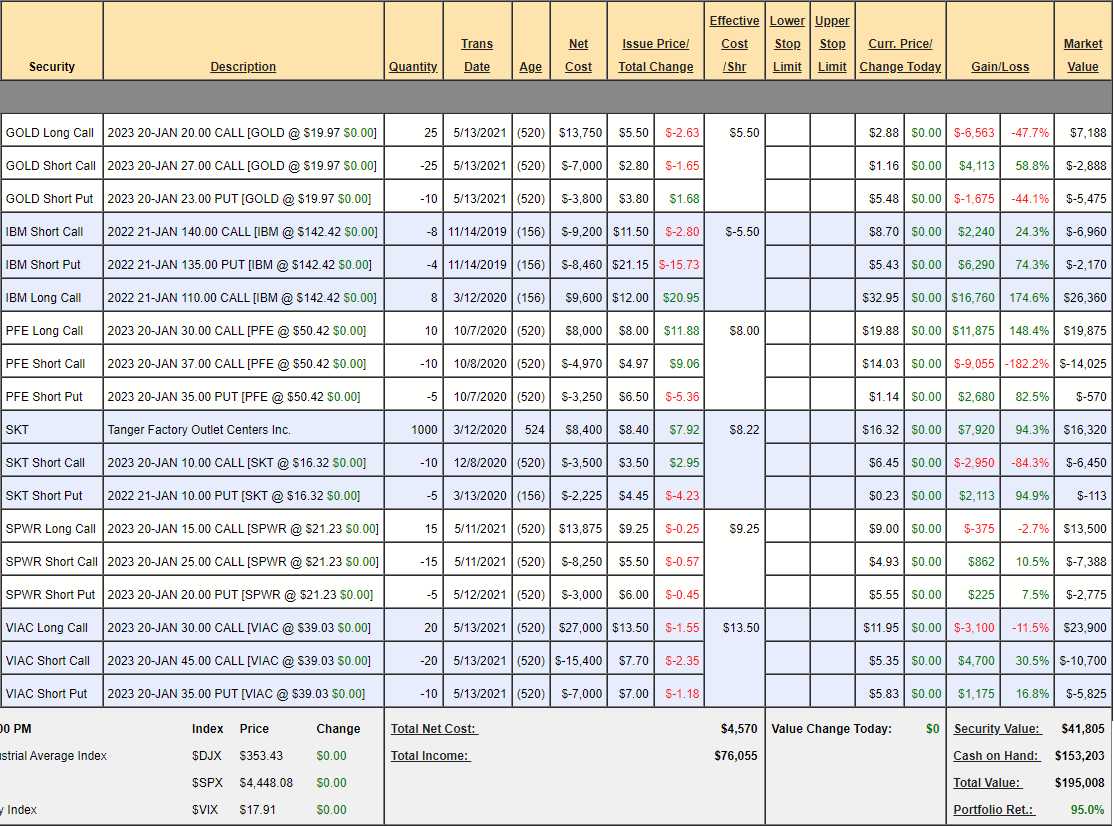

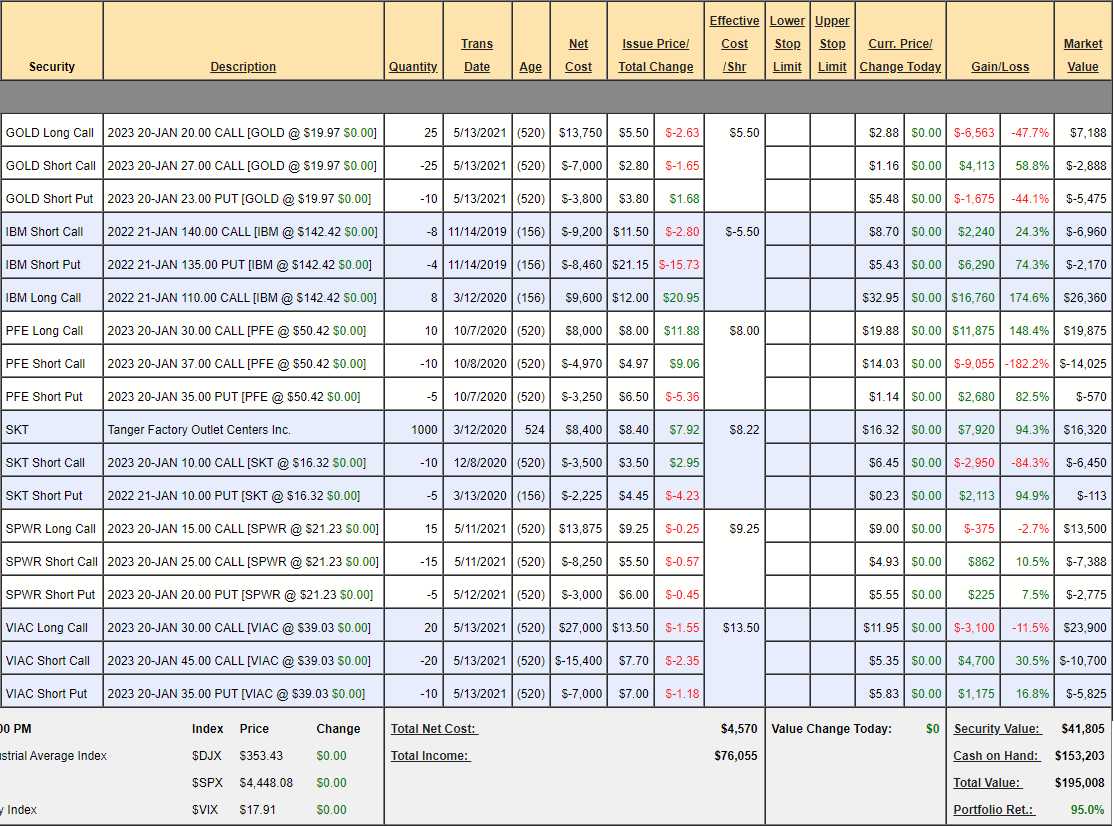

Money Talk Portfolio Review: There's not much to review here as we only adjust the MTP when I'm on the show, which I will be in two weeks. Being up 100% is a nice place to quit and start a new portfolio but we'll decide in two weeks. We actually lost a little ground from last month as we're now only up 95% at $195,008 from $199,489 in our last review. As it's a touchless portfolio other than our quartely Televised adjustments, these are generally bullet-proof positions so we'll see what we can bear to part with:

- GOLD – This is a $17,500 spread currently with a net $1,175 credit so

…

Actually, this is kind of part 2, as we reviewed the LTP in yesterday's Report.

Actually, this is kind of part 2, as we reviewed the LTP in yesterday's Report.