Analog Devices, Inc. (ADI) aligned with analyst estimates for its fiscal fourth quarter ended October 2023. However, it offered an outlook below market estimates as the chipmaker grapples with an ongoing supply glut in the semiconductor industry.

ADI announced a reported revenue of $2.72 billion during its fiscal fourth quarter, representing a 16% decrease on a year-over-year basis. The gross margin for this period stood at $1.65 billion, 23% less than the previous year, with a reduction in the gross margin percentage by 540 basis points to 60.6%.

The operating income for this period amounted to $634 million, witnessing a 42% fall compared to last year, while the operating margin diminished by 1,050 basis points, steadying at 23.4%. Moreover, the adjusted earnings per share (EPS) clocked in at $2.01 for this quarter, a 26% decline from the same quarter in the previous year.

As inflation continues to persist, customers are refraining from placing additional orders for chips, leading to excess supply within semiconductor companies after the pandemic-fueled buying spree lost momentum. Furthermore, cautious expenditure patterns adopted by automobile manufacturers in response to potential slowdowns in their electric vehicle segments have further impacted ADI order volumes.

The company anticipates a first-quarter revenue of $2.50 billion, plus or minus $100 million, falling short compared to estimates of $2.68 billion. Simultaneously, an adjusted EPS of $1.70 is expected, plus or minus 10 cents, which again falls below estimates of $1.90.

With such uncertainties hovering over the horizon, current circumstances may not be deemed favorable for investing in the stock. As we delve deeper into reviewing crucial financial metrics, the situational analysis becomes increasingly clear.

