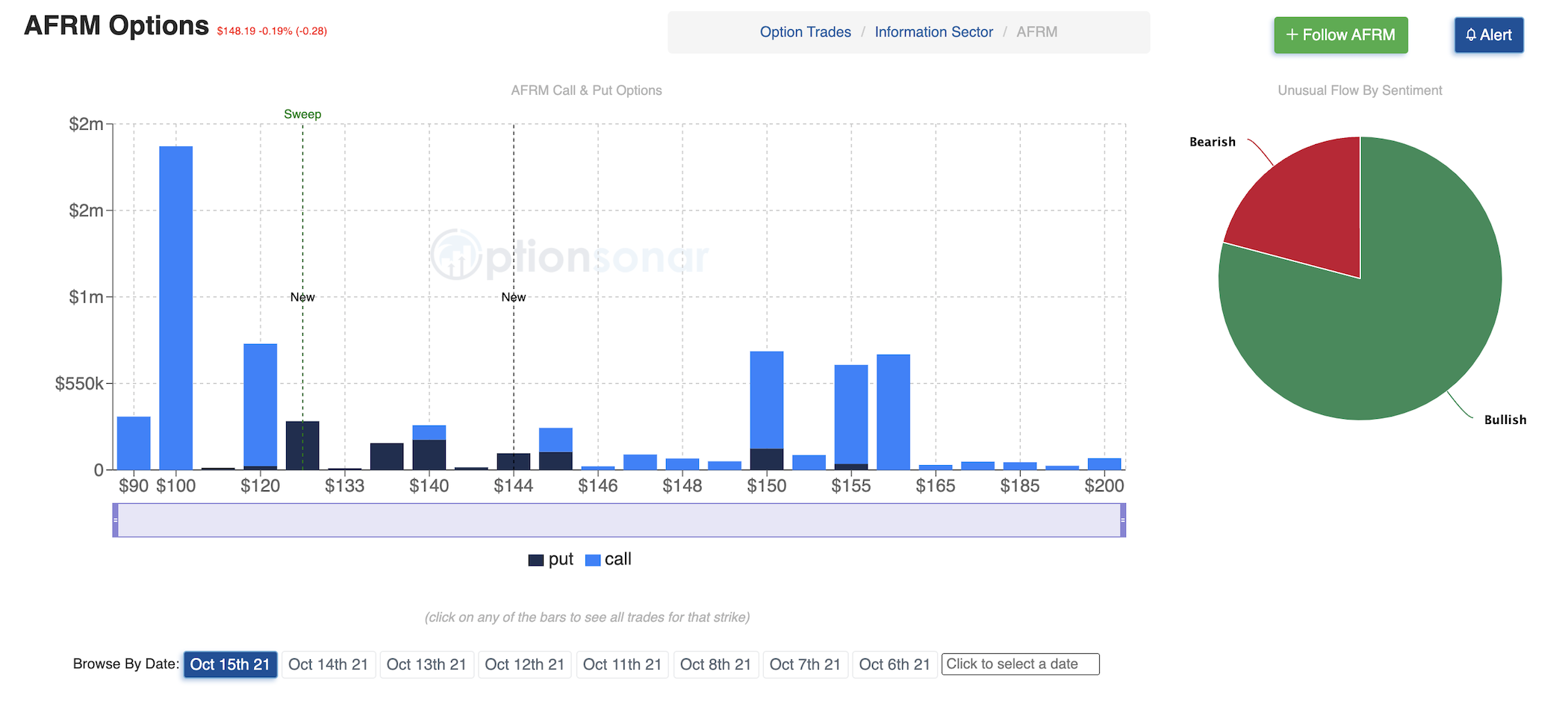

SAN FRANCISCO - Oct. 15, 2021 - PRLog -- Affirm's stock, a publicly traded financial technology company, captured substantial at the money call stock options expiring at the end of the year. Many traders use in-the-money stock options to leverage their exposure to the underlying stock. They are referred to as stock replacement trades as they require less capital to enter but are subject to the same level of directional risk as owning the underlying equity directly. Our unusual options activity research from this week dictates that option traders expect AFRM's stock price to reach $200 by the end of the year.

View the latest unusual options activity for AFRM stock

Option prices are a good indicator of stock price movements. However, even though options are traditionally thought of as a hedge instrument, due to their high leverage, they are also often used by large institutional buyers to capitalize on large stock movements.

You may not be able to tell from a glance, but not all option trades are created equal. Some carry more information than others - and unusual option trades are that type of trade.

Unusual options activity is a type of trade being bought on the ask or sold on the bid, with unusual volume and/or trade size. This means that these are new contracts being traded, expressing a fresh opinion on the stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

A large purchase of call options carries a signal that there is a likelihood of a large move in the underlying stock.

Optionsonar is a cutting-edge service that provides investors with the latest unusual options activity in an easy-to-read format. The software has been exclusively available to institutional traders on Wall Street, but now it's available to you!

Photos: (Click photo to enlarge)

Read Full Story - Option trading activity for Affirm stock is unusually high | More news from this source

Press release distribution by PRLog

Option trading activity for Affirm stock is unusually high

October 15, 2021 at 15:53 PM EDT