(Please enjoy this updated version of my weekly commentary published June 9th, 2022 from the POWR Stocks Under $10 newsletter).

First, let’s review the past week…

Over the past week, the S&P 500 is down by 3.5%, although the bulk of the damage came in today’s session as traders were eager to take off risk in front of the CPI.

Up till around 1 pm today, it would be fair to say that the market was still stuck in the range. And, I was prepared to write about some of the bearish developments that had taken place over the past week. These included:

China shutting down in parts of Shanghai as case counts predictably increased due to the economy reopening.

We are seeing credit spreads blow up and are approaching the levels we saw in May.

This is another indication that we are moving from a period of financial stress to one of economic stress.

Economic data continues to underwhelm, while energy prices keep trending higher.

All in all, my case for a short squeeze and continuation of the rally took several serious blows with the EOD break below the range, like a fatal strike to these hopes.

To recap: my bullishness centered around an oversold market with extremely bearish sentiment. And, there were some potentially positive catalysts in the form of China reopening that could trigger a short squeeze with so many short or on the sidelines.

As I wrote in the Intro, I was losing confidence in this thesis and even more so after today’s price action.

Our trading plan revolved around getting bullish above 3,850 and even more so above 4,100. Now as we fall below 4,100, it’s only appropriate to decrease risk and exposure and wait for the next high-quality setup.

Energy

While, the market has been pretty volatile of late, energy has been an exception and an outperformer.

This might be changing. If the economy continues to weaken, then concerns of weakening demand will push prices lower.

Of course, if the economy does strengthen or even not weaken as much as expected, energy should outperform given the tight supply dynamics.

So, yes, as part of the risk-reduction plan, I will take some profits on energy positions.

Economic Growth

Occasionally, markets get offside. And for a brief period of time, technicals overwhelm fundamentals. This is the gist of our 10%+ rally.

But, once this passes, the market focuses again on the fundamentals. If the fundamentals improved in the interim, then the ‘bounce’ can turn into a ‘bottom’.

Unfortunately, this is not the case at the moment. I don’t see sufficient improvement that would justify a change in trend. But, I do see a bounce that was sufficient enough to reset some short-term technical and sentiment measures.

And if we look at the fundamentals, what do we see?

The economy is rolling over. And, the Fed is not there to provide some succor with lower rates.

This is why inflation is the key factor. If it starts to bend and come down, then it means there’s a light at the end of the tunnel. But, if it remains high, that means more tightening is likely.

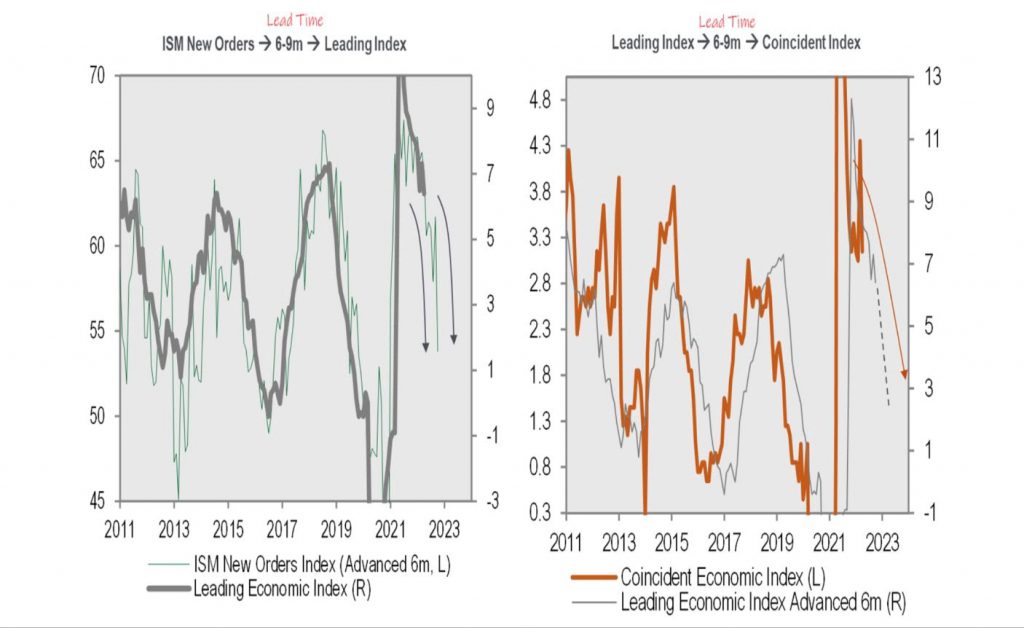

This chart shows that ISM New Orders tend to lead the LEI which leads the economy.

A weakening economy isn’t necessarily bearish for stocks, but it is when the Fed is also hiking.

This is another indication that the prudent course of action is to lock in some of our profits and get to a more defensive position.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low priced companies with explosive growth potential.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead.

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

SPY shares fell $0.08 (-0.02%) in premarket trading Friday. Year-to-date, SPY has declined -15.22%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post Sideways Range with Little Change Awaiting CPI Report appeared first on StockNews.com