Analyzing Financial Performance Trends of Analog Devices Inc. from 2021 to 2023

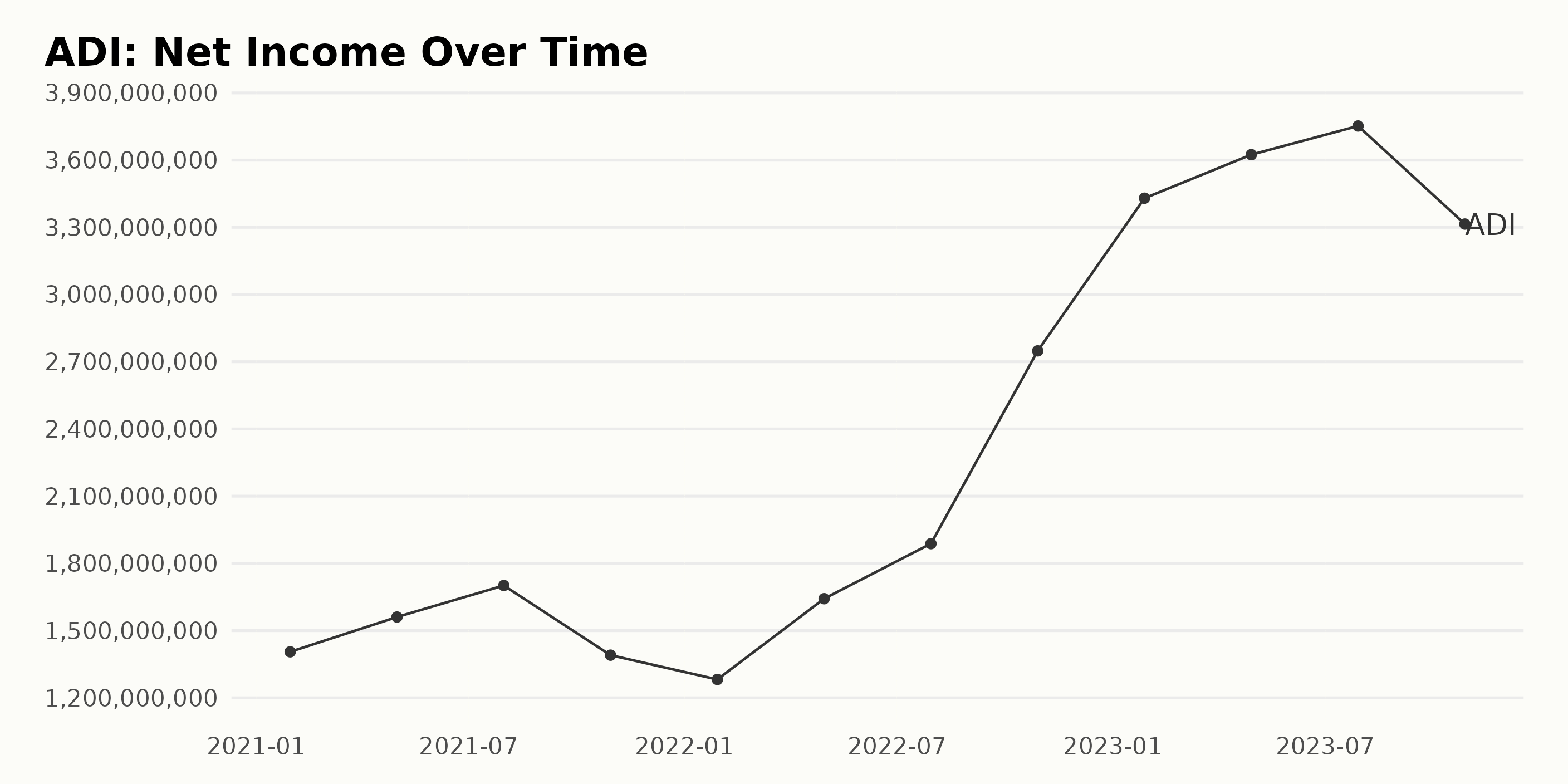

The trailing-12-month net income of Analog Devices Inc. (ADI) has generally seen a rising trend over the observed period, albeit with some fluctuations.

- Starting from January 2021, the net income was $1.4 billion.

- There was progressive growth seen through May 2021 to July 2021, from $1.56 billion to $1.7 billion.

- However, there were simultaneous dips by October 2021 and January 2022, reducing to $1.39 billion and further down to $1.28 billion, respectively.

- The figures revived in April 2022, shooting up to $1.64 billion, followed by a further hike in July 2022, reaching $1.89 billion.

- The most striking increase was noticed by October 2022, where the net income soared drastically to $2.75 billion.

- This growing trajectory continued into 2023, reaching its peak in July 2023 with a net income of $3.75 billion.

- Despite this, there was a slight slump by October 2023, dropping to a net income of $3.31 billion.

In comparison to the initial figure in January 2021, the net income of Analog Devices Inc. cumulated an impressive growth rate by the end of the series in October 2023.

Overview:

