HOUSTON - Dec. 19, 2023 - PRLog -- The largest credit union in America, Navy Federal Credit Union, is under fire after it was revealed that it has alarming disparities in making home loans to African-Americans, and rejected more than half of Black applicants for conventional mortgages in 2022.

According to a CNN report, Navy Federal approved more White borrowers who earned less than $62,000 annually than it did Black borrowers who earned more than $140,000 a year.

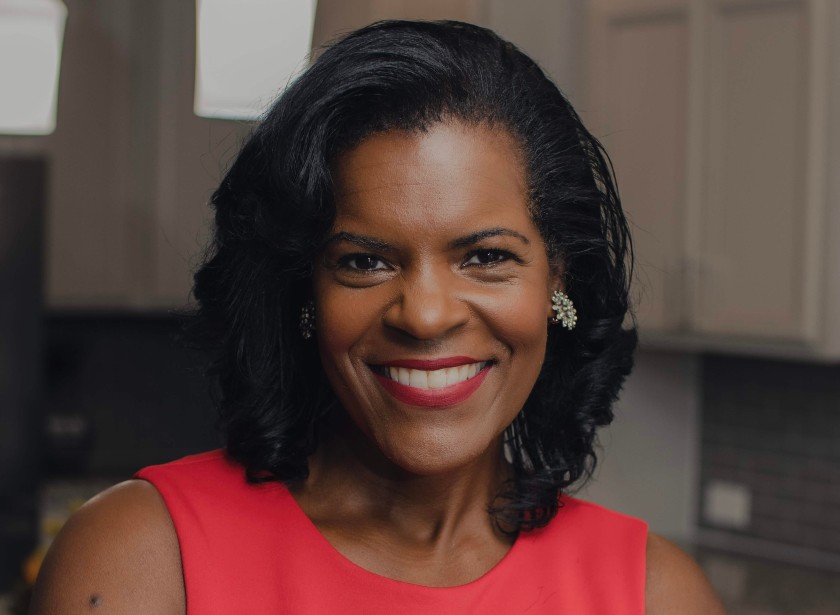

Lynnette Khalfani-Cox, The Money Coach®, is available to discuss the larger topic of how widespread racial disparities are in the financial services industry – everything from redlining and mortgage discrimination to the appraisal gap and predatory lending – and what can be done about this problem. (See her 10 tips below).

Lynnette has written about this topic, researched the subject, and personally experienced discrimination in the mortgage process as well.

"Unfortunately, I know all too well how discrimination in financial services can pack a powerful punch – both financially and emotionally," Lynnette says. "But it's not just Navy Federal. Housing and mortgage discrimination is a pervasive issue, one with far-reaching financial consequences."

In her new book, Bounce Back: The Ultimate Guide to Financial Resilience, Lynnette devotes an entire chapter to discussing how to fight and recover from the effects of financial discrimination.

She explains that such discrimination doesn't just hurt Black and Brown people; it hurts everyone: communities don't develop; economic progress is stifled; the wealth gap widens; GDP suffers; and companies face public backlash and risk of lawsuits.

Lynnette's 10 Tips to Fight Mortgage Discrimination

Lynnette suggests 5 things that can be done at the government and institutional level:

Regulatory enforcement. Federal officials need to enforce existing credit and housing laws, especially the Fair Housing Act of 1968, which prohibits loan discrimination based on race.

Targeted lending. Banks and credit unions should create more special-purpose credit programs that target home buyers and combat racial disparities in lending. "These are already authorized by the Equal Credit Opportunity Act. Lenders just need to create more of them," Lynnette says.

Policy reform. Credit unions should be subjected to CRA rules, just like banks. CRA refers to the Community Reinvestment Act, which aims to promote lending to underserved populations.

Financial remedies. HUD, the U.S. Department of Housing and Urban Development, can investigate complaints about discrimination in mortgage lending. "If discrimination is found, HUD can take steps such as reaching settlements, ordering remedies, or referring cases to the Department of Justice for further action," Lynnette says.

Additional Monitoring. Financial institutions should be subject to stricter ongoing monitoring and compliance checks to ensure that discriminatory lending is identified and addressed.

Furthermore, Lynnette offers these 5 tips for African Americans who are seeking home loans:

"The burden shouldn't be on us, as Black people, or people of color in general, to fix systemic issues like racial discrimination or disparities in lending," Lynnette says. "Nonetheless, there are steps we can take to help fight potential or actual wrongdoing by lenders and others."

Omit your race. When you apply for a home loan, you are asked to disclose your race. "But this is an optional question on mortgage applications. You don't have to answer it," Lynnette says.

Place two bets. "It's sad that Black consumers have to do this, but it's an effective strategy to always run two mortgage applications simultaneously," Lynnette suggests. Then go with the lender that gives you the best loan rate and terms, or that approves you fastest.

Speak up and advocate for change. If you suspect any kind of housing or credit discrimination, point it out and challenge any unfair practices or outcomes. Push for stronger consumer protection laws and regulations that prevent predatory or discriminatory lending practices. "Contact your elected officials and urge them to support such policies too," Lynnette says.

Report housing discrimination. To file a complaint, notify the Consumer Financial Protection Bureau (CFPB), the Office of the Comptroller of the Currency, which regulates banks, or the National Credit Union Administration (NCUA), which oversees credit unions.

Bank Black. Even if you have relationships with mainstream financial firms, consider also doing business with a Black-owned bank in the U.S. "Admittedly, that's not always easy. We've seen a steady decline in the number of Black-owned banks in America, a trend worsened by the COVID pandemic. So there are currently only 22 Black-owned banks in the country," Lynnette notes.

About the Expert: Lynnette Khalfani-Cox, The Money Coach®, is a personal finance expert, speaker, and New York Times bestselling author who has written 16 money-management books. Her specialties include credit, debt, paying for college, entrepreneurship, real estate, and wealth building. A former award-winning financial journalist and Wall Street Journal reporter for CNBC, Lynnette has been interviewed on thousands of TV shows ranging from Good Morning America and The TODAY Show to Oprah and The Talk. She has also been published by outlets such as AARP, Black Enterprise, Essence, Kiplinger Advisor, The Wall Street Journal, USA Today, and Vox.

Lynnette is available for interviews, expert commentary, book reviews, and other media opportunities. Review copies of Bounce Back are also available upon request.

Learn more about Lynnette at her website, LynnetteKhalfaniCox.com, her free advice blog AskTheMoneyCoach.com, or by connecting with her via social media.

Photos: (Click photo to enlarge)

Source: TheMoneyCoach.net

Read Full Story - After Navy Federal Scandal, Financial Expert Shares How to Fight Mortgage Discrimination | More news from this source

Press release distribution by PRLog