Up and down we go! In our September Portfolio Review (16th), we were down about 50% in the STP at $94,705 but our October Review (12th) caught the dip and the STP blasted back to $128,727 but now the S&P is back at record highs and the STP is back to $91,022 and that's down 54.5% but we still have $156,199 in cash so there's no need to add money yet – but it is a good time to improve our hedges. The STP's primary function is to act as a hedge for our bullish positions in the Long-Term Portfolio, which we'll review at the end of the week. The LTP is at $2,210,453 at the moment, up 342% overall, up $79,858 ($2,130,595) since our October 15th review . So up $79,858 in the LTP and down $37,705 in the STP is up net $42,153 and that's the number we care about. Sure we could have made more money if we had less hedges but we went back to mainly CASH!!! in August and we've been cautious into the end of the year and will remain so until Q1 earnings are over. The LTP/STP paired portfolios are at a record-high $2,301,475 from a $600,000 start on 10/11/19, so we're up $1,701,475 (283%) on our 2nd anniversary – isn't that worth protecting? And it's the protection we have in the STP that allows us to be so aggressive when adding new longs to the LTP – which we did a lot of during the October dip (see our October Top Trade Alerts as examples). Now it's time for Thanksgiving and we'll be picking our Trade of the Year in two weeks and that is the option trade I feel will most likely return 300% by the end of the following year. We've never been wrong about a Trade of the Year but we did miss our timing twice – fortunately we always give ourselves 2 years – just in case. Since we're just about at what I think may be a pre-correction market top – we're going to get more aggressive with our hedges this morning: SKF – We thought the Financials might falter in an inflationary cycle and they did not …

Up and down we go!

Up and down we go!

