The gig economy became mainstream through Uber Technologies Inc. (NYSE: UBER) and exploded during the COVID-19 pandemic. The lockdowns accelerated the evolution of remote work, the elastic office, and Zoom Video Communications Inc. (NASDAQ: ZM) calls. The combination created a perfect storm for the gig economy as the answer for flexible work regarding hours, location, and employment status.

Two companies are highly representative of the gig and freelance economy. Their platforms connect workers to employers as they play the middleman market maker and take a cut. As recession fears again loom, the gig economy may benefit from offering workers independence, choice and income streams to supplement or generate their income. Here are 2 gig work stocks that may benefit from an economic slowdown.

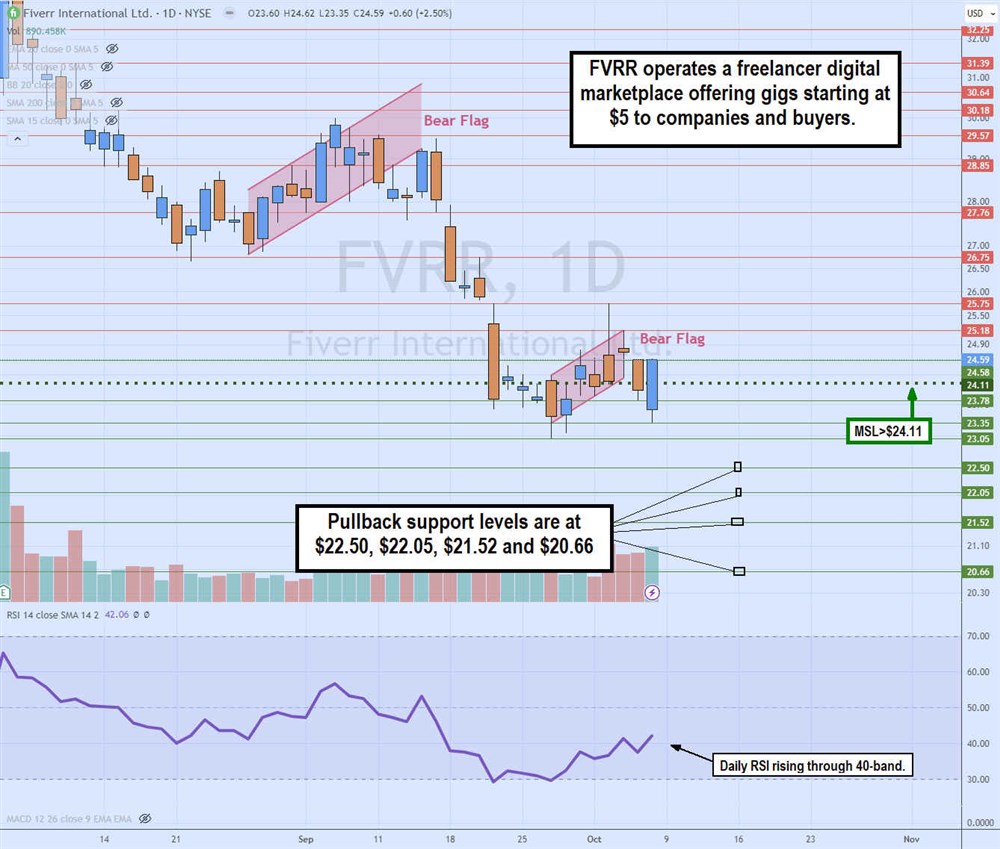

Fiverr International Ltd. (NASDAQ: FVRR)

It is almost difficult to fathom that Fiverr International stock hit a high of $336 in February 2021 and proceeded to lose 92% of its value down to $24.59 by October 2023. The company operates an online marketplace for gig work, connecting buyers of cheap work and freelancers selling their work. Gigs start as low as $5, thus the name Fiverr. The platform connects the buyers and sellers collecting fees on the transactions. Freelancer services include logo design, SEO, video and animations, website development, coding, graphic design, artificial intelligence (AI) and legal work. Fiverr does offer a premium service with more expensive rates for its top freelancers under Fiverr Pro. The company takes a 20% cut on the initial $500 and 5% afterward on projects. Fiverr Pro commissions are 10%.

