CareTrust REIT, Inc. (NYSE: CTRE), a healthcare real estate investment trust specializing in skilled nursing and assisted living real estate investments, is proud to announce the celebration of its 10-year anniversary. In separate press releases, on this significant milestone, CareTrust REIT has announced two strategic transactions totaling approximately $180 million, further proving its commitment to growth and excellence in the healthcare sector.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240604777578/en/

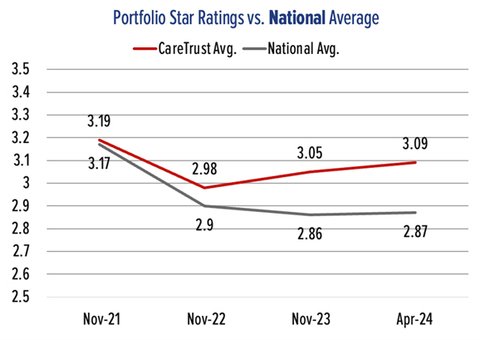

Portfolio Star Ratings vs. National Average (Source: Center for Medicare and Medicaid Services)

A Decade of Commitment to Quality Care and Shareholder Value

Over the past ten years, CareTrust REIT has grown from a spin-off of assets leased to a single tenant to a trusted capital partner to dozens and a high performer in the healthcare real estate market. Dave Sedgwick, CareTrust REIT Chief Executive Officer, said, “Our results are a testament to the unwavering dedication and hard work of our board and team, both past and present. We owe our success to the outstanding operators leasing our properties. Their expertise and commitment to providing high-quality care to their patients and employees have been instrumental in our ability to deliver strong performance and value to our loyal shareholders.”

With respect to the strength of the CareTrust portfolio and corresponding shareholder benchmarks, Mr. Sedgwick said, “A decade ago, our founding President and Chief Executive Officer Greg Stapley put a team together who had deep operating understanding and experience because he understood that the value of skilled nursing and seniors housing real estate is incredibly sensitive to the capabilities of the operators. We cannot thank Greg enough for his vision and for the foundation he laid at CareTrust.”

Mr. Sedgwick continued, “Building a REIT ‘by operators, for operators’ informs who we lease to, how we underwrite, and how we asset manage. When I personally ran facilities before CareTrust, I knew intimately that quality care, of both your patients and employees, precedes sustainable financial stability. Because our tenants have complete control over the operations of our properties, leasing to operators who excel at both their ‘mission’ and a sustainable ‘margin’ is vital.”

CareTrust REIT's dedication to delivering value to shareholders is reflected in its impressive financial achievements over the past decade, including a total shareholder return of 247% since inception.

Looking Forward

Mr. Sedgwick commented on the multi-decade demographic wave of seniors that is now starting to break. He said, “It is incredible to realize that the number of Americans who are 85 years and older will almost double in just 10 years. When you couple that projected growth in demand with the trend of shrinking supply of facilities, the term ‘tsunami,’ seems appropriate. CareTrust is exceptionally positioned to ride this wave.”

In speaking about the near-term investment outlook, James Callister, Chief Investment Officer, said, “The investment environment continues to be very healthy for us. We have growing relationships with some of the best operators in the country. Today, we are quoting a reloaded pipeline of approximately $460 million.” Bill Wagner, Chief Financial Officer, said, “When you look at where our cost of equity is compared to our cost of debt today and you have visibility into a historic pace and pipeline of investments, our financing strategy is self-evident. We have issued 2.5 million shares under our ATM program quarter-to-date at a gross price of $24.90 for gross proceeds of $62.3 million bringing the total outstanding share count to 144.6 million shares. Today’s cash on hand is approximately $230 million. Together with full availability under our revolver, we have tremendous flexibility to fund growth for the foreseeable future.”

Mr. Sedgwick, concluded, “As we celebrate this 10-year milestone, I extend my deepest gratitude to our team and operators for their invaluable contributions to our success. We also thank our loyal shareholders, bankers, brokers, and other friends of CareTrust for their continued support and confidence in our mission to create long-term value by matching great operators with great opportunities. We are just getting started.”

About CareTrust™

CareTrust REIT, Inc. is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing, seniors housing and other healthcare-related properties. With a nationwide portfolio of long-term net-leased properties, and a growing portfolio of quality operators leasing them, CareTrust REIT is pursuing both external and organic growth opportunities across the United States. More information about CareTrust REIT is available at www.caretrustreit.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that are not historical statements of fact and statements regarding the Company’s intent, belief or expectations, including, but not limited to, statements regarding the following: industry and demographic conditions, the investment environment, the Company’s investment pipeline, and financing strategy.

Words such as “anticipate,” “believe,” “could,” “expect,” “estimate,” “intend,” “may,” “plan,” “seek,” “should,” “will,” “would,” and similar expressions, or the negative of these terms, are intended to identify such forward-looking statements, though not all forward-looking statements contain these identifying words. The Company’s forward-looking statements are based on management’s current expectations and beliefs, and are subject to a number of risks and uncertainties that could lead to actual results differing materially from those projected, forecasted or expected. Although the Company believes that the assumptions underlying these forward-looking statements are reasonable, they are not guarantees and the Company can give no assurance that its expectations will be attained. Factors which could have a material adverse effect on the Company’s operations and future prospects or which could cause actual results to differ materially from expectations include, but are not limited to: (i) the ability and willingness of our tenants to meet and/or perform their obligations under the triple-net leases we have entered into with them, including without limitation, their respective obligations to indemnify, defend and hold us harmless from and against various claims, litigation and liabilities; (ii) the risk that we may have to incur additional impairment charges related to our assets held for sale if we are unable to sell such assets at the prices we expect; (iii) the impact of healthcare reform legislation, including minimum staffing level requirements, on the operating results and financial conditions of our tenants; (iv) the ability of our tenants to comply with applicable laws, rules and regulations in the operation of the properties we lease to them; (v) the ability and willingness of our tenants to renew their leases with us upon their expiration, and the ability to reposition our properties on the same or better terms in the event of nonrenewal or in the event we replace an existing tenant, as well as any obligations, including indemnification obligations, we may incur in connection with the replacement of an existing tenant; (vi) the availability of and the ability to identify (a) tenants who meet our credit and operating standards, and (b) suitable acquisition opportunities and the ability to acquire and lease the respective properties to such tenants on favorable terms; (vii) the ability to generate sufficient cash flows to service our outstanding indebtedness; (viii) access to debt and equity capital markets; (ix) fluctuating interest rates; (x) the impact of public health crises, including significant COVID-19 outbreaks as well as other pandemics or epidemics; (xi) the ability to retain our key management personnel; (xii) the ability to maintain our status as a real estate investment trust (“REIT”); (xiii) changes in the U.S. tax law and other state, federal or local laws, whether or not specific to REITs; (xiv) other risks inherent in the real estate business, including potential liability relating to environmental matters and illiquidity of real estate investments; and (xv) any additional factors included in our Annual Report on Form 10-K for the year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, including in the section entitled “Risk Factors” in Item 1A of such reports, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240604777578/en/

Contacts

CareTrust REIT, Inc.

(949) 542-3130

ir@caretrustreit.com