WAR!!! What is it good for? Well it's great for commodities as Oil ( /CL ) has jumped up to test $100 per barrell and Gasoline ( /RB ) has popped over $3 and Natural Gas ( /NG ) is surprisingly lagging at $4.83 – but it will get there shortly ( we played it long at $4.57 in yesterday's Live Member Chat Room ). Silver ( /SI ) which we've been playing over $24 since last week, hit $25.67 so our stop is now $25.50 for a massive short-term gain – something else we discussed in yesterday's Live Trading Webinar . As we discussed in yesterday's PSW Report ( subscribe here if you want to know what's going to happen in the markets ), war makes people nervous and nervous people tend to dump risky stocks in favor of commodities and CASH!!! and, as we discussed in last week's Portfolio Reviews (again, subscribe! ), we have plenty of that in our Member Portfolios and plenty of hedges as well. Our Short-Term Portfolio, which we reviewed last Tuesday at $384,818 and contains our hedges, closed yesterday at $442,998 so up $58,180 for the week and today likely to be up another $50,000 on this dip and, of course, we begain with $200,000 so we've doubled up on our hedges during this downturn, which mitigates the losses our long positions are taking. Having good hedges allows us to ride out these downturns panic-free, without margin pressure of fear of losses and, more importantly, the cash inflow from our hedges gives us the OPPORTUNITY to take advantage of stocks as they go on sale. For example, Apple (AAPL) is down to $153 this morning and I don't see how Putin invading the Ukrain is going to stop my daughter and her friends fron geting the newest 5G phones this year. I mean, how can you show your support for Ukranians on TicTok without a new IPhone or the connection service provided by AT&T (T)? In our Butterfly Portfolio, we sold the AAPL April $155 calls for $21.50 on Dec 22nd and we sold 40 of them for $86,000 to cover our long AAPL position. Yesterday I said we were likely to buy them back as they were up almost 50% but today it's a certainty and …

WAR!!!

WAR!!!

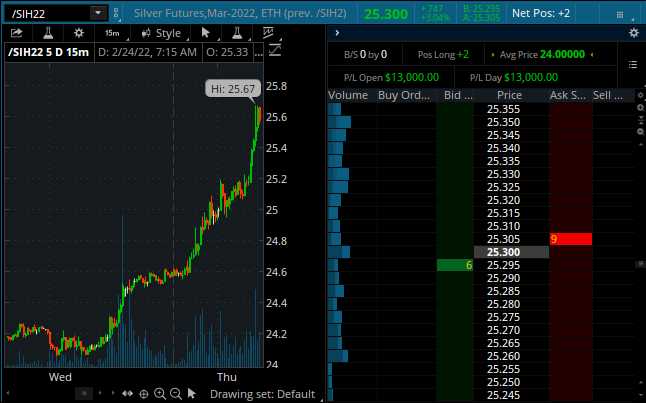

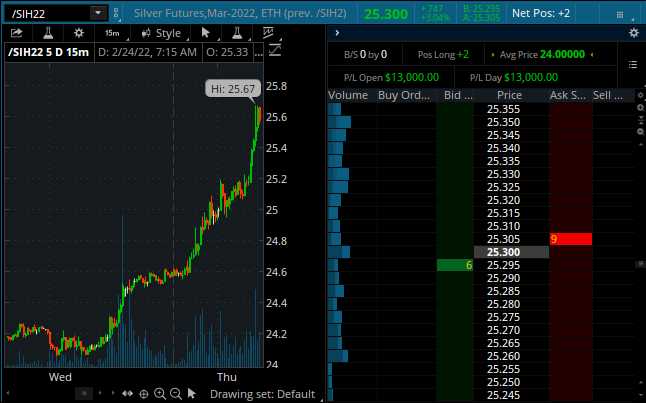

What is it good for? Well it's great for commodities as Oil (/CL) has jumped up to test $100 per barrell and Gasoline (/RB) has popped over $3 and Natural Gas (/NG) is surprisingly lagging at $4.83 – but it will get there shortly (we played it long at $4.57 in yesterday's Live Member Chat Room). Silver (/SI) which we've been playing over $24 since last week, hit $25.67 so our stop is now $25.50 for a massive short-term gain – something else we discussed in yesterday's Live Trading Webinar.

As we discussed in yesterday's PSW Report (subscribe here if you want to know what's going to happen in the markets), war makes people nervous and nervous people tend to dump risky stocks in favor of commodities and CASH!!! and, as we discussed in last week's Portfolio Reviews (again, subscribe!), we have plenty of that in our Member Portfolios and plenty of hedges as well.

As we discussed in yesterday's PSW Report (subscribe here if you want to know what's going to happen in the markets), war makes people nervous and nervous people tend to dump risky stocks in favor of commodities and CASH!!! and, as we discussed in last week's Portfolio Reviews (again, subscribe!), we have plenty of that in our Member Portfolios and plenty of hedges as well.

Our Short-Term Portfolio, which we reviewed last Tuesday at $384,818 and contains our hedges, closed yesterday at $442,998 so up $58,180 for the week and today likely to be up another $50,000 on this dip and, of course, we begain with $200,000 so we've doubled up on our hedges during this downturn, which mitigates the losses our long positions are taking.

Having good hedges allows us to ride out these downturns panic-free, without margin pressure of fear of losses and, more importantly, the cash inflow from our hedges gives us the OPPORTUNITY to take advantage of stocks as they go on sale. For example, Apple (AAPL) is down to $153 this morning and I don't see how Putin invading the Ukrain is going to stop my daughter and her friends fron geting the newest 5G phones this year. I mean, how can you show your support for Ukranians on TicTok without a new IPhone or the connection service provided by AT&T (T)?

In our Butterfly Portfolio, we sold the AAPL April $155 calls for $21.50 on Dec 22nd and we sold 40 of them for $86,000 to cover our long AAPL position. Yesterday I said we were likely to buy them back as they were up almost 50% but today it's a certainty and…

WAR!!!

WAR!!!  As we discussed in yesterday's PSW Report (subscribe here if you want to know what's going to happen in the markets), war makes people nervous and nervous people tend to dump risky stocks in favor of commodities and CASH!!! and, as we discussed in last week's Portfolio Reviews (again, subscribe!), we have plenty of that in our Member Portfolios and plenty of hedges as well.

As we discussed in yesterday's PSW Report (subscribe here if you want to know what's going to happen in the markets), war makes people nervous and nervous people tend to dump risky stocks in favor of commodities and CASH!!! and, as we discussed in last week's Portfolio Reviews (again, subscribe!), we have plenty of that in our Member Portfolios and plenty of hedges as well.