The global fashion industry is projected to experience robust growth. Revenue in the global fashion industry is projected to grow at an almost 10% CAGR to $1.45 trillion by 2027. This presents a promising opportunity for omnichannel apparel retailer J.Jill, Inc. (JILL).

The company exhibits impressive profitability. Its trailing-12-month gross profit margin and EBITDA margin of 68.60% and 17.21% are 94.7% and 52.3% higher than the industry averages of 35.23% and 11.30%, respectively. Its trailing-12-month levered FCF margin of 9.03% is 221.8% higher than the 2.80% industry average.

Moreover, JILL has recently completed refinancing its Priming Term Loan and Subordinated Term Loan Facilities. Mark Webb, Chief Financial and Operating Officer of JILL, said, “With the refinancing behind us and given the significant cash generation of the business, we now have the financial flexibility to execute on our objectives and drive total shareholder return.”

Let's take a look at JILL's key financial metrics.

Tracking J. Jill Inc. (JILL) Performance: 2020 to 2023

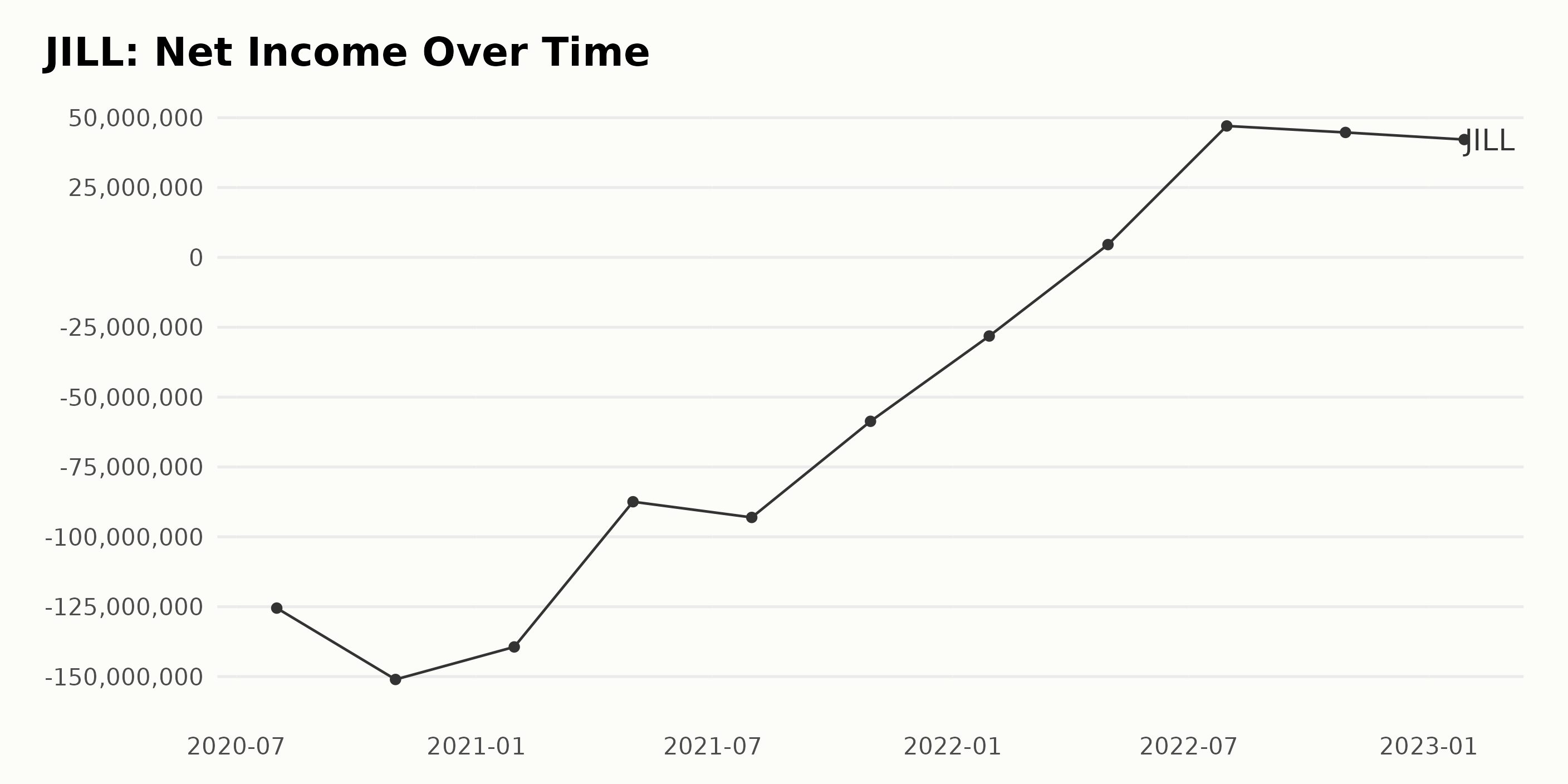

Since the inception of JILL in August 2020, the company’s net loss has narrowed from -$125.5 million in August 2020 to -$2.81 million as of January 28, 2023. This is a decline of 97.8% or an average annual decline rate of 45%. However, the trend appears to be reversing, with the most recent values showing an increase of $18.97 million, or a growth rate of 56.3%.

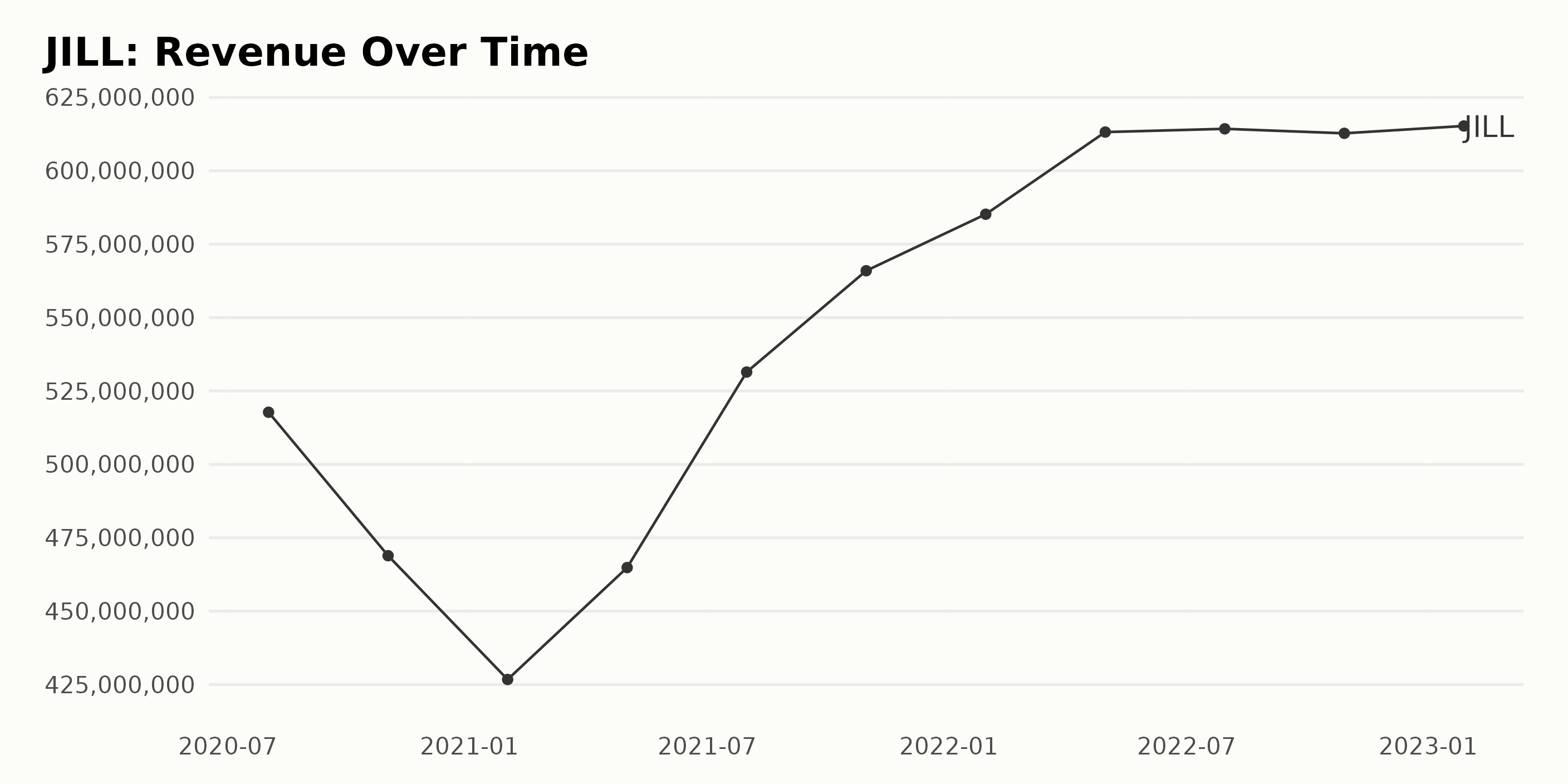

JILL has seen a generally increasing trend in revenue, with a variation of $99.68 million from the beginning of August 2020 ($51.77 million) to the end of January 2023 ($61.52 million), a growth rate of 18.5%. Over the last period (January 28, 2023), revenue increased marginally by 0.5% to $61.53 million.