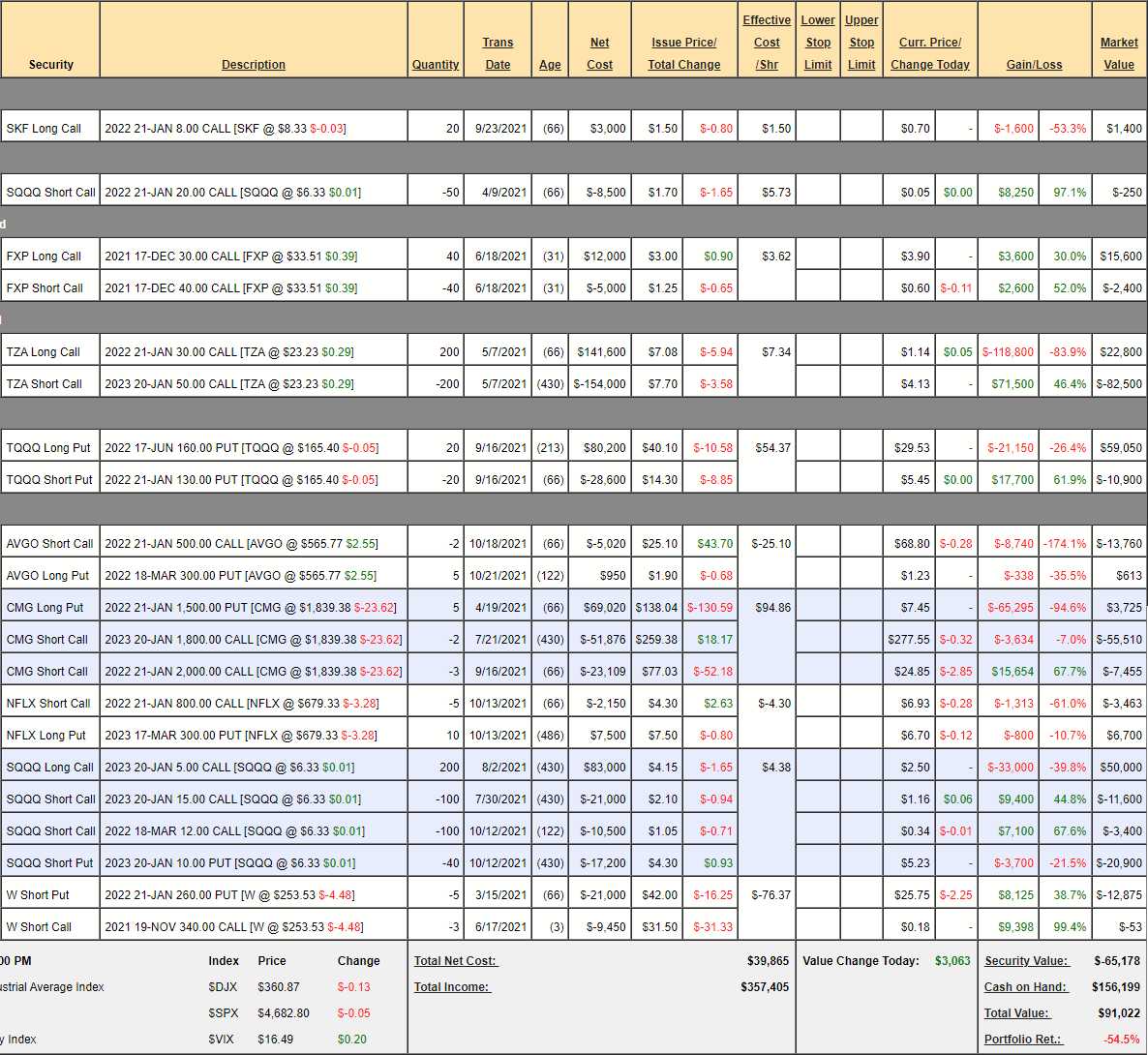

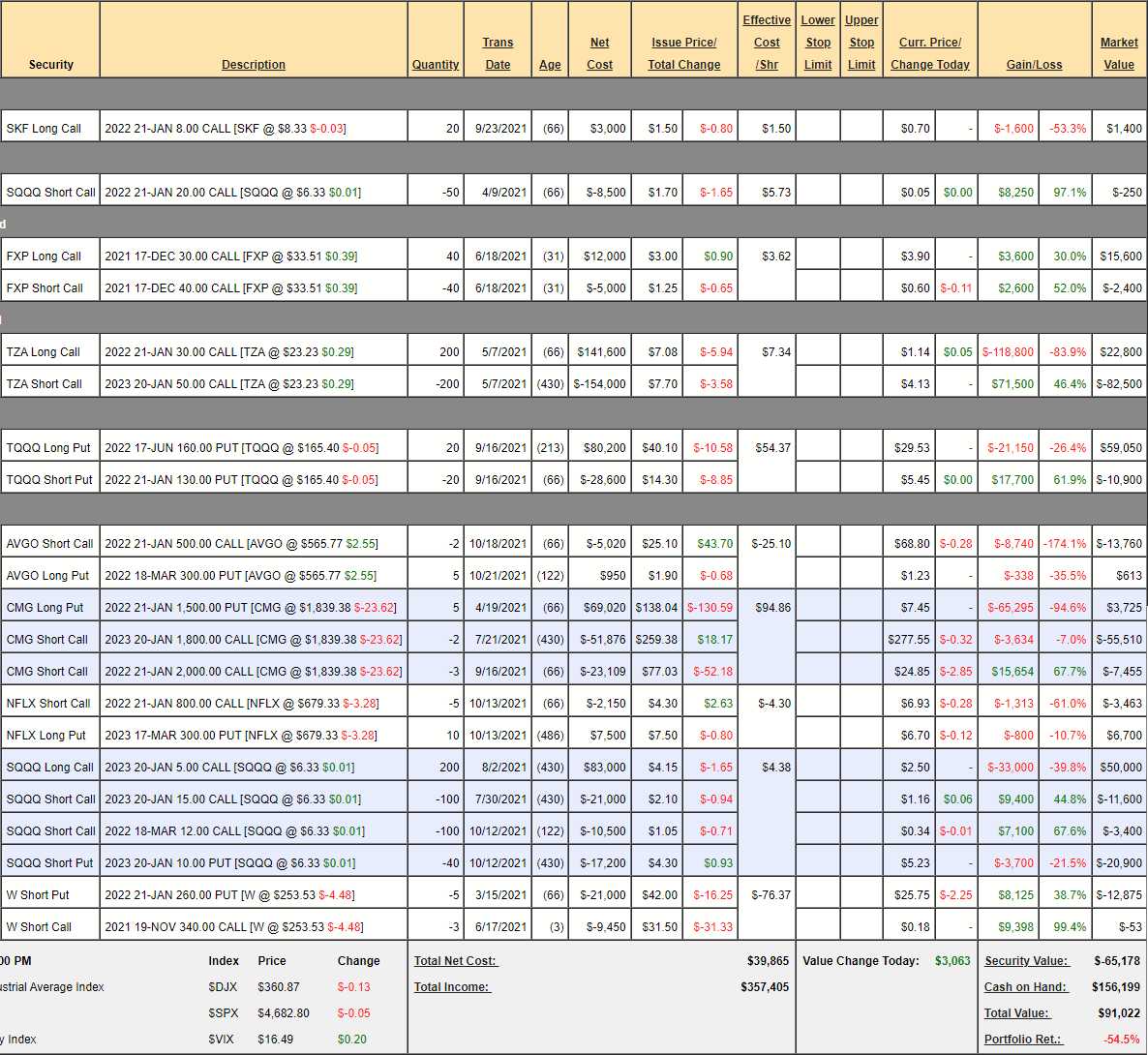

In our September Portfolio Review (16th), we were down about 50% in the STP at $94,705 but our October Review (12th) caught the dip and the STP blasted back to $128,727 but now the S&P is back at record highs and the STP is back to $91,022 and that's down 54.5% but we still have $156,199 in cash so there's no need to add money yet – but it is a good time to improve our hedges.

The STP's primary function is to act as a hedge for our bullish positions in the Long-Term Portfolio, which we'll review at the end of the week. The LTP is at $2,210,453 at the moment, up 342% overall, up $79,858 ($2,130,595) since our October 15th review. So up $79,858 in the LTP and down $37,705 in the STP is up net $42,153 and that's the number we care about. Sure we could have made more money if we had less hedges but we went back to mainly CASH!!! in August and we've been cautious into the end of the year and will remain so until Q1 earnings are over.

The LTP/STP paired portfolios are at a record-high $2,301,475 from a $600,000 start on 10/11/19, so we're up $1,701,475 (283%) on our 2nd anniversary – isn't that worth protecting? And it's the protection we have in the STP that allows us to be so aggressive when adding new longs to the LTP – which we did a lot of during the October dip (see our October Top Trade Alerts as examples).

Now it's time for Thanksgiving and we'll be picking our Trade of the Year in two weeks and that is the option trade I feel will most likely return 300% by the end of the following year. We've never been wrong about a Trade of the Year but we did miss our timing twice – fortunately we always give ourselves 2 years – just in case.

Since we're just about at what I think may be a pre-correction market top – we're going to get more aggressive with our hedges this morning:

- SKF – We thought the Financials might falter in an inflationary cycle and they did not

…

Up and down we go!

Up and down we go!