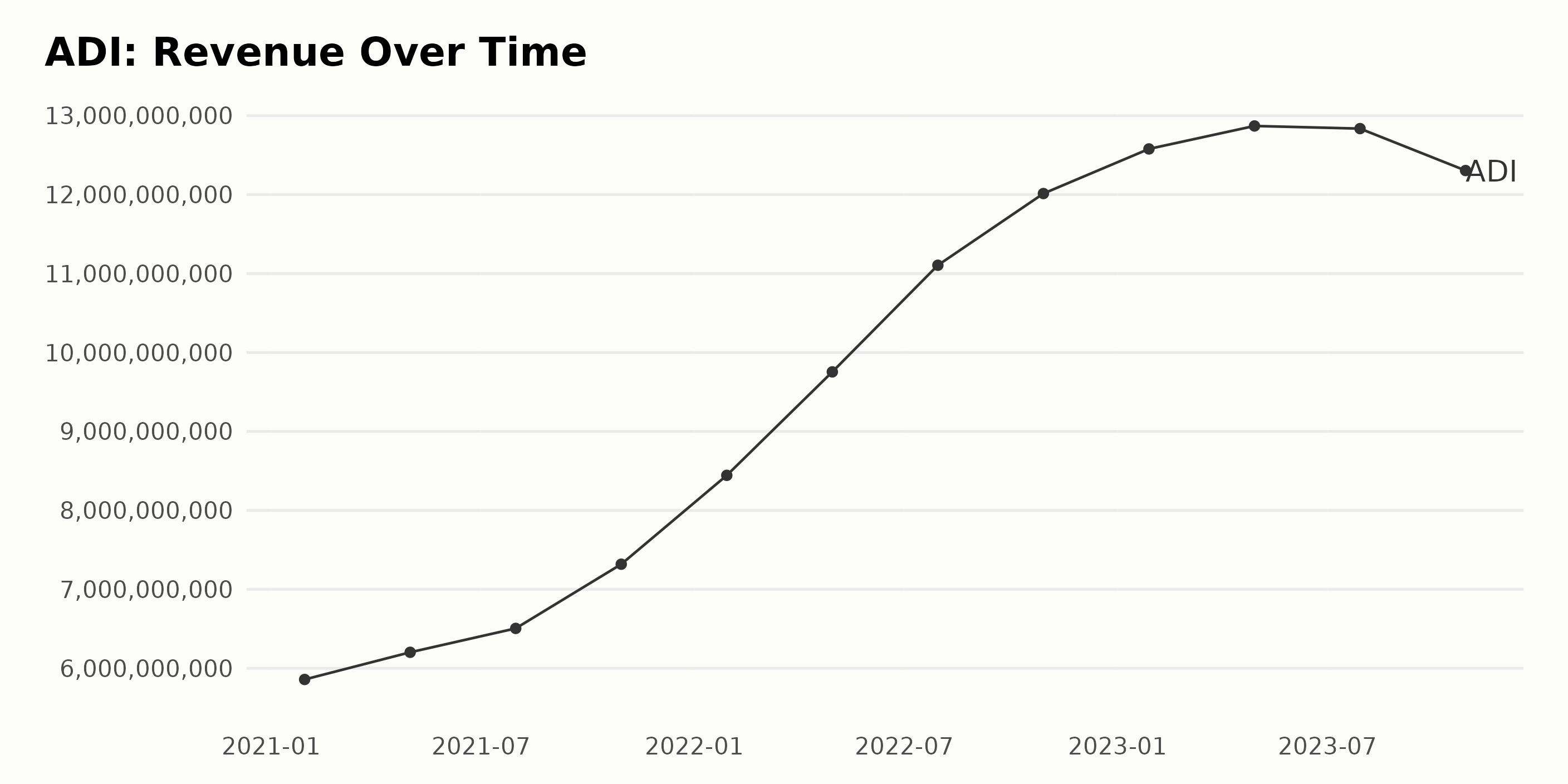

- Analog Devices Inc. (ADI) has shown a consistent upward trend in its trailing-12-month Revenue over the course of the data series, from January 2021 to October 2023.

- The company has seen a significant increase in its Revenue, beginning with $5.86 billion in January 2021 and culminating at $12.31 billion in October 2023.

Year 2021:

- In 2021, the growth in Revenue was steady and strong. Starting from $5.86 billion in January, revenue escalated to $7.32 billion by October 2021.

- This represents an increase of roughly $1.46 billion or a growth rate of almost 24.87% over the span of 10 months in 2021.

Year 2022:

- The positive trend continued into 2022. January saw $8.44 billion in Revenue, which went up to $12.01 billion by October, marking an increase of about $3.57 billion.

- The growth rate for 2022 was around 42.30%, significantly higher than the previous year.

Year 2023:

- However, the upward trend showed signs of plateauing and even a slight dip towards the end of the time series in 2023.

- From January 2023 to October 2023, the Revenue began at $12.58 billion but slightly decreased to $12.31 billion at the end of this period, representing a modest decrease of around 2.14%.

Overall Growth From Start To End:

- Overall, comparing the first value ($5.86 billion in January 2021) to the last value ($12.31 billion in October 2023), ADI's Revenue has more than doubled, representing a growth rate of roughly 110% over the entire dataset period.

