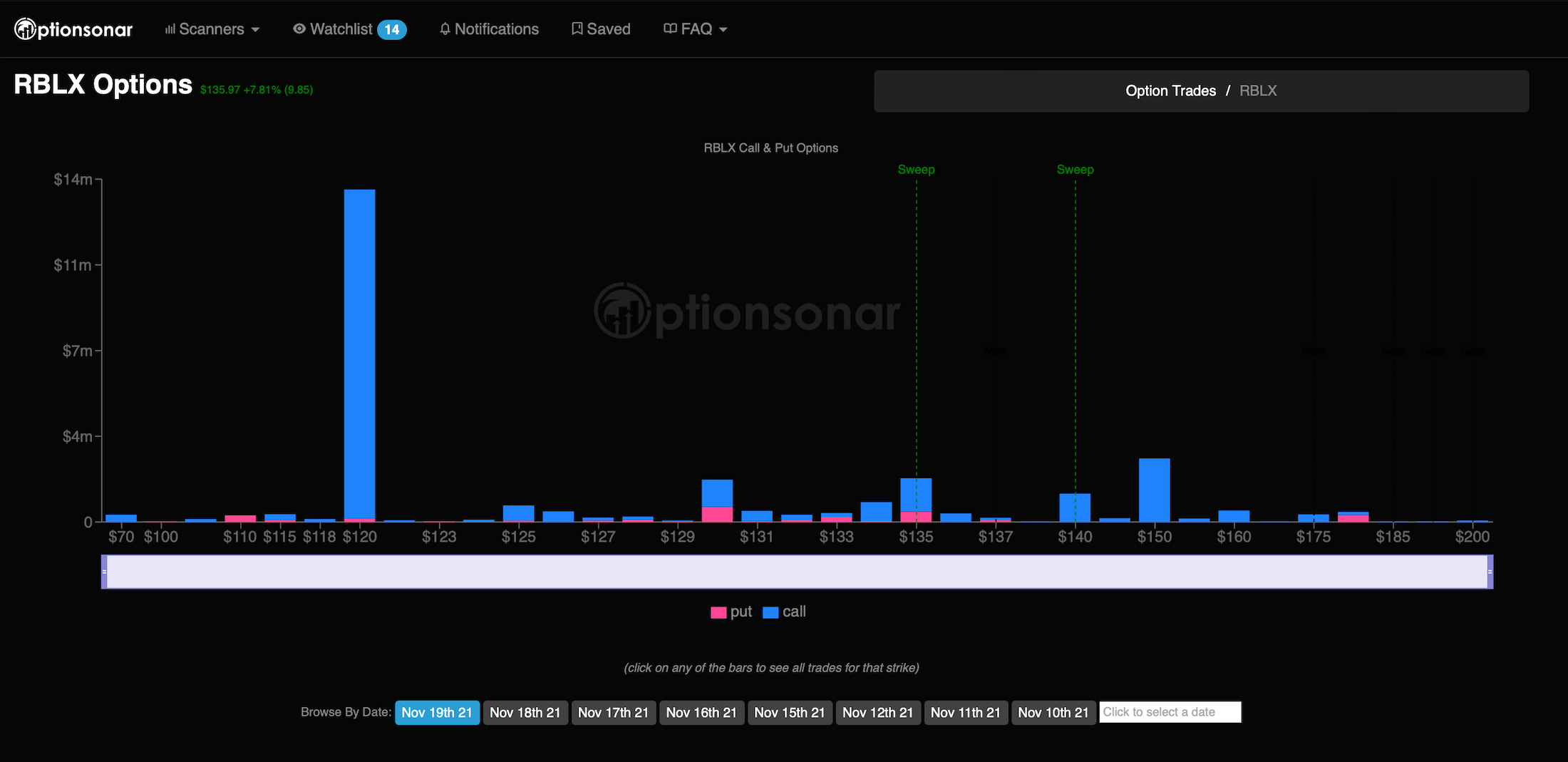

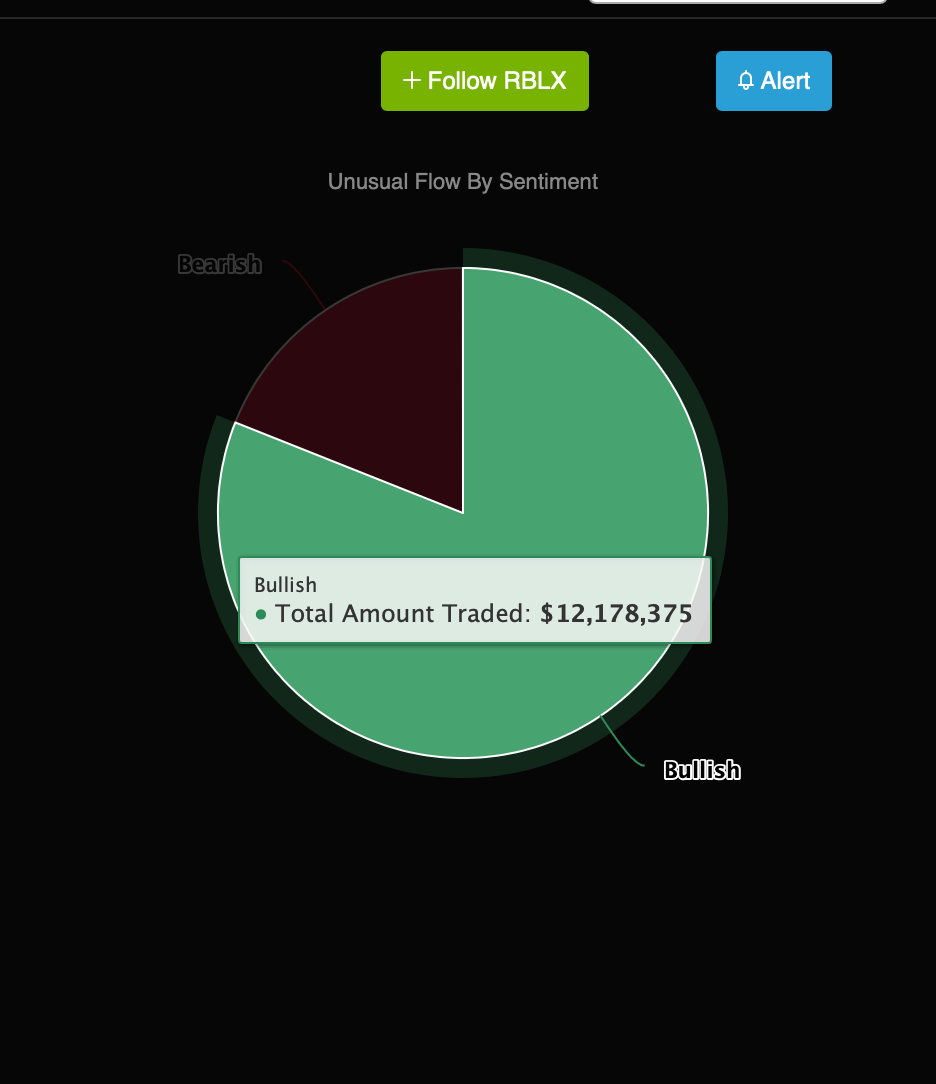

SAN FRANCISCO - Nov. 19, 2021 - PRLog -- Large in the money call options on Roblox's stock are due to expire at the end of the month. In the money stock options offer traders a leveraged way to gain exposure to the underlying stock. They are frequently referred to as stock replacement trades because they require less capital to put on, but they present directional risk just as if you owned the underlying equity directly. These traders are betting over $13 million that the stock price of Docusign will at least be $120 by the end of the month.

View the latest unusual options activity for Roblox (RBLX) stock

Why are options such an important indicator for future stock price movements?

Options have traditionally been thought of as a hedge instrument, but because of the amount of leverage they have, they are also used by large institutional buyers to capitalize on large upcoming stock movements.

What is unusual option activity?