Criticisms of Fiverr

There are complaints on both sides for Fiverr from buyers and sellers. Since it's an international platform, $5 may not be much in the U.S., but it can go a long way in many third-world nations. English can be a language barrier with cheap overseas talent. You often get what you pay for. Buyers complain that $5 is misleading as freelancers will often upsell you. Sellers complain that it’s a race to the bottom with cheap labor and impossible to compete with the cheap wages overseas. Many see the platform as a content mill, with freelancers overwhelmingly using software or AI to automate and churn out tasks for cheap.

Creeping Growth

Fiverr reported its Q2 2023 earnings of 49 cents per share, beating estimates by 12 cents. Revenues grew 5.2% YoY to $89.4 million, slightly beating the $89.26 million consensus analyst estimates. The company had 4.3 million active buyers in the quarter as of June 30, 2023, the same as the year-ago period. The take rate rose to 30.7% up 90 bps from the year-ago period. Spend per buyer was $265, up 2% from $259 from the year-ago period. GAAP gross margin was 82.5%, up 310 bps from 79.4% in the year-ago period.

In-Line Guidance

Fiverr provided flat guidance in line with analyst estimates. For Q3 2023, the company expects revenues of $89.5 million to $92.5 million versus $90.73 million consensus estimates. This represents 8% to 12% YoY growth and adjusted EBITDA of $14.5 million to $16.5 million. For the full-year 2023, Fiverr expects revenues of $358 million to $365 million versus $361.35 million, representing 6% to 8% YoY growth. Adjusted EBITDA is expected between $56 million to $60 million.

Fiverr International analyst ratings and price targets are at MarketBeat. Fiverr International peers and competitor stocks can be found with the MarketBeat stock screener.

Double Bear Flags

The daily candlestick chart on FVRR illustrates the double bear flag patterns formed between September 2022 and October 2023. The daily market structure low (MSL) triggered the $24.11 breakout. The daily relative strength index (RSI) is rising through the 40-band. Pullback support levels are at $22.50, $22.05, $21.52 and $20.66.

Upwork Inc. (NASDAQ: UPWK)

The world’s largest freelancer platform is Upwork, which was the lovechild between Elance and oDesk when they merged in 2014. Upwork is a notch up in quality as prices are more expensive for gigs. Upwork is more catered to professionals and corporations with a wider range of services. Upwork also takes a larger cut of the transactions, taking a commission, a buyer fee, and optional subscription fees from freelancers.

If Fiverr is the Dollar Store of gig work, then Upwork is like Walmart Inc. (NYSE: WMT). Upwork launched its AI Services Hub in July 2023 and partnered with Microsoft Co. (NASDAQ: MSFT) partner OpenAI to establish experts on the Upwork platform. The company aims to become the preeminent destination for AI-related talent and work.

Differentiation Strategy

The differentiation strategy works for Upwork. They report Q2 2023 earnings of 10 cents per share, beating analyst expectations by 10 cents. Revenues climbed 7.5% YoY to $168.6 million versus $162.53 million consensus analyst estimates. The company has over 18 million freelancers and five million clients.

Raised Guidance

Upwork raised its Q3 2023 for earnings of 9 cents to 11 cents per share versus 8 cents consensus analyst estimates on revenues of $165 million to $170 million versus $165.73 million analyst estimates. They raised full-year 2023 earnings estimates to 36 to 39 cents, beating 26 cents consensus analyst estimates. Revenues are expected between $665 million and $675 million, beating $661.33 analyst estimates.

Upwork analyst ratings and price targets are at MarketBeat.

Daily Major Cup and Handle Pattern

UPWK shares spiked from $9.97 close to a peak at $15.88 after its Q2 2023 earnings release and have since pulled back towards the $10.39 daily market structure low (MSL) trigger. UPWK has initially triggered the daily ascending triangle breakout. However, a larger view of the daily candlestick chart illustrates a major cup and handle pattern formation.

The cup lip line commenced after peaking at $15.78 on Sept. 21, 2022, as shares fell to a low of $6.56 on May 3, 2023. Earnings enabled the retest of the cup lip line at $15.88 on Aug. 25, 2023. Shares have been cascading lower to form the handle as it approaches the daily MSL trigger at $10.39. The daily RSI is attempting to coil off the 30-band oversold level. Pullback supports are at $11.11, $10.39 daily MSL trigger, $9.68 and $8.75.