Welcome back to IPO season.

No, we won’t call it hot liquidity summer, but after an August lull, the public-offering cycle is back upon us. Last week we saw filings from Warby Parker, Toast and Freshworks. We’ve dug into Warby already. This week, we’re tackling the details of the latter two debuts, starting with Toast.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Why do we care about Toast? It’s a technology startup. It’s a unicorn. And it raised more than $900 million while private, per Crunchbase data. And the company is a leading constituent of the Boston startup scene.

Even more, the software-and-payments company combines subscription incomes, transaction fees, hardware revenues and lending earnings. Its business is complex — in a good way — and may help us better understand what happens to software companies when they build more financial capabilities into their original applications.

It’s an interesting company, one that was initially impacted heavily by the COVID-19 pandemic. Let’s go over the company’s overall financial performance, dig into how COVID affected the company’s business, consider how its revenue mix is changing over time, discuss how important fintech incomes are for the company and what it might be worth. This will be good fun. Let’s go!

It’s an interesting company, one that was initially impacted heavily by the COVID-19 pandemic. Let’s go over the company’s overall financial performance, dig into how COVID affected the company’s business, consider how its revenue mix is changing over time, discuss how important fintech incomes are for the company and what it might be worth. This will be good fun. Let’s go!

We’ll carve more deeply into how the company generates revenues shortly. For now, just keep in mind that the company has a number of revenue streams, each of which has a different gross-margin profile. So, we’re not only discussing high-margin software revenues in the following.

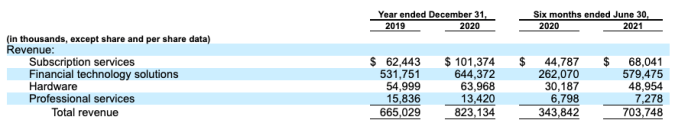

Here’s Toast’s topline performance for 2019, 2020, and the first half of both 2020 and 2021, taken from its S-1 filing:

Image Credits: Toast S-1

We can quickly see that the company grew from 2019 to 2020, albeit at a moderate clip. More recently, observing the two columns on the far right, we can see much more rapid growth from the company. In year-on-year comparative terms, Toast grew 24% in 2020 and 105% in the first half of 2021.

Thinking about how COVID-19 hit the food business, observing modest growth at the company in 2020 feels somewhat strong; despite huge market chop, Toast still grew nicely. And the company’s H1 2021 results indicate that the product work that Toast engaged in during the global pandemic has worked well, allowing it to accelerate growth by a factor of four in the last two quarters when compared to 2020’s overall pace of revenue expansion.

The above data also helps us better understand why Toast is going public now. After pushing through 2020, the company’s current portrait is one of accelerating growth leading to massive top-line accretion. Toast looks more than strong. And there’s no better time to go public than when you have numbers to brag about.