Dow 36,000!

We're finally here. Just a little late as this book was published in November of 2000 arguing that stocks in 1999 were signigicantly undervalued and traders did not understand the "new paradigm" and that the Dow would go up 4 TIMES in the next 4 years. Well, 22 years later they are finally "right" and the Dow closed last week at 36,327.

If we consider inflation to average 3% over 22 years, the Dow SHOULD be around 16,000 with inflation alone. Inflation, however, has an interesting effect on the market as it also inflates earnings – even though the earnings, in real-dollar terms, as no more than they were before the inflation.

In other words, if I sell you a hamburger I make for $1 for $1.50, I make 0.50 in profits but, if I price it in Pesos, which are 2 for a Dollar, then I sell you a hamburger for 3 Pesos that cost me 2 Pesos to make and I make 1 Peso. It's the same thing, we're just measuring it differently. That's where people get confused because we're comparing Dollars to Dollars and people can't get their head around the fact that a 2021 Dollar is not the same as a 1999 Dollar – but they are different as Pesos and Dollars are today!

So the stock making a profit of 0.50 selling hamburgers and getting a 20x multiple would be valued at $10 while the stock making a profit of 1 Peso and getting the same 20x multiple would be valued at 20 Pesos – much more, right? No, it's the exact same thing and so is a stock that was making 0.50 in 1999 but is now making $1 – the stock price may have gone from $10 to $20 but it's the exact same real value as it was back then – the "growth" is an illusion.

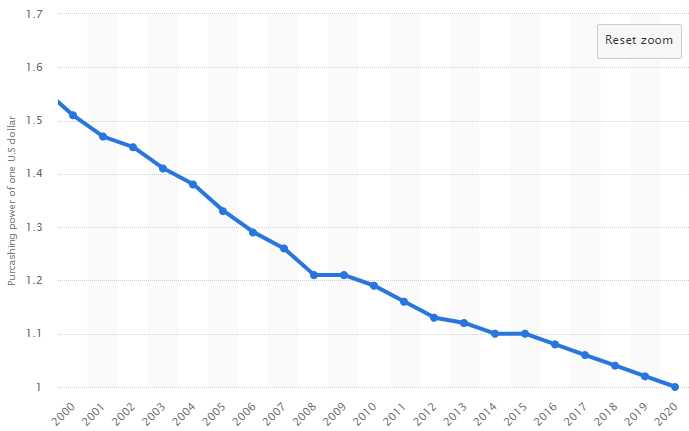

Then we take into account the declining purchasing power of those dollars, which also relates to inflation and that's down 35% since 2000. That means you need $1.6 today to buy whatever you could back in 2000 – including stocks. Now, look at the P/E Ratio of stocks over the past 10 years…