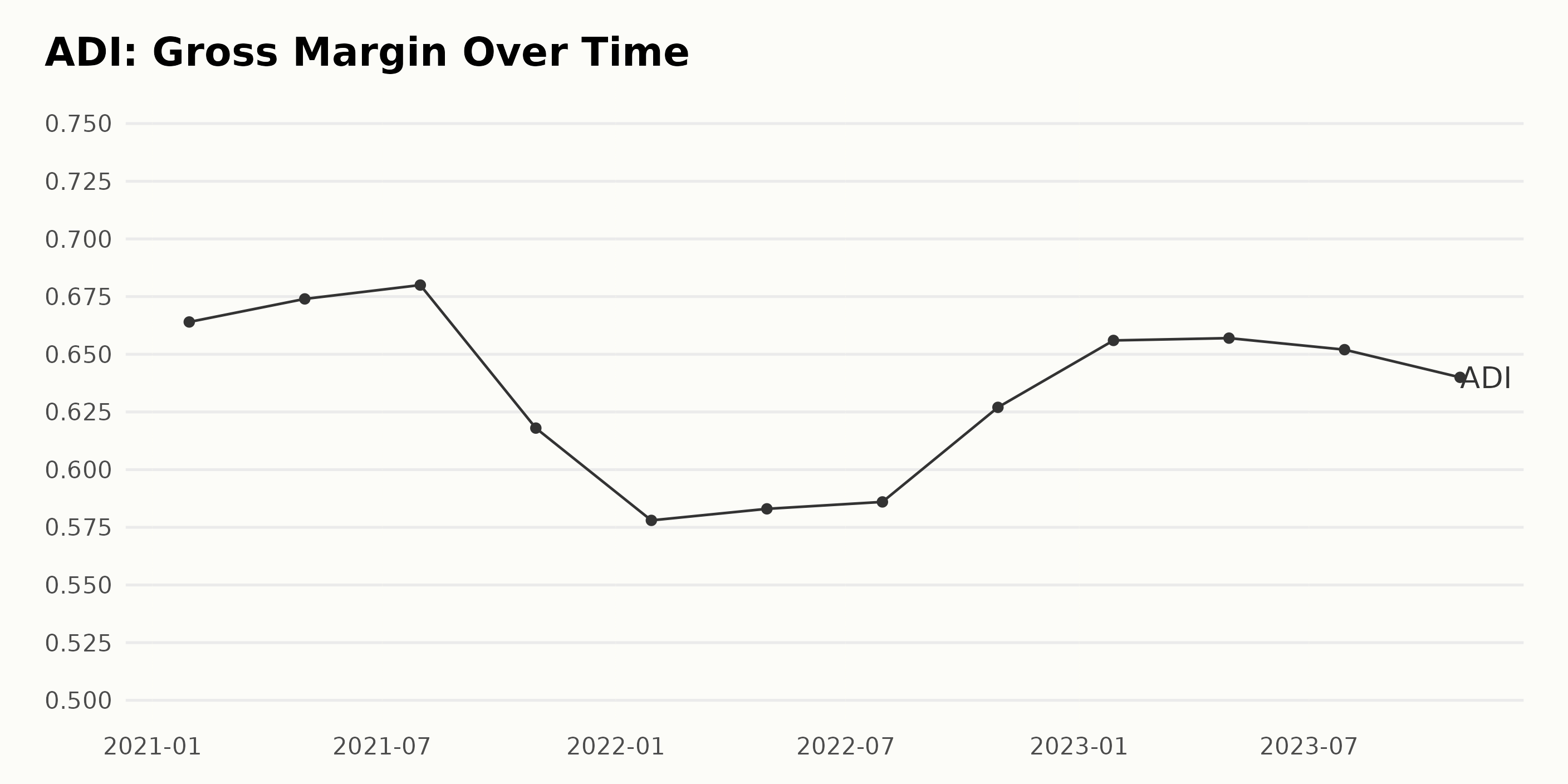

The Gross Margin of Analog Devices Inc. (ADI) has seen quite a variation over the period from January 2021 to October 2023. Here is a summary of the gross margin performance:

- In January 2021, the Gross Margin was 66.4%.

- It registered a slight increase, reaching a peak of 68.0% by July 2021.

- The value dipped significantly to 61.8% by October 2021.

- In 2022, it experienced a decrease until January, when it was measured at 57.8%, but it moderately increased again in subsequent months, reaching 62.7% by October.

- The Gross Margin experienced relative stability in 2023, beginning at 65.6% in January and finally tallied at 64.0% in October.

Over this period, the Gross Margin of ADI demonstrates fluctuating behavior, achieving its highest value in July 2021 and its lowest in January 2022. The company displayed a declining trend in Gross Margin from July 2021 until January 2022. From then on, though, there was a tepid recovery until October 2022, which then tapered slightly throughout the rest of 2023. Calculating the difference from the first value in January 2021 (66.4%) to the last value in October 2023 (64.0%), the gross margin has declined by 2.4% overall over the given period.

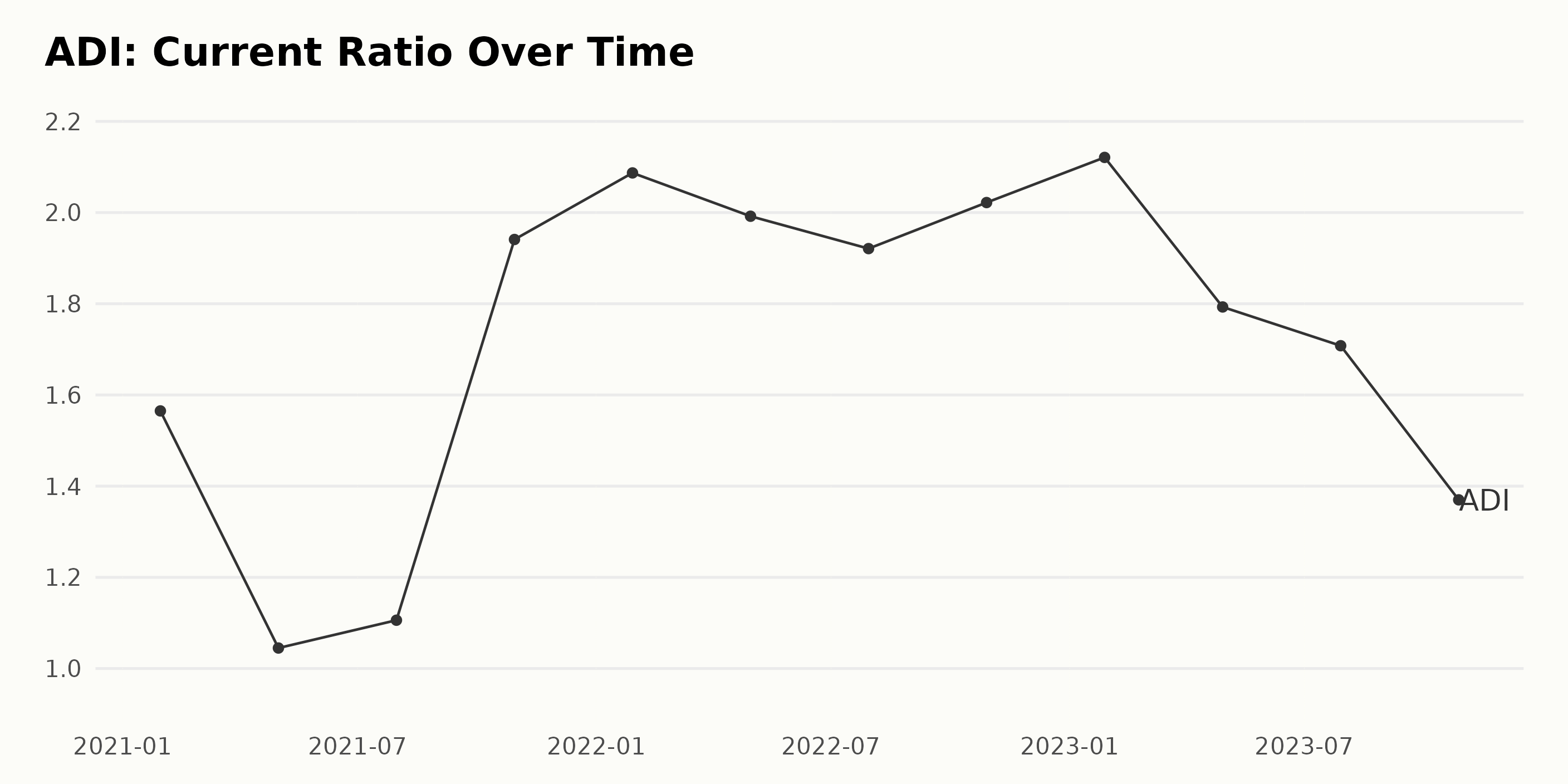

The Current Ratio of Analog Devices Inc. (ADI) has seen both upward and downward fluctuations over the period from January 2021 to October 2023.

- Starting at 1.57 in January 2021, the ratio took a sharp plunge, bottoming out at 1.05 in May 2021.

- By July 2021, there was a slight improvement as the ratio rose to 1.11. By October 2021, it had accelerated to reach its peak of 1.94.

- Entering 2022, the ratio continued to climb, reaching a new high of 2.09 in January before experiencing a dips and peaks throughout the year, ending at 2.02 in October.

- Continuing a general downward trend into 2023, the Current Ratio reached lows of 1.71 in July and even dropped to 1.37 by October.

- The most recent data suggests a noticeable decrease in the company’s liquidity ratio, indicating that it had a lower proportion of assets it could readily use to cover its debts.

Calculating the growth rate from the initial value of 1.57 in January 2021 to the final value of 1.37 in October 2023, the Current Ratio has decreased by approximately -12.7% over this time period. This fluctuating trend implies variable stability in ADI's short-term debt-paying capabilities, with an overall decrement by the end of the period under review.