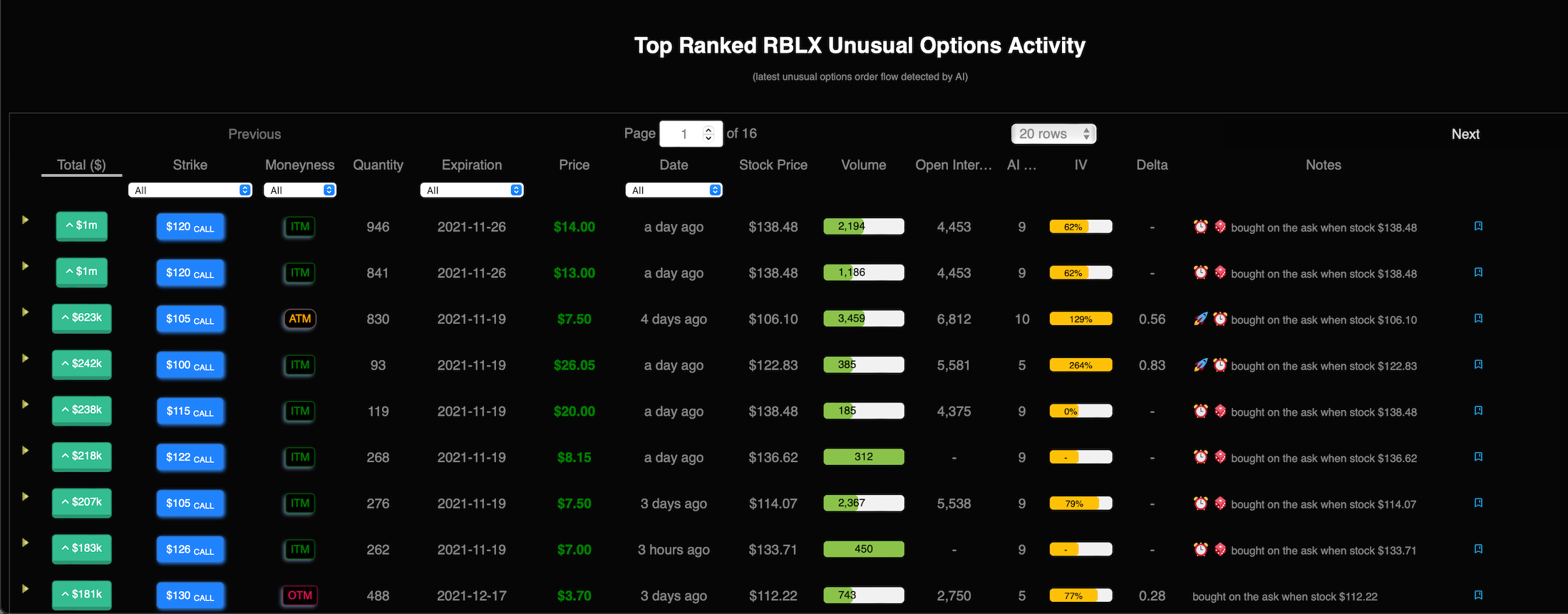

Each day, there are millions of options trades. However, not all trades are made equal. Certain trades contain more information than others. Unusual option trades are one example.

Unusual options activity is defined as a single trade that is bought on the ask or sold on the bid, with unusual volume and/or trade size compared to the open interest for that particular strike and expiry. This means that these are new contracts being traded, expressing a fresh opinion on the underlying stock.

Why is this interesting? Well given a large enough trade and it being bought on the ask or sold on the bid it shows extreme urgency on the trader's side.

For example, let's look at a trade of 5,000 calls which had a bid and ask spread of $3.00 by $3.70 respectively, and the order was executed on the ask at $3.70.

What does that tell us?

The trader bought 5,000 call contracts, dropping $1.8M on the trade. Now, if they were patient and waited to fill the order in the middle of the bid and ask spread, say $3.35, they could have saved potentially $175K, but they didn't. To me, that says they have high expectations for this trade, and saving $175K is chump change.

This paired with the unusual high daily volume and size of the trade makes this type of trade very interesting, carrying a signal that there is a likelihood of a potential large move in the underlying stock. Unusually large purchases of options contracts indicate that someone thinks there is an impending event that will move a stock in a big way.

Optionsonar makes it very easy to stay in the loop on the latest unusual options activity by using a proprietary algorithm that was once only available to institutional traders on Wall Street.

Photos: (Click photo to enlarge)

Read Full Story - Roblox stock experiences large, unusual options activity | More news from this source

Press release distribution by PRLog

Roblox stock experiences large, unusual options activity

November 19, 2021 at 15:10 PM EST