From now on I might also share some crypto trade ideas on my blog because I finally entered into this market. It seems clear that at some point cryptos will be part of our financial landscape too and will continue to gain acceptance, so I thought that's could be a good time to also share my technical knowledge and apply it to these digital coins.

I would also like to make clear that I have never been paid to promote a stock/company, and I never will. All of my stock picks, technical analysis, and posts are crafted utilizing my own knowledge and experience. I trade all types of stocks, big mid and small caps, but never the OTC market. I thank you for coming here and reading what I have to say about stocks on a technical level.

Additionally, I would also take this opportunity once again to inform you that my Twitter profile continues to be cloned by imposters duplicating exactly all my tweets, images and purchasing followers to be popular in the eyes of newbie investors. These scam artists are trying to use my name and send private people messages to sell Bitcoin products. I don't have a Telegram account. Neither will I ask you for money or spam websites.

( click to enlarge )

( click to enlarge )In my previous tweets about this digital coin, we saw Bitcoin breaking the upper line of the primary downtrend channel, which was a big bullish signal. Currently, the pullback seems to be forming the right shoulder of which seems to be an Inverted Head and Shoulders pattern with neckline around 45.5K. If this pattern becomes active, then we can expect a rally to ATH.

( click to enlarge )

( click to enlarge )The Inverted Head and Shoulders pattern mentioned on Bitcoin, can be also detected on Ethereum daily chart with a neckline around 3250

( click to enlarge )

( click to enlarge )There is no Inverted H&S pattern on the daily chart of Doge but the recent pullback on low volume to the key support zone (prev loading zone) seems to be a good entry point for swing traders. The chart is also displaying positive divergences. I'm buying dips and holding for the long haul. Cryptos reminds me of the internet in early stages.

( click to enlarge )

( click to enlarge )Y-mAbs Therapeutics Inc (NASDAQ:YMAB) showed buying strength all day on Friday. The stock price is on the verge of breaking out and it could happen soon. The volume dramatically increased as the stock ran to near its major resistance, showing us there are buyers watching the stock again. Any close abv 8.49 and the stock will absolutely fly into the 10's right away.

( click to enlarge )

( click to enlarge )Sundial Growers Inc (NASDAQ:SNDL) closed strong on Friday, as the stock ended the day at highs. The technical daily chart shows a continuation of the trend with MACD and RSI in the Bullish areas. This stock is on the top of my watch list for next week, due to the recent price action, volume and momentum.

( click to enlarge )

( click to enlarge )AYRO Inc (NASDAQ:AYRO) On my watch list $1.36 is the pivot here. The stock broke the downtrend channel and successfully retested it. This is a good time to build your position in AYRO for the next rally. If it breaks 1.36, we could see 2 quickly. Stock is trading significantly below cash levels.

( click to enlarge )

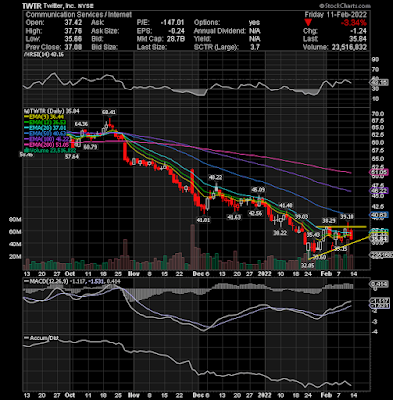

( click to enlarge )Twitter, Inc. (NYSE:TWTR) A two-week consolidation formed an ascending triangle bottom pattern on the daily chart. Let us pay attention to price action so we can securely place our buy orders.

( click to enlarge )

( click to enlarge )Kosmos Energy Ltd (NYSE:KOS) Setting up nicely for new highs.

( click to enlarge )

( click to enlarge )Core Laboratories N.V. (NYSE:CLB) Watch Monday's action for a possible breakout over $28.56

( click to enlarge )

( click to enlarge )ExxonMobil (NYSE:XOM) is still coiling just under $82 and appears about ready to make a new breakout soon. Holding the stock with a stop at $75.98 (rising EMA20).

TRADE IDEAS NEWS: The next 2-week Test Drive on TradeIdeas starts February 14th and runs through February 28th. The Test Drive lets non-subscribers or standard subscribers enjoy all Premium Subscription features for up to 2-weeks. I recommend you sign up before Monday, February 14th so you have the full 2-weeks of access. You can sign up through Friday, February 18th but won't get the full 2-weeks. Grab this offer and sign up HERE

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC