Meta Platforms, Inc. (META) delivered a stellar performance in the third quarter, exceeding expectations with a revenue surge of 23%, marking the most rapid growth pace since 2021. Reporting revenues of $34.15 billion, the company notably surpassed the consensus estimate of $33.56 billion. EPS, too, exceeded expectations, as it settled at $4.39, outpacing the anticipated $3.63.

The credit for Meta’s climbing success rests largely on the resurgence of its core digital advertising business, which took a hit in 2022 but is steadily regaining vigor. The firm has also realized substantial advancements in enhancing the efficiency of its online ads.

A noteworthy part of Meta’s strategy involves leveraging the potential of artificial intelligence (AI). The company has invested heavily in this technology, which has helped it land retailers looking to serve customers targeted promotions. AI is expected to constitute Meta’s largest investment area in 2024.

In terms of user engagement, META reported Daily Active Users (DAUs) reaching 2.09 billion for the previous quarter, while the Average Revenue Per User (ARPU) touched $11.23, again exceeding analyst expectations.

Nonetheless, share prices of the internet behemoth experienced a dip following an announcement from executive leadership. Company executives have suggested that fourth-quarter performance may be susceptible to macroeconomic and geopolitical instability as well as potential regulatory interventions.

Despite a potentially rocky near-term outlook, Meta’s promising long-term growth prospect positions it as a solid investment opportunity. To gain a more thorough understanding of its potential, a deep dive into key performance indicators is necessary.

Financial Performance and Analysis: META’s Revenue, Net Income, and Key Ratios (2020-2023)

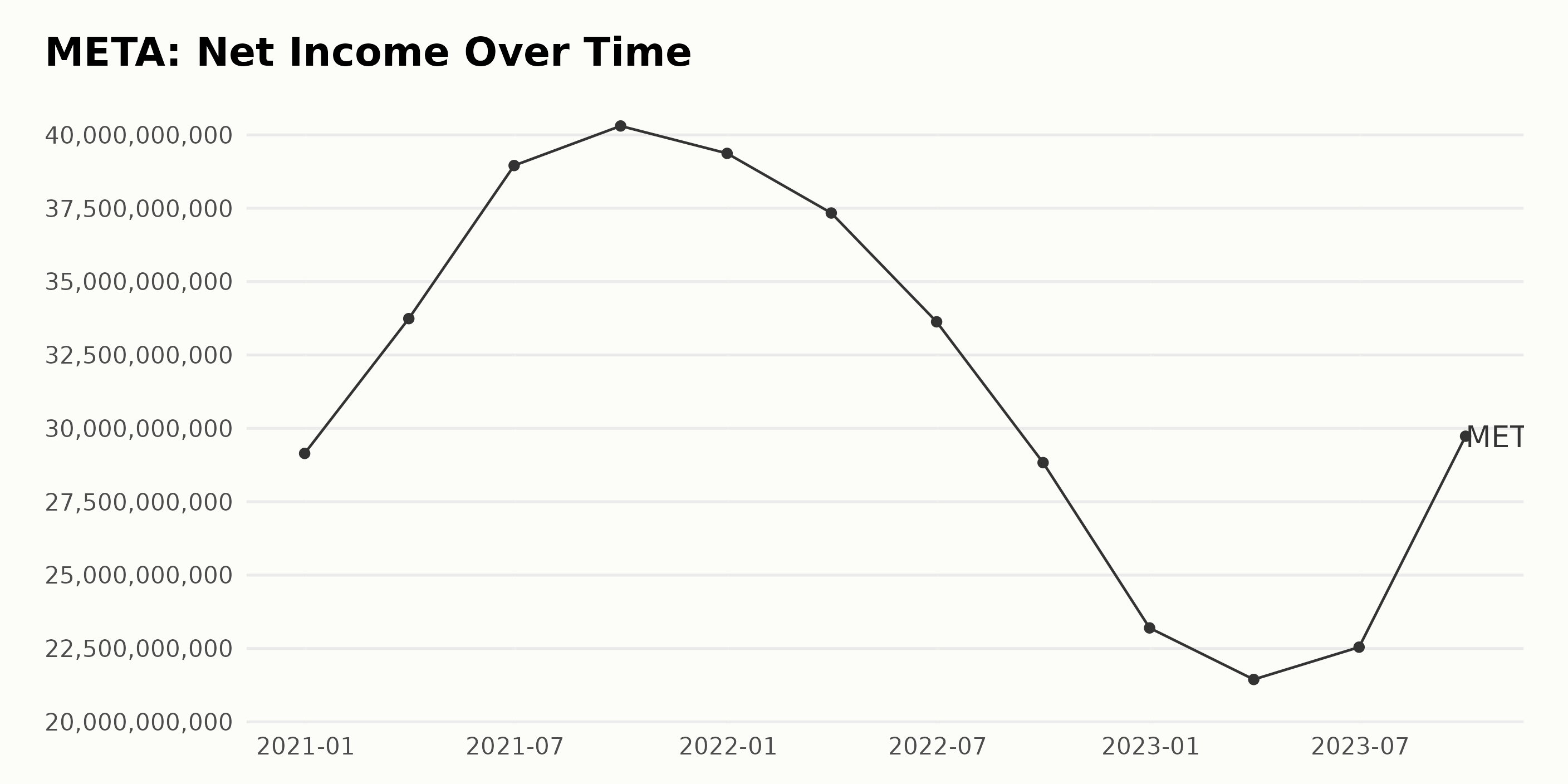

Looking at the trailing-12-month net income trend of META, we can identify some significant fluctuations over time. Summarising the data we have:

- At the end of December 2020, META’s net income was $29.14 billion.

- Throughout 2021, it generally increased, reaching its peak at $40.3 billion by the end of September 2021.

- However, by the end of 2021, there was a slight decline in net income to $39.37 billion.

- In 2022, META experienced substantial decreases, with its net income decreasing consistently every quarter, with it standing at $23.2 billion by the end of the year, a drop of around $16.17 billion from the previous year.

- The first quarter of 2023 saw a further decline to $21.44 billion, but this was followed by a small uptick to $22.55 billion in June 2023.

- There was a quick rebound in September 2023 as net income surged back up to its highest point since 2021, reaching $29.73 billion.

Over the entirety of the series, from December 2020 to September 2023, META’s net income fell from $29.14 billion to $29.73 billion. This represents a growth rate of nearly 2% despite some major ups and downs during this period.

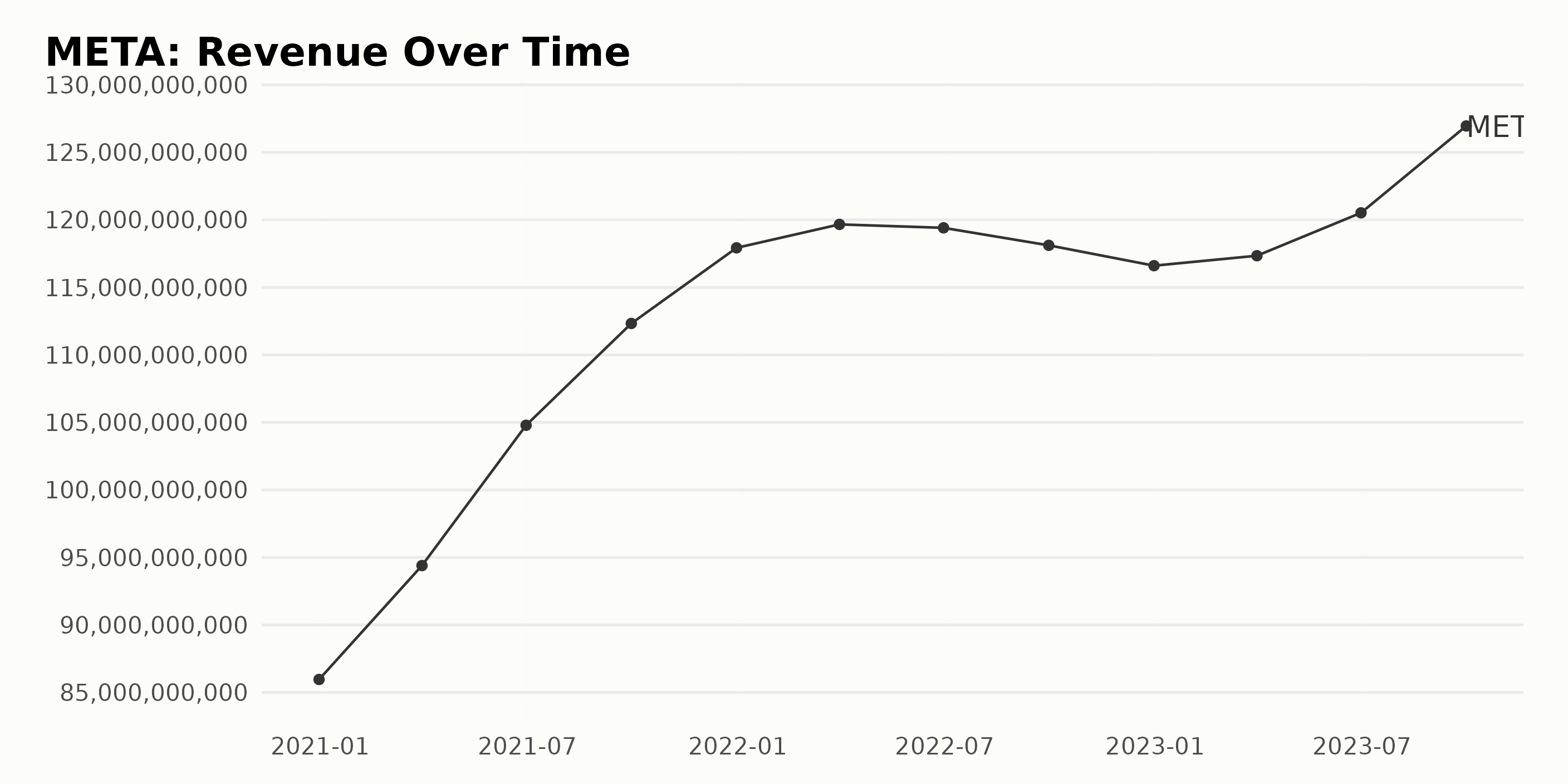

The trailing-12-month revenue of META showed substantial growth from December 2020 to September 2023. Here is a detailed summary of the data:

- In December 2020, the company’s revenue was $85.97 billion.

- By March 2021, an upturn was observed, with revenue rising to $94.4 billion.

- This upward trend continued until June 2021, when revenue reached $104.79 billion and further soared to $112.33 billion by September 2021.

- As we transitioned into the year 2022, revenue peaked at $119.67 billion in March but then slightly dipped to $119.41 billion in June and significantly dropped to $118.12 billion by September.

- Revenue decreased further to reach the lowest point for the year at $116.61 billion in December 2022.

- However, the year 2023 witnessed a rebound as revenue climbed back to $117.35 billion in March, followed by a robust increase to $120.52 billion in June and a substantial jump to its highest point at $126.96 billion in September.

Overall, from the first recorded value in December 2020 to the last in September 2023, META’s revenue showed a promising increase, representing a growth rate of approximately 47.7%. However, the journey wasn’t consistently uphill. It experienced some fluctuations, particularly the dips observed in 2022, but managed to recover and surge further in 2023.

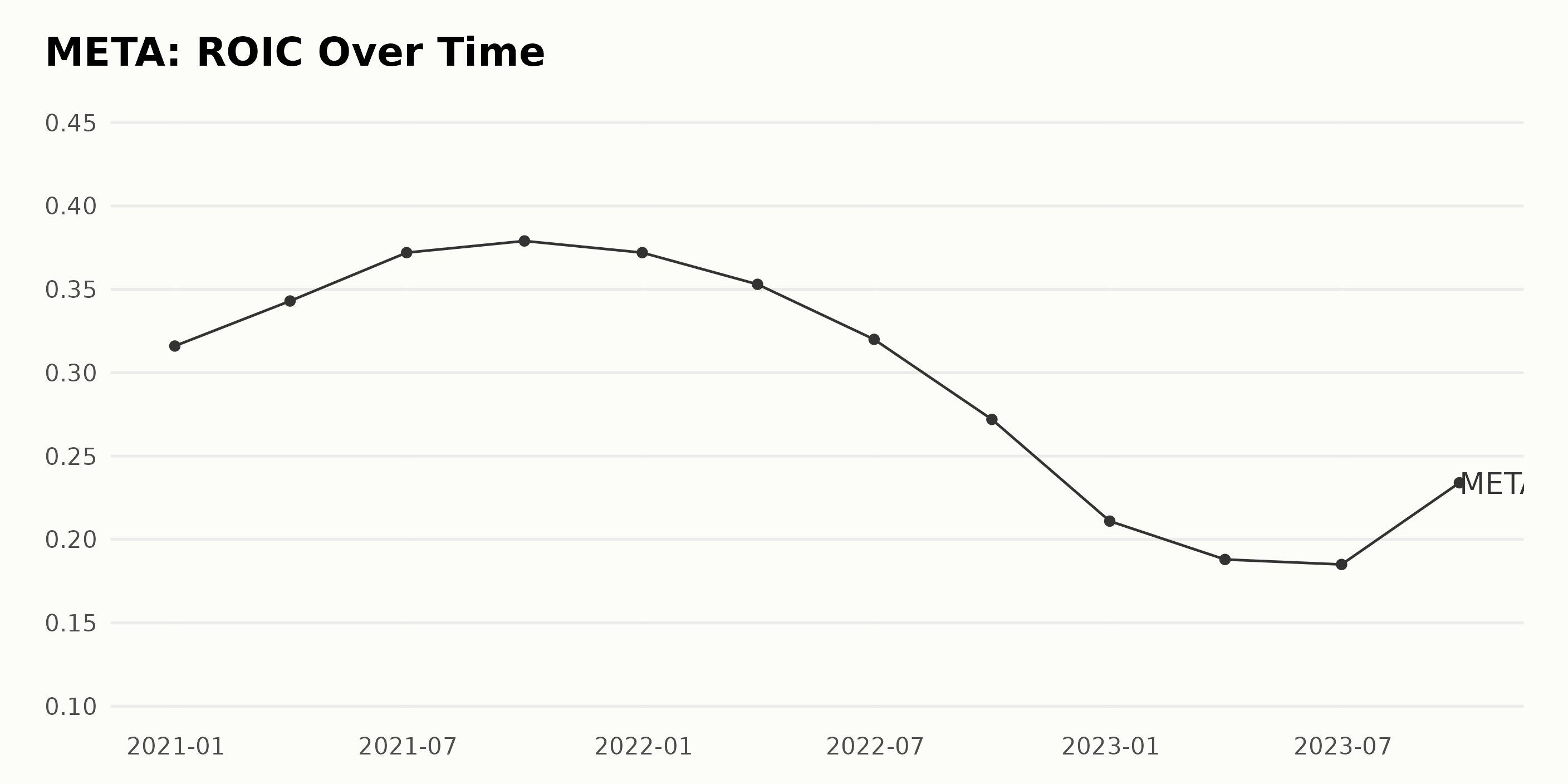

The trend and fluctuations of the Return On Invested Capital (ROIC) of META, across the series indicates a slight fluctuation followed by an overall decline.

- In December 2020, META reported a ROIC of 0.316.

- The value rose to 0.343 in March 2021 and further increased to 0.372 by June 2021.

- The value slightly increased to 0.379 at the end of the third quarter of 2021.

- Interestingly, the numbers dipped back to the earlier figure of 0.372 by December 2021.

- From there, the values show an overall declining trend through 2022, with reported figures at 0.35 in March, 0.32 in June, and 0.272 in September, dropping down to 0.211 in December 2022.

- At the beginning of 2023, the numbers declined slightly further to 0.188 in March.

- A slight increase was visible by June 2023 with an ROIC of 0.185, which again rose to 0.234 in September 2023.

- The slight resurgence in the ROIC figures towards the end of the series signals a potential recovery. Further monitoring of data could provide better insights into whether this is a sustainable rise or just a short-term boost.

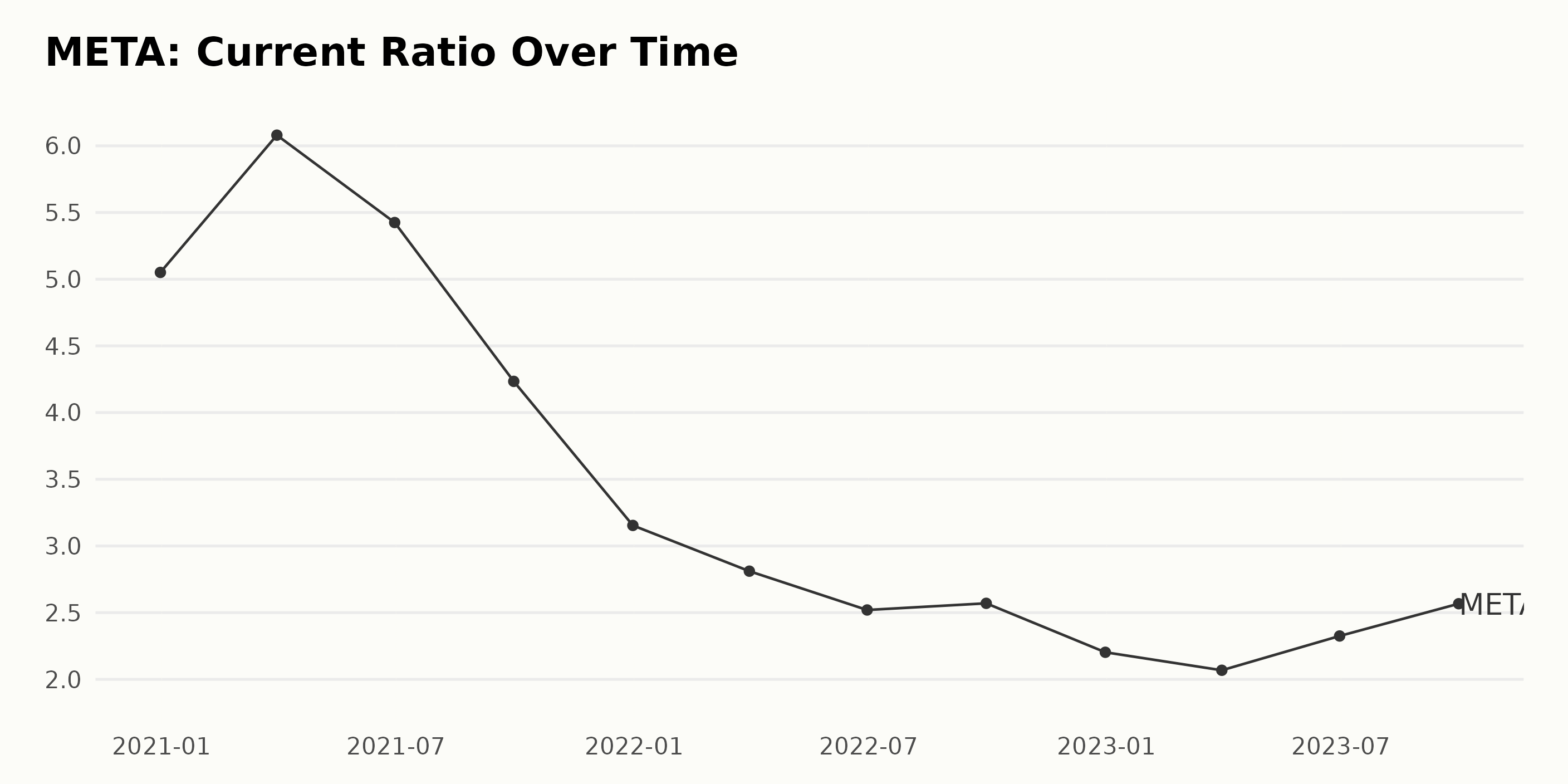

The reported Current Ratio of META has undergone significant fluctuations from December 2020 to September 2023.

- In December 2020, it stood at 5.05.

- Its highest point in the series was recorded on March 31, 2021, registering a current ratio of 6.08.

- Following that peak, a downward trend was observed through December 2022, reaching its lowest value of 2.20 on December 31, 2022.

- Despite a brief period of recovery, where it increased to 2.57 in September 2022, by March 2023, it dropped down to 2.07.

- Recent data shows a recovery trend with an increase to 2.32 and 2.57, respectively, in June and September of 2023.

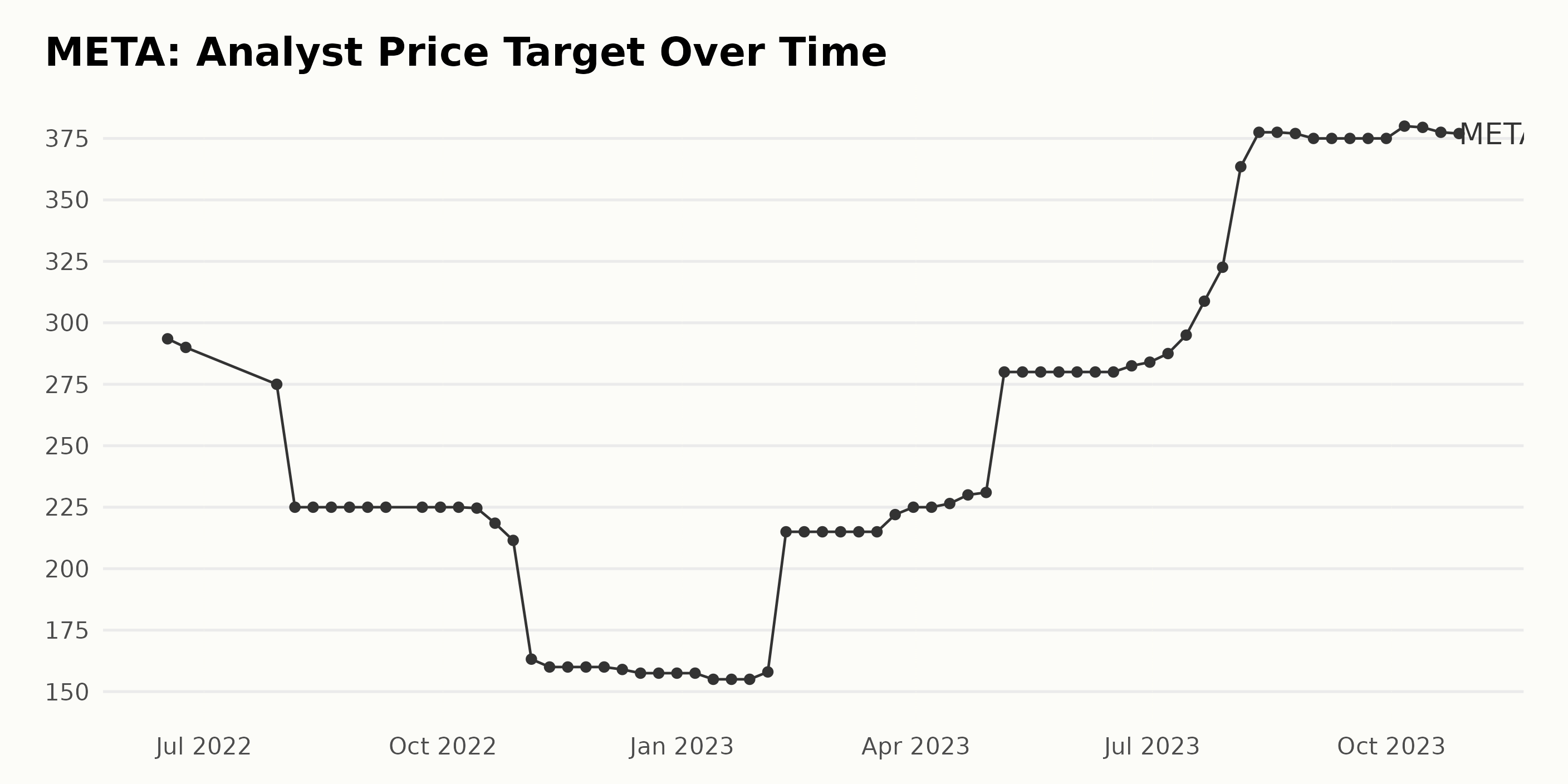

The Analyst Price Target for META showed highs, lows, and periods of stability over time. A general downward trend was observed from mid-June 2022 to the end of 2022, with a few fluctuations.

Key Data Points:

- In June 2022, the target price stood at 293.5, gradually decreasing to 290 by the end of the month.

- Sharp declines were seen from July to November 2022, with the target price hitting a low of 160 by November 2022 and remaining steady till mid-December 2022.

- There was a slight decrease in the target price from 160 to 155 in January 2023, but it failed to reach the lows of November 2022.

- From February to April 2023, the target price fluctuated around 215 - 230, with a noticeable increase to 280 in May 2023 and staying steady till June 2023.

- In late June 2023, there began an upward trend, which carried on through July and August 2023, with a target price peaking at 377.5.

- The target price saw marginal decreases from September to October 2023, ending up slightly around 375 with an upward tick to 380 in October 2023, followed by a small decline towards the end of October 2023, where it stood at 377.

According to the data, between June 2022 and October 2023, the Analyst Price Target for META saw an overall increase of about 28.5% despite considerable fluctuations throughout this period. The final value in the series was 377 in October 2023.

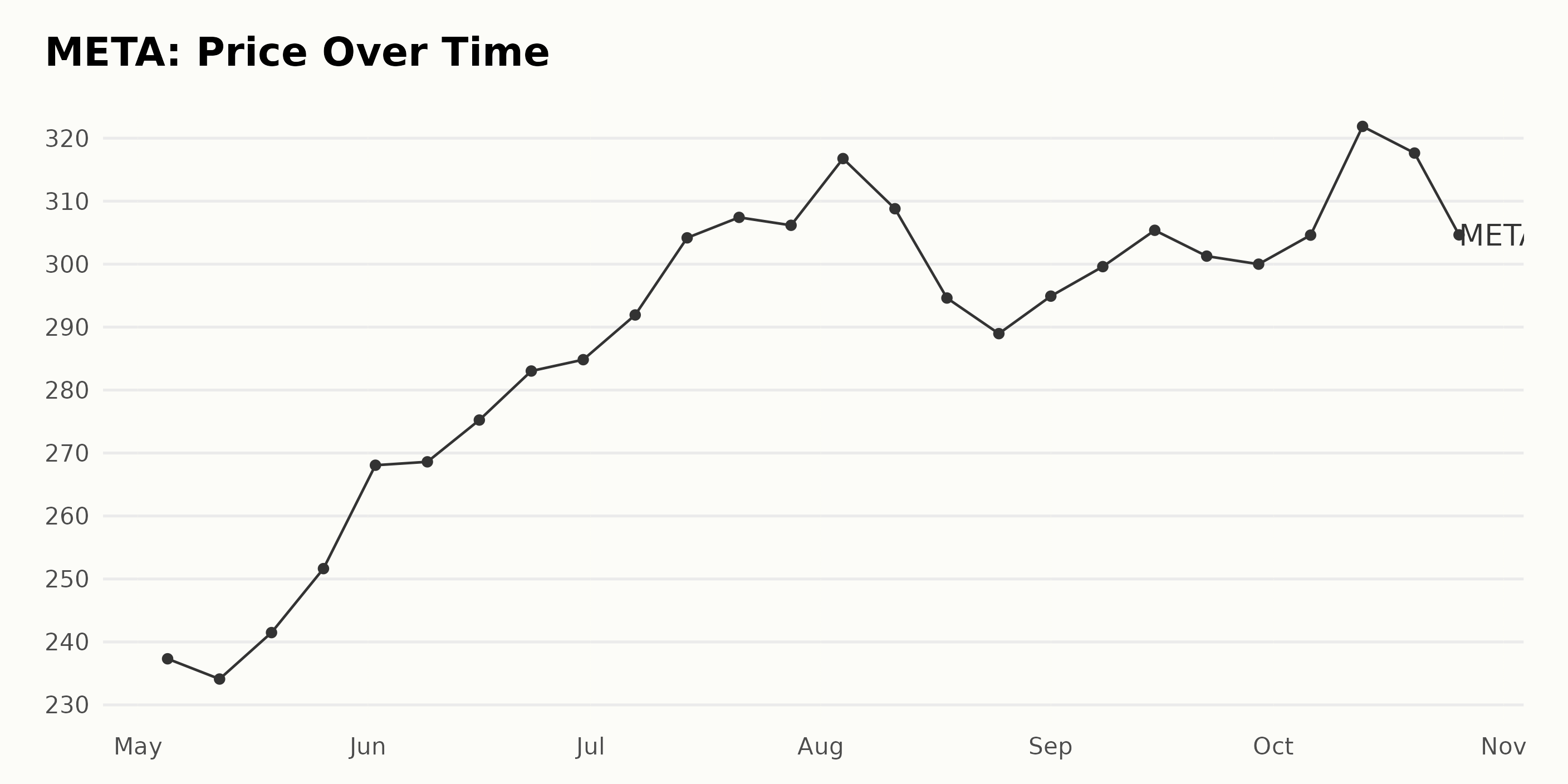

Exploring META’s 2023 Growth Trend: A Detailed Share Price Journey from May to October

From the provided data, it appears that the share price of META generally increased from May to October 2023. The price has some minor fluctuations but exhibited a significant uptrend overall. Here are details of the trend at crucial points in time:

- On May 5, 2023, the price was $237.32

- A slight decrease in price was observed on May 12, 2023, with a value of $234.11

- June recorded a noticeable increase in share price, ending on June 30, 2023, at $284.83

- July saw a further increase, with the shares peaking at $307.43 on July 21, 2023

- However, in August, there was a notable decrease in the price, down to $288.96 by the end of the month.

- In September, the prices seemed to recover slightly, reaching up to $305.37 on September 15, 2023.

- Finally, October reflected another increase, and the share peaked at $321.87 on October 13, 2023, marking a raise from the initial value.

The growth rate seems to be accelerating in the period from May to June, followed by some minor deceleration with increases and decreases until October 2023. It’s noteworthy to mention the highest share price of $321.87 during this period, strengthening the trend of general growth. Here is a chart of META’s price over the past 180 days.

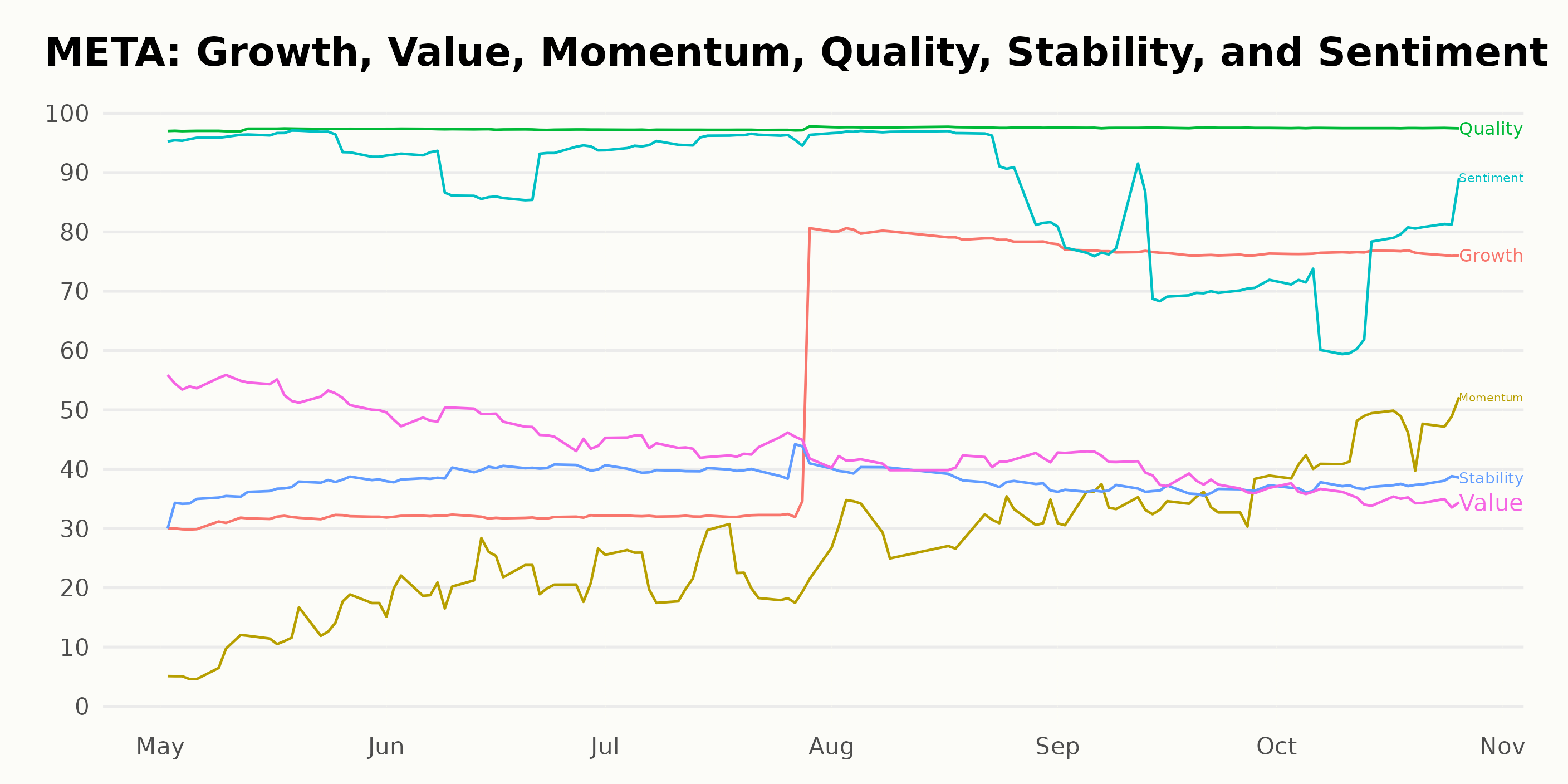

Evaluating META’s Performance: Insights on Quality, Sentiment and Growth Trends

META has an overall A rating, translating to a Strong Buy in our POWR Ratings system. It is ranked #2 out of the 57 stocks in the Internet category.

After a careful review of the POWR ratings for META across several dimensions, there are three dimensions that stand out: Quality, Sentiment, and Growth. These dimensions consistently exhibited high ratings and noteworthy trends.

Quality - The Quality dimension consistently rated extremely high for META across all periods examined. It revealed a sustained strength with values between 97 and 98 from May 2023 to October 2023. With such consistent high scores, this suggests that META is robust in terms of its operations and performance.

Sentiment - The Sentiment ratings also displayed remarkable consistency, scoring quite high from May 2023 to September 2023, with values ranging from 90 to 96. However, there was a notable drop in score to 74 and 73 in September and October 2023, respectively - this could suggest changes in market attitude toward META in these periods.

Growth - The Growth dimension showcased a clear upward trend, with values steadily rising from 31 in May 2023 to a peak of 79 in August 2023. Despite minor fluctuations in the latter period (from August to October 2023), META maintained high scores above 75. This indicates robust growth patterns for META within this period.

These findings provide valuable insights into META’s performance in these dimensions over the specified period.

How does Meta Platforms, Inc. (META) Stack Up Against its Peers?

Other stocks in the Internet sector that may be worth considering are Yelp Inc. (YELP), Travelzoo (TZOO), and Alphabet Inc. (GOOGL) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

META shares were trading at $295.11 per share on Friday afternoon, up $6.76 (+2.34%). Year-to-date, META has gained 145.23%, versus a 8.62% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Meta Platforms (META) Earnings Beat: Is the Internet Behemoth Set for Further Upside? appeared first on StockNews.com