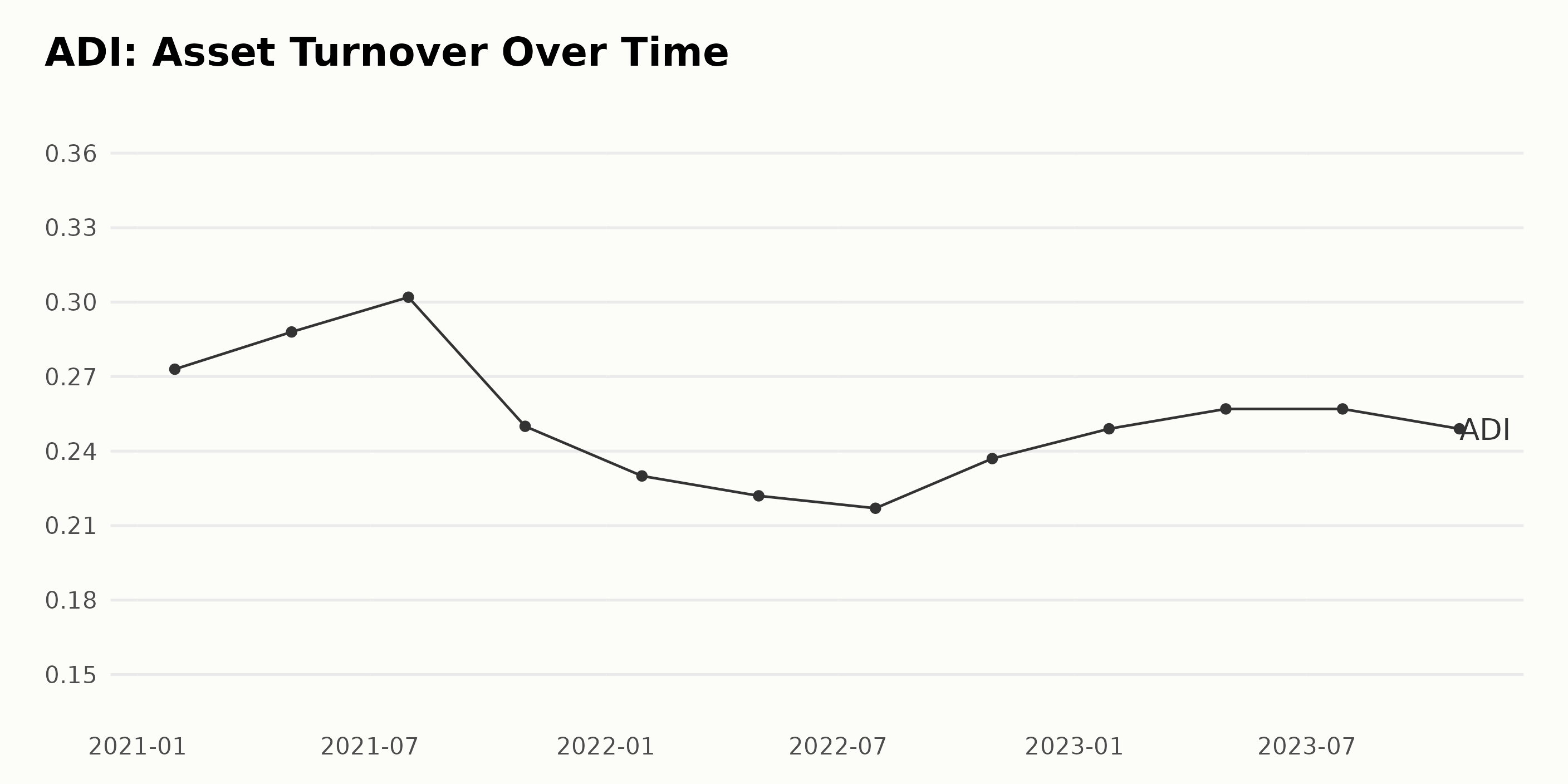

The Asset Turnover ratio of Analog Devices Inc. (ADI), as indicated by the series of data, displayed a mixed trend with several fluctuations over the period starting from January 2021 till October 2023.

- In 2021, ADI displayed an increasing trend in its Asset Turnover ratio, moving from 0.273 in January to 0.302 by July. However, the latter part of the year saw a general decline, closing the year at 0.25 in October.

- The downward trend continued into the first half of 2022, with the ratio declining further to 0.217 by July. An upward swing was registered in the second half of the year, as it increased marginally to 0.237 by October.

- By 2023, ADI's Asset Turnover ratio indicated a consistent growth, standing at 0.257 from April to July. A slight decrease was observed towards the end of the period, down to 0.249 in October.

The growth rate of Analog Devices Inc.'s Asset Turnover, when measured from January 2021's value of 0.273 to October 2023's value of 0.249, indicates a slight decrease by about 8.79%. From this, we can infer that despite the fluctuations and the marginal overall decrease over the nearly three-year period, ADI managed to maintain relative stability in their ability to generate sales from their assets.

However, it is quite essential to emphasize on the more recent data, specifically at the last quarter of 2023 saw a minor reduction compared to the peak in July 2023. Monitoring future Asset Turnover data can provide a more insightful picture regarding Analog Devices Inc.'s efficiency in generating revenue from its assets.

