I love the Money Talk Portfolio! It's a real test of skill since we can only do adjustments on show days and tonight I'll be on Money Talk (Bloomberg, Canada) at 7pm for the first time since Feb 16th . At that time, we were up 140.9% at $240,926 and we had gotten very defensive, moving to 2/3 CASH!!! ahead of the coming correction – which we felt was long overdue. The S&P was around 4,400 at the time and is now 7.3% lower, at 4,076, and our portfolio is down 7% at $223,779 . This is exceptionally good as our newest trade, LABU (Biotech ETF) was a huge mistake at the time and we're down $16,630 on that which means there is nothing wrong at all with the rest of our positions and just the one that needs to be fixed. We still have $145,344 (65%) in CASH!!! – and it should be a good time to deploy some as there are real bargains out there. In the MTP, we seek to find " bullet-proof " positions that we won't need to adjust from month to month as we only get one random day each quarter to make our changes. Though LABU was a bit of a risk, it's a generally conservative portfolio but we felt we could afford a risk as we were up 140% at the beginning of year 3. The market is still a bit iffy – so we're not going too crazy but there are some compelling moves to make. BYD – 20% off the top is not bad and still good for a new trade at net $8,362 on the $40,000 spread so we have $31,638 (378%) of upside potential if BYD can get to $75 in 18 months. GOLD – A great inflation hedge but not acting like it lately. Fortunately, we are deep in the money and I'm comfortable with our targets on this $30,000 spread that is currently at net $8,438 so we have $21,562 (255%) of upside potential on this one . HPQ – Blew past our goal and no …

I love the Money Talk Portfolio!

