It's fun to ignore reality.

It's fun to ignore reality.

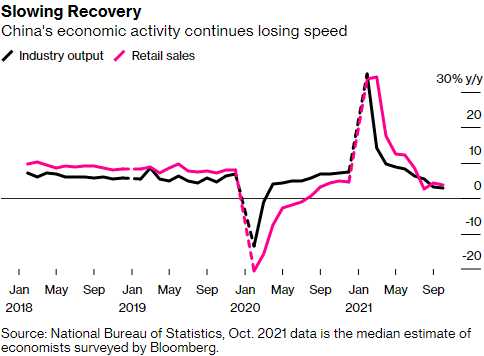

Or to imagine that the World is more fun than it is with less Covid and less Global Warming and less Inflation and better GDPs, etc. Reality, however, can be a harsh mistress and ignorning reality can be harsher still – eventually. But not this morning as our indexes are back around their record highs – even as China's Industrial Production coming in at 3% – the worst since Q2 of 2020 while their PMI is also collapsing – worst since February of 2020 – when the country was first shut down.

An energy crunch over September and October coupled with elevated cost pressures is squeezing Corporate Profits and hitting Factory Output in the World's 2nd-largest economy, yet over here we act like nothing that happens in China could possibly affect the US markets or our economy.

Falling real-estate prices and credit-market turmoil for heavily indebted developers means fixed asset investment in the first 10 months of the year is expected to have slowed to 6.2% from 7.3% previously. Chinese economists warn that the downturn in real estate — which accounts for up to 25% of output — could hurt the wider recovery. Goldman Sachs (GS) and others warn China could see sub-5% growth next year.

Falling real-estate prices and credit-market turmoil for heavily indebted developers means fixed asset investment in the first 10 months of the year is expected to have slowed to 6.2% from 7.3% previously. Chinese economists warn that the downturn in real estate — which accounts for up to 25% of output — could hurt the wider recovery. Goldman Sachs (GS) and others warn China could see sub-5% growth next year.

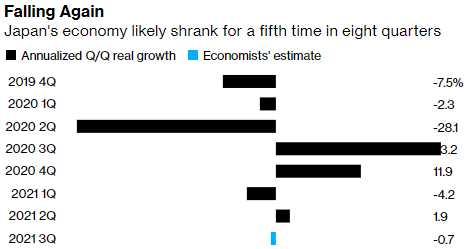

Japan releases figures on Monday that are expected to show the recovery of the world’s third-largest economy slipping into reverse after hitting a summer virus wave and global supply-side glitches. A particularly bad result could fuel even more stimulus from Prime Minister Fumio Kishida later in the week, when he decides on a package of economic measures. Trade and inflation numbers also come out from Japan this week.