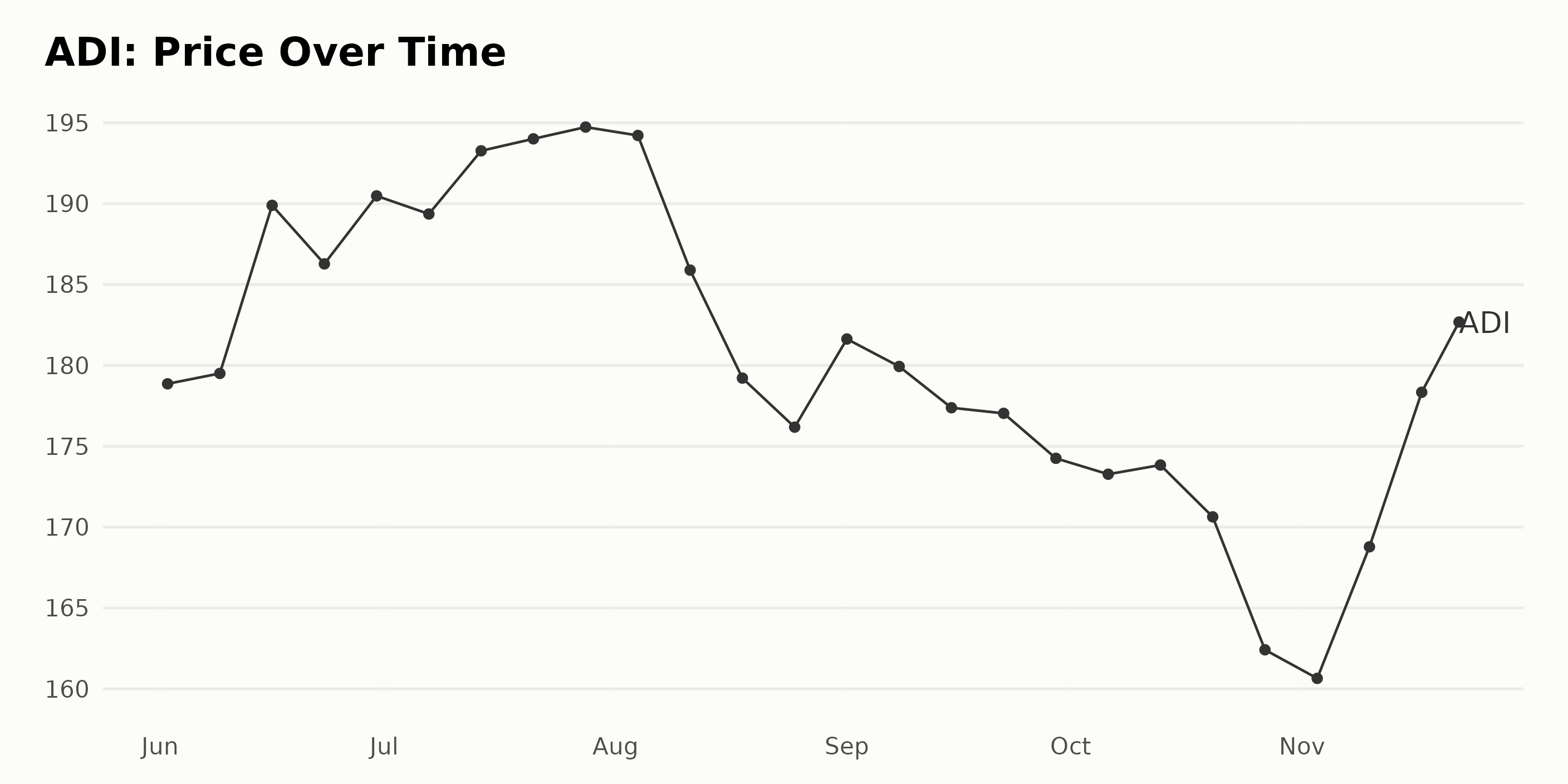

Assessing ADI's Share Price Fluctuations: A Journey of Growth, Decline and Recovery

Below is the analysis of the trend and growth rate of Analog Devices Inc. (ADI) share prices over the given period:

- On June 2, 2023, the price began at $178.86.

- The share price observed a general upward trend throughout June, with a peak at approximately $190.48 on June 30, 2023. This suggests an accelerating growth rate within this period.

- This upward trend continues into July, albeit at a slower pace, with the highest point being $194.73 on July 28, 2023.

- However, August takes a downward turn for ADI, with the lowest point falling to $176.18 towards the end of the month on August 25, 2023, indicating a decelerating growth rate.

- The price then sees slight fluctuations throughout September but maintains a generally declining trend. By the end of the month on September 29, 2023, the value has decreased to $174.25.

- This downward trend continues well into October and even accelerates, with the price dropping to a low of $162.41 on October 27, 2023.

- Finally, starting from November, there appears to be an upward trend once again, reaching $182.68 on November 22, 2023, possibly suggesting a resurgence in ADI's growth rate.

The overall trend of the data suggests fluctuating periods of accelerating and decelerating growth rate. The share prices experienced an initial growth phase, followed by a considerable decline but appeared to recover towards the end of the period covered by the data. Here is a chart of ADI's price over the past 180 days.