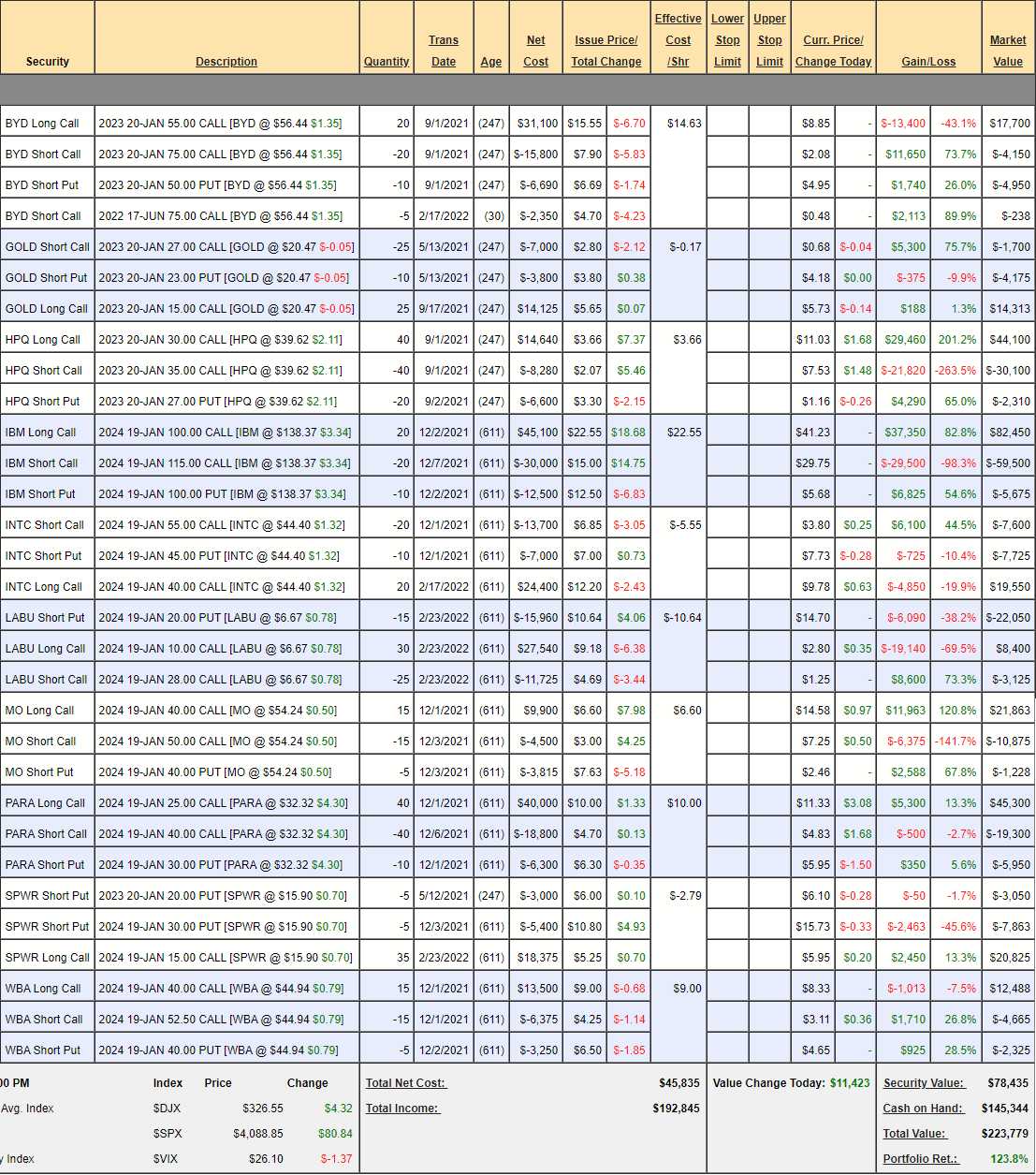

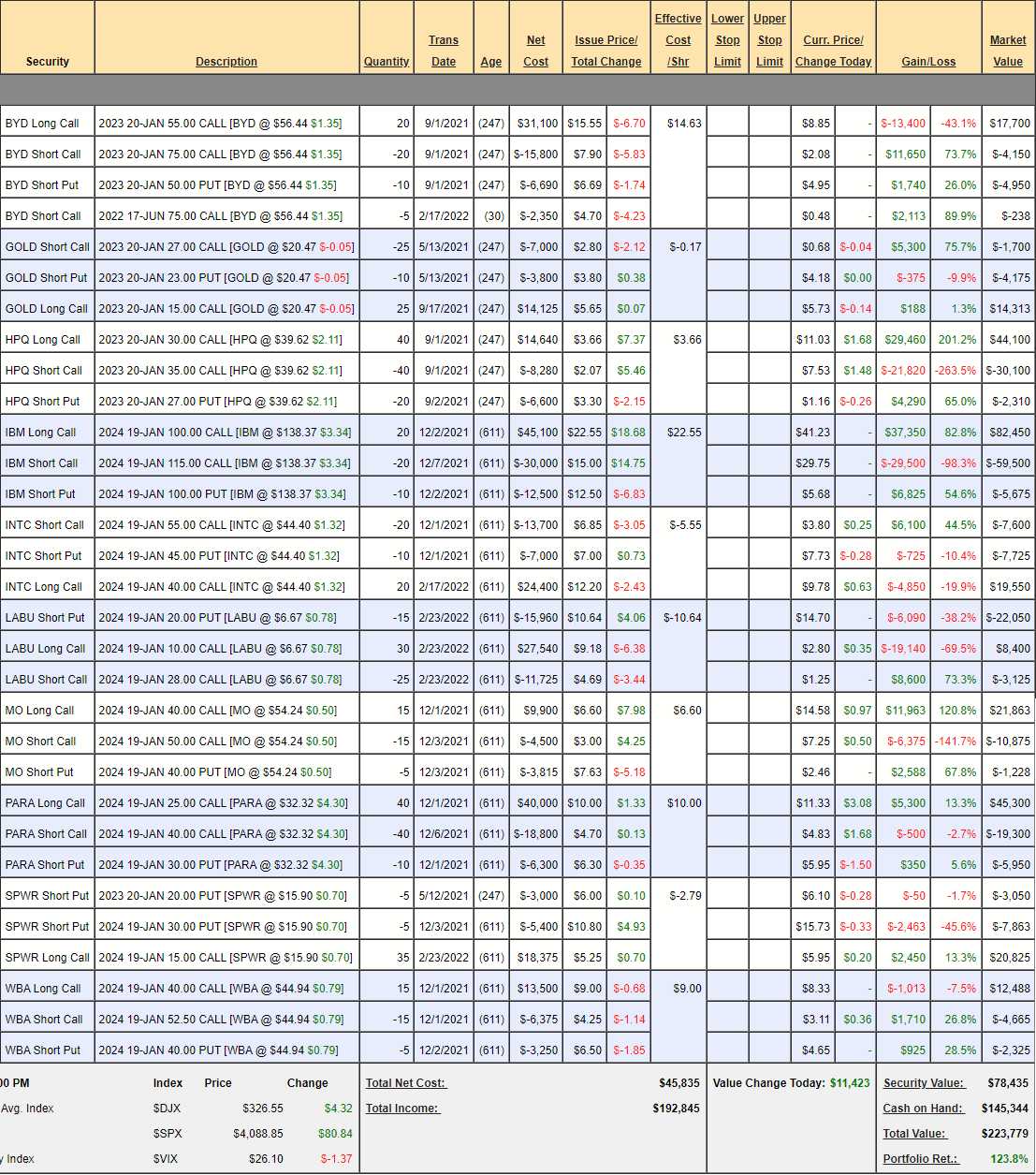

It's a real test of skill since we can only do adjustments on show days and tonight I'll be on Money Talk (Bloomberg, Canada) at 7pm for the first time since Feb 16th. At that time, we were up 140.9% at $240,926 and we had gotten very defensive, moving to 2/3 CASH!!! ahead of the coming correction – which we felt was long overdue. The S&P was around 4,400 at the time and is now 7.3% lower, at 4,076, and our portfolio is down 7% at $223,779.

This is exceptionally good as our newest trade, LABU (Biotech ETF) was a huge mistake at the time and we're down $16,630 on that which means there is nothing wrong at all with the rest of our positions and just the one that needs to be fixed. We still have $145,344 (65%) in CASH!!! – and it should be a good time to deploy some as there are real bargains out there.

In the MTP, we seek to find "bullet-proof" positions that we won't need to adjust from month to month as we only get one random day each quarter to make our changes. Though LABU was a bit of a risk, it's a generally conservative portfolio but we felt we could afford a risk as we were up 140% at the beginning of year 3.

The market is still a bit iffy – so we're not going too crazy but there are some compelling moves to make.

- BYD – 20% off the top is not bad and still good for a new trade at net $8,362 on the $40,000 spread so we have $31,638 (378%) of upside potential if BYD can get to $75 in 18 months.

- GOLD – A great inflation hedge but not acting like it lately. Fortunately, we are deep in the money and I'm comfortable with our targets on this $30,000 spread that is currently at net $8,438 so we have $21,562 (255%) of upside potential on this one.

- HPQ – Blew past our goal and no

…