(Please enjoy this updated version of my weekly commentary originally published March 14th, 2023 from the POWR Growth newsletter).

For anyone who has been ignoring the news the past few days — because that is the only way you would have missed this story — Silicon Valley Bank collapsed, sending the entire market into a panic as everyone wondered whether this would be an industry-wide problem.

That panic continued Monday, when many found out that government regulators had closed a second major bank (Signature Bank) over the weekend.

And while we didn’t see any more banks go under yesterday, we did see trading halted on nearly two dozen banks.

SVB and Signature Bank were the second- and third-largest bank failures, respectively, in U.S. history. So, even if it doesn’t turn out to be a systemic issue within the entire bank industry, it’s still kind of a big deal.

Especially if you’re Fed Chair Jerome Powell.

You see, Powell is now in a bit of a pickle. Today’s CPI numbers put inflation at 6%, which is still well above the Fed’s chosen 2% target level.

For the past year-plus, the Fed has used interest rate hikes as its weapon of choice to curtail inflation. But rising rates are the culprit behind SVB’s sudden collapse.

As of this weekend, fighting inflation is no longer the Fed’s sole focus… it also needs to consider overall financial stability and lending conditions.

A pause in rate hikes would be best for helping stabilize banks… but as February’s CPI report reminded us this morning, inflation is not dying out quickly, which means there’s a compelling case to continue raising rates.

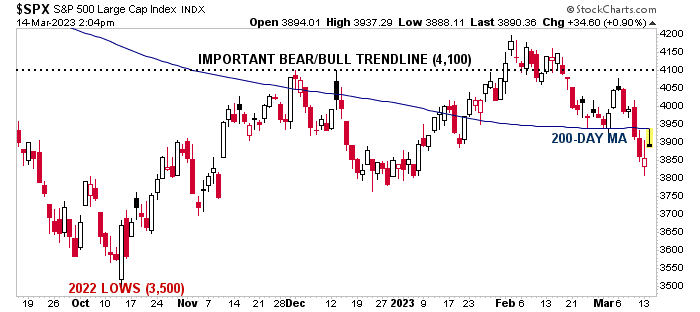

As can be seen for the below chart of the S&P 500 (SPY), stocks are now trading back below the 200-day moving average, which has been a constant framework for bullish and bearish action throughout the Fed’s recent rate-hiking program.

What to do… what to do…

Personally, I’m glad not to be in his shoes.

The next Federal Reserve meeting is scheduled for March 21 and 22, and that will likely be the next big market mover.

A pause would be good for banks but bad for the fight against inflation. A 50-bps hike would be good for the fight against inflation but bad for banks.

I expect they’ll split the difference and we’ll end up with a 25-bps hike, which wouldn’t do much for inflation and would put banks in an even tighter spot. So, kind of the worst of both worlds.

On that note, I want to take a step back so that we can take a step forward.

POWR Growth operates on a specific charter. Our aim is to find and own the best growth stocks, with help from the POWR Ratings system. That’s a great strategy, and one that’s been profitable for many years. It’s a great piece of a well-balanced portfolio.

However, it does not offer much flexibility in times of market uncertainty. Our best hedge against a bear market or recession will be (1) maintaining a large amount of cash and (2) trying to find the growth stocks outperforming in a tough environment.

There are other services in our arsenal that are built for versatility. If that’s something you’re looking for, I recommend checking out Tim Biggam’s POWR Options, which can profit from both ups and downs in the market using puts and calls.

There’s also Reitmeister Total Return, which seeks to generate positive returns no matter the market conditions using U.S. stocks, as well as ETFs tracking gold, bonds, inverse performance… sky’s the limit.

Now, I’m not saying it’s impossible for us to generate a profit in this market without access to those same tools.

THIS IS NOT A WHITE FLAG OF SURRENDER.

But I do want to make sure we’re all on the same page with what this strategy can and can’t do. And right now, due to unfavorable market conditions, we’re trading with one hand behind our back.

Conclusion

I know; we’re closing out a big chunk of our portfolio today. That wasn’t by design or even necessarily intent. It’s just what I’m seeing looking at the news, looking at each stock’s fundamental outlook, and looking at the price action.

It’s interesting that this lines up remarkably closely with our two hedge actions — moving to majority cash and finding the outperformers in a tough environment.

Despite what we’re up against, I’m always on the lookout for growth stocks to add to our portfolio, and actually just started looking into a fresh pick.

Assuming my research doesn’t reveal any major headwinds, we should be putting some of our cash to good use in the next 24 hours.

What To Do Next?

See my top stocks for today’s market inside the POWR Growth portfolio.

This exclusive portfolio gets most of its fresh picks from our proven “Top 10 Growth Stocks” strategy which has produced stellar average annual returns of +46.85%.

And yes, it continues to outperform by a wide margin even in these rough and tumble markets.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Meredith Margrave

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $385.61 per share on Wednesday afternoon, down $6.12 (-1.56%). Year-to-date, SPY has gained 0.83%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Meredith Margrave

Meredith Margrave has been a noted financial expert and market commentator for the past two decades. She is currently the Editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Meredith's background, along with links to her most recent articles.

The post 2 Big Problems the Feds Have to Overcome… appeared first on StockNews.com