Decoding Significant Trends in ADI's Momentum, Quality, and Sentiment Ratings

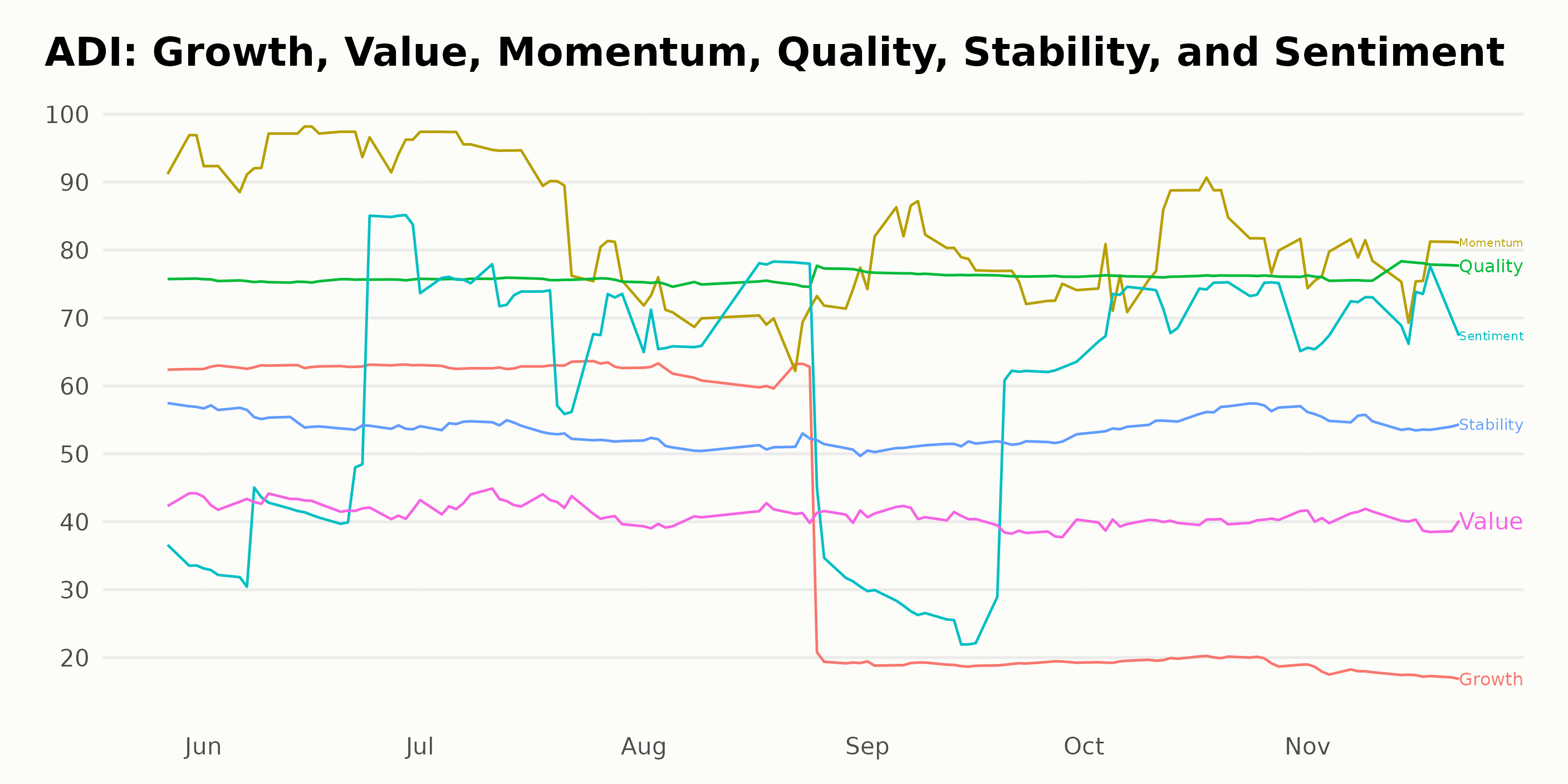

ADI has an overall C rating translating to a Neutral in our POWR Ratings system. It is ranked #45 out of 91 stocks in the Semiconductor & Wireless Chip category.

Based on the POWR Ratings for ADI across six dimensions, the three most noteworthy dimensions, measured with the highest values and clear trends over time, are Momentum, Quality, and Sentiment.

Momentum: This dimension consistently records high ratings for ADI. In May 2023, the Momentum rating was at its peak value of 95. Throughout the months that followed, it fluctuated slightly but remained higher than other dimensions, with ratings in the range of 71 in August 2023 to a bump up to 82 by October 2023.

Quality: This is another strength area for ADI as per the POWR ratings. Starting from May 2023 with a strong rating of 76, it maintained this level through to October 2023. It is vital to note that there was a minor increase to 77 in November 2023.

Sentiment: The trend in the Sentiment rating suggests an increase over time, demonstrating a positive movement for ADI. The Sentiment value was 35 in May 2023 but it rose to a peak of 73 by October 2023.

While ADI demonstrated good performance in terms of Momentum and Quality over the observed period, the significant growth in the Sentiment rating is particularly noteworthy.

How does Analog Devices Inc. (ADI) Stack Up Against its Peers?

Other stocks in the Semiconductor & Wireless Chip sector that may be worth considering are ChipMOS TECHNOLOGIES INC. (IMOS), Everspin Technologies Inc. (MRAM), and Renesas Electronics Corporation (RNECF) -- they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

ADI shares were trading at $182.67 per share on Thursday afternoon, up $1.42 (+0.78%). Year-to-date, ADI has gained 12.95%, versus a 20.30% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Analog Devices (ADI) Post-Earnings Analysis: Buy, Hold, or Sell? appeared first on StockNews.com