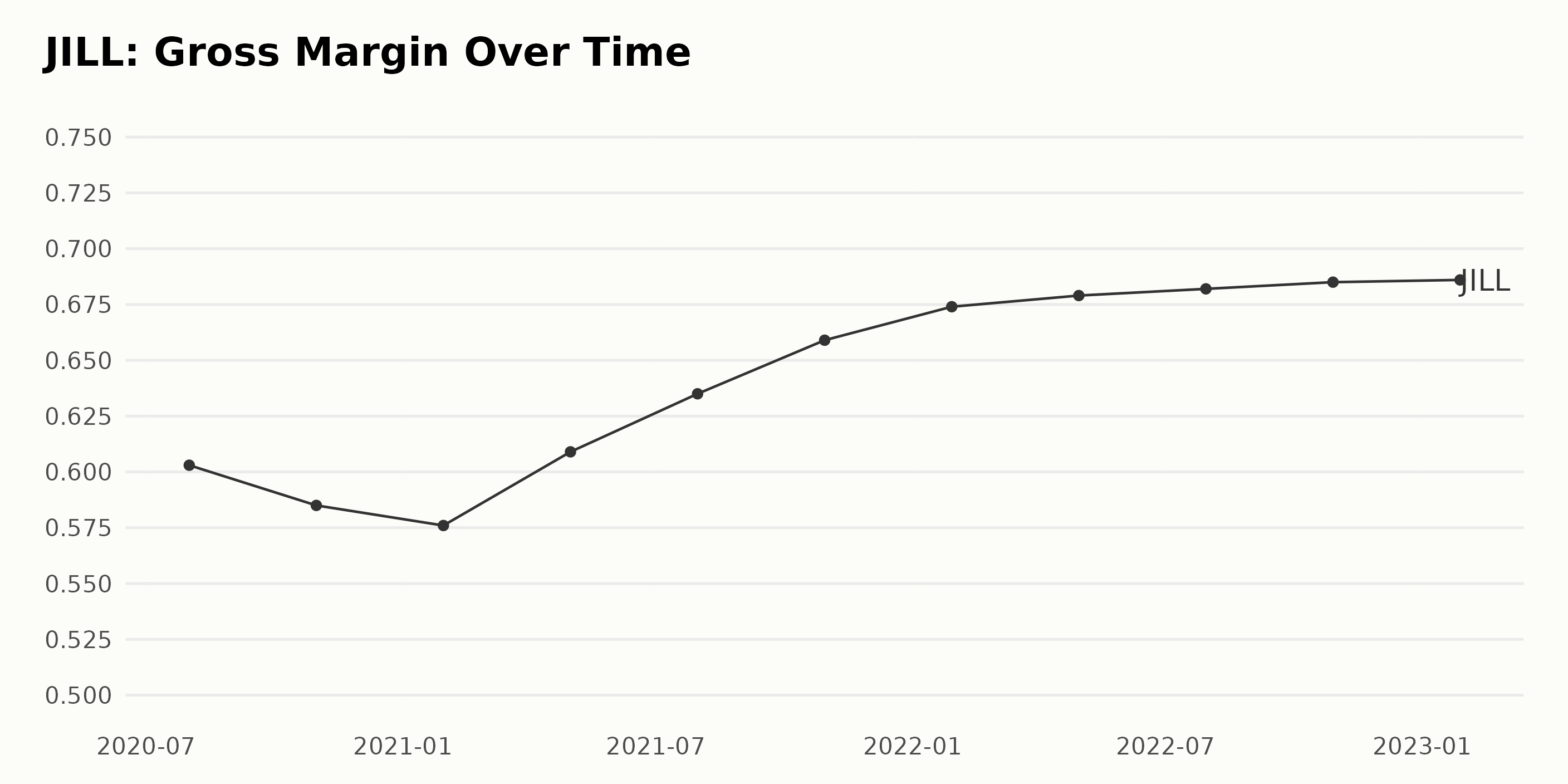

JILL’s gross margin has fluctuated over time, with the highest percentage at 68.5% in October 2022 and the lowest at 58.5% in October 2020. The most recent data shows a slight increase to 68.6% in January 2023, suggesting a growth rate of 13.9%.

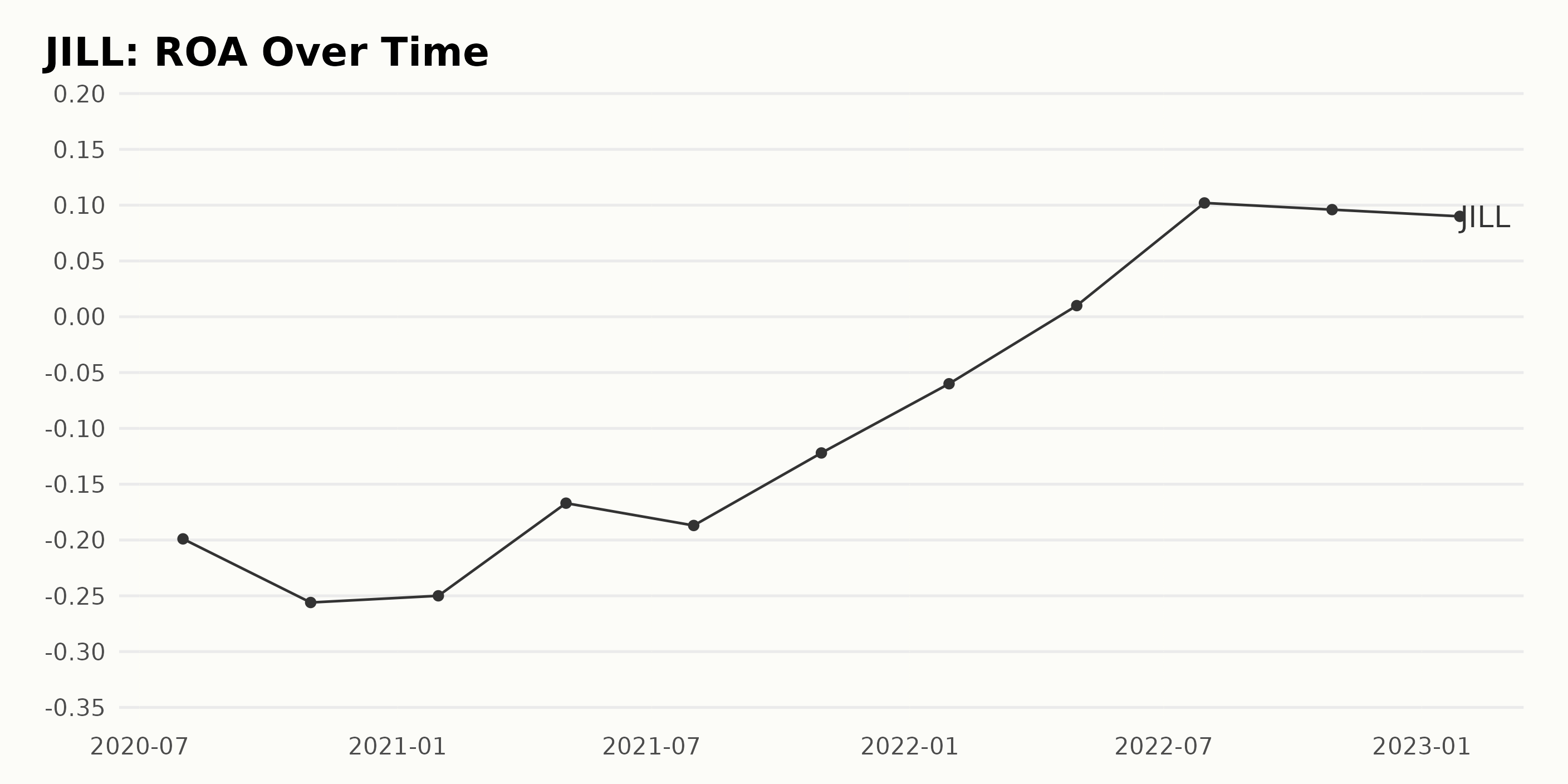

JILL’s Return On Assets (ROA) has seen fluctuations since 2020 but with a generally positive trend. In August 2020, the ROA was -0.20; in January 2023, it was 0.09, providing a growth rate of 54%, despite falling to -0.25 in 2021. The most recent data from January 2023 reveals a ROA of 0.09.

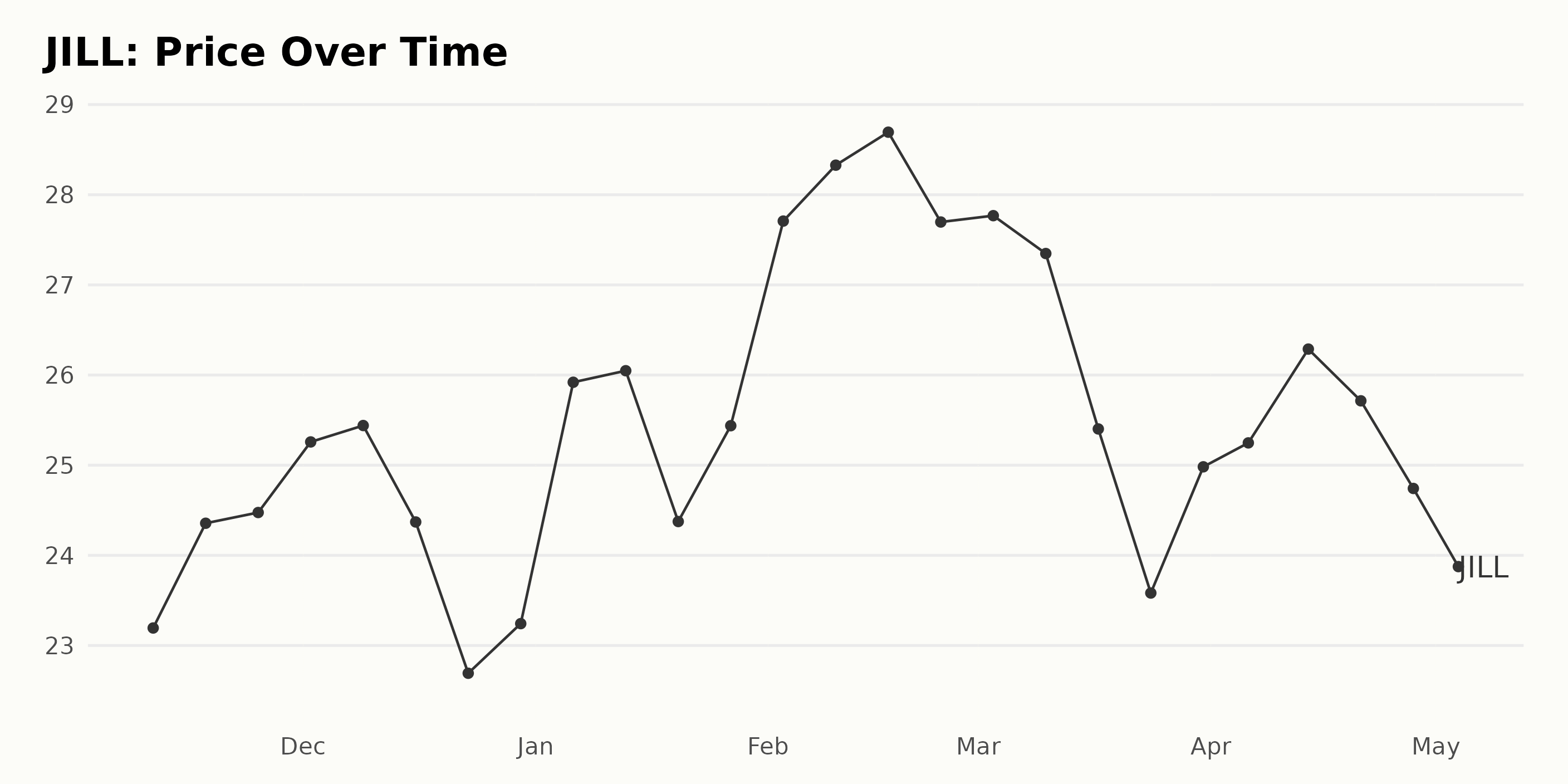

Price Trend Over 180 Days

There appears to be a trend of increasing prices for JILL. From $23.19 on November 11, 2022, to $24.76 on May 3, 2023, prices have increased by $1.57, which works out to an approximate average growth rate of 0.13% per week. Here is a chart of JILL's price over the past 180 days.

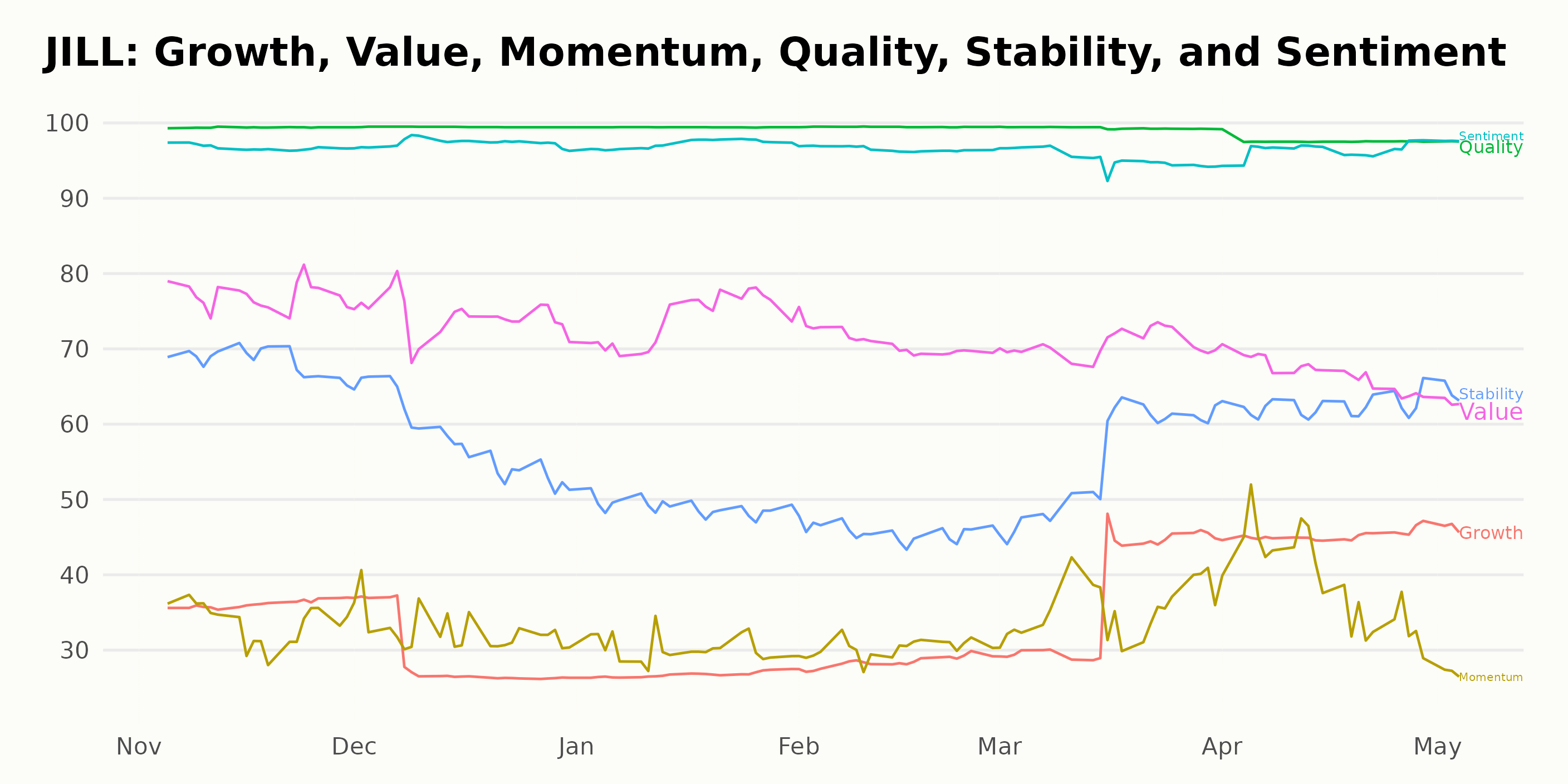

Jill Inc. POWR Ratings: Fluctuations in Quality, Sentiment, and Stability

JILL's overall POWR Ratings grade is currently B, translating to Buy in our proprietary rating system, and its rank in the Fashion & Luxury category is third out of 67 stocks.

For JILL, the POWR Ratings exhibit high ratings of Quality and Sentiment and mid-range ratings on Stability. The Quality rating has consistently remained at 99, while the Sentiment rating has stayed relatively high at 97 since September 2022. The Stability rating has varied over time, initially increasing from 68 to 58 during December 2022 and then decreasing to 46 by February 2023.

Growth and Momentum have also fluctuated, with Growth increasing from 27 to 45 within the same period. Momentum has declined from 34 to 27 within the same time frame. Value has remained the lowest-rated dimension of the three, ranging from 63 to 77.

How does J. Jill Inc. (JILL) Stack Up Against its Peers?

Other stocks in the Fashion & Luxury sector that may be worth considering are Hugo Boss AG (BOSSY), The TJX Companies, Inc. (TJX), and Movado Group, Inc. (MOV). These stocks have an overall POWR rating of A or B.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

JILL shares were trading at $22.58 per share on Thursday afternoon, down $0.73 (-3.13%). Year-to-date, JILL has declined -8.95%, versus a 6.26% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post May's Hottest Fashion Stock: The Top Choice for Your Portfolio's First Week appeared first